Supertanker clean-ups: Momentum could continue as clean-dirty tanker spreads rise

In this blog we focus on the recent behaviours of supertankers as well as the drivers behind this trend.

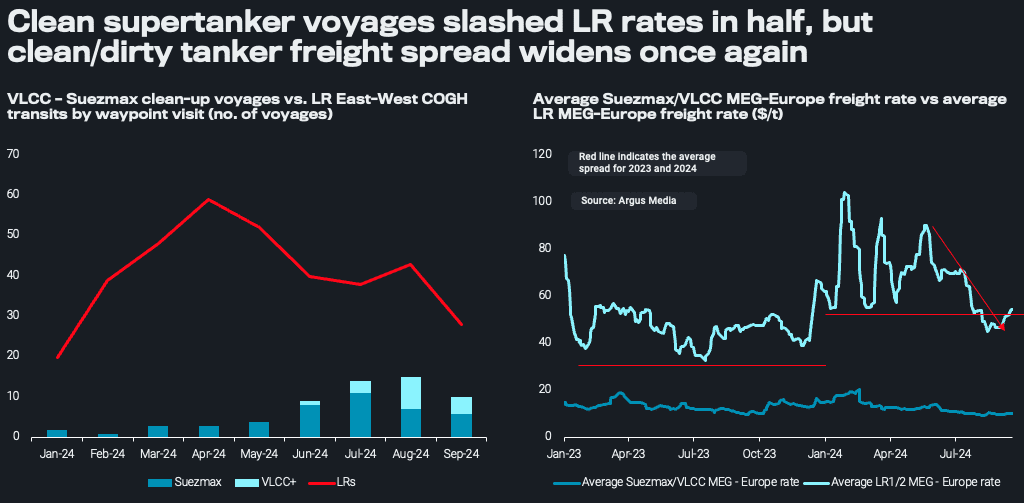

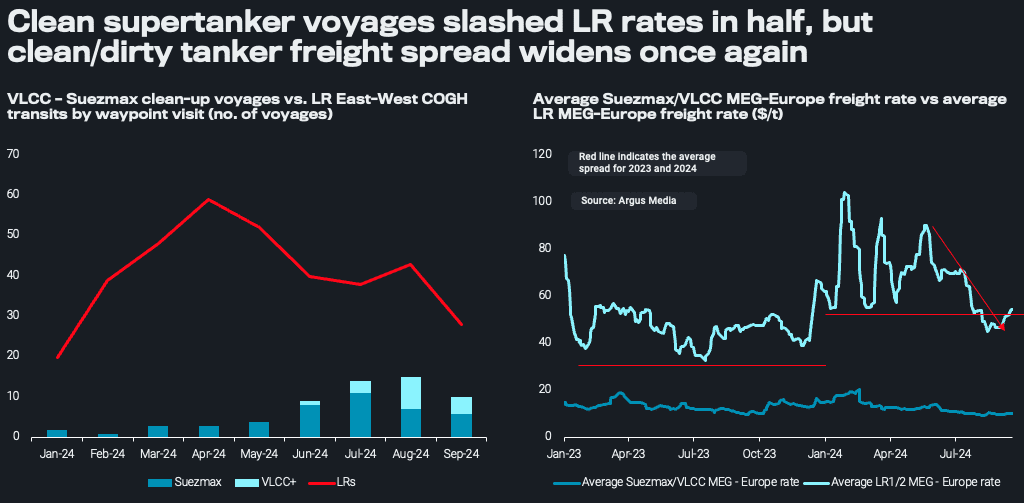

In the first 9 months of this year, 43 supertankers (13 VLCCs and 30 Suezmaxes) switched to carrying clean products. This is owing to a surge of LR East-to-West of Suez freight rates due to the Red Sea attacks, which on average have risen by $20/t between 2024 ytd and 2023.

The crude tanker market was comparatively weaker amidst a lack of long-haul voyages and even after considering cleaning costs, offered sufficient economic incentives for operators to switch to the clean market. Around 2 mt of CPP cargoes per month (predominantly middle distillates) were carried on these tankers in July and August, which corresponds to around 22 LR2s, accounting for 13% of the global LR2 monthly utilisation.

As a result, this development partially muscled LR tankers out of the East-to-West route, with Cape of Good Hope laden transits for this vessel class declining by 30% between April and August 2024. Subsequently, LR freight rates for the Middle East-to-Europe route have dropped to half their values since their last spike in April 2024.

However, over the recent weeks, the support of the naphtha market on LR2 utilisation as well as the significantly limited availability of LRs in the Middle East Gulf has once again widened the spread between clean and dirty tankers, signalling that the trend of clean-ups could continue.

Operators predominantly switch back to dirty after one cargo

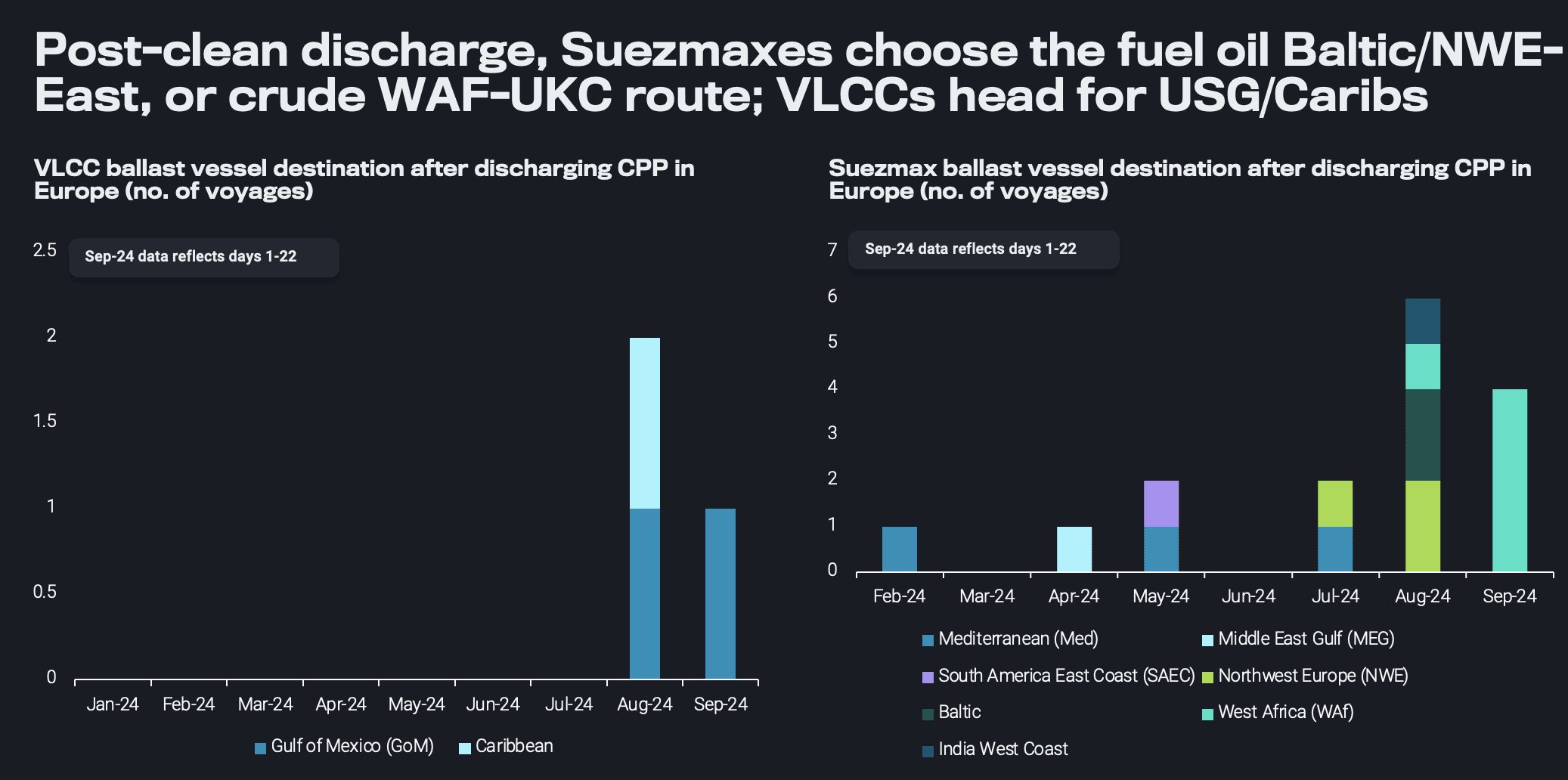

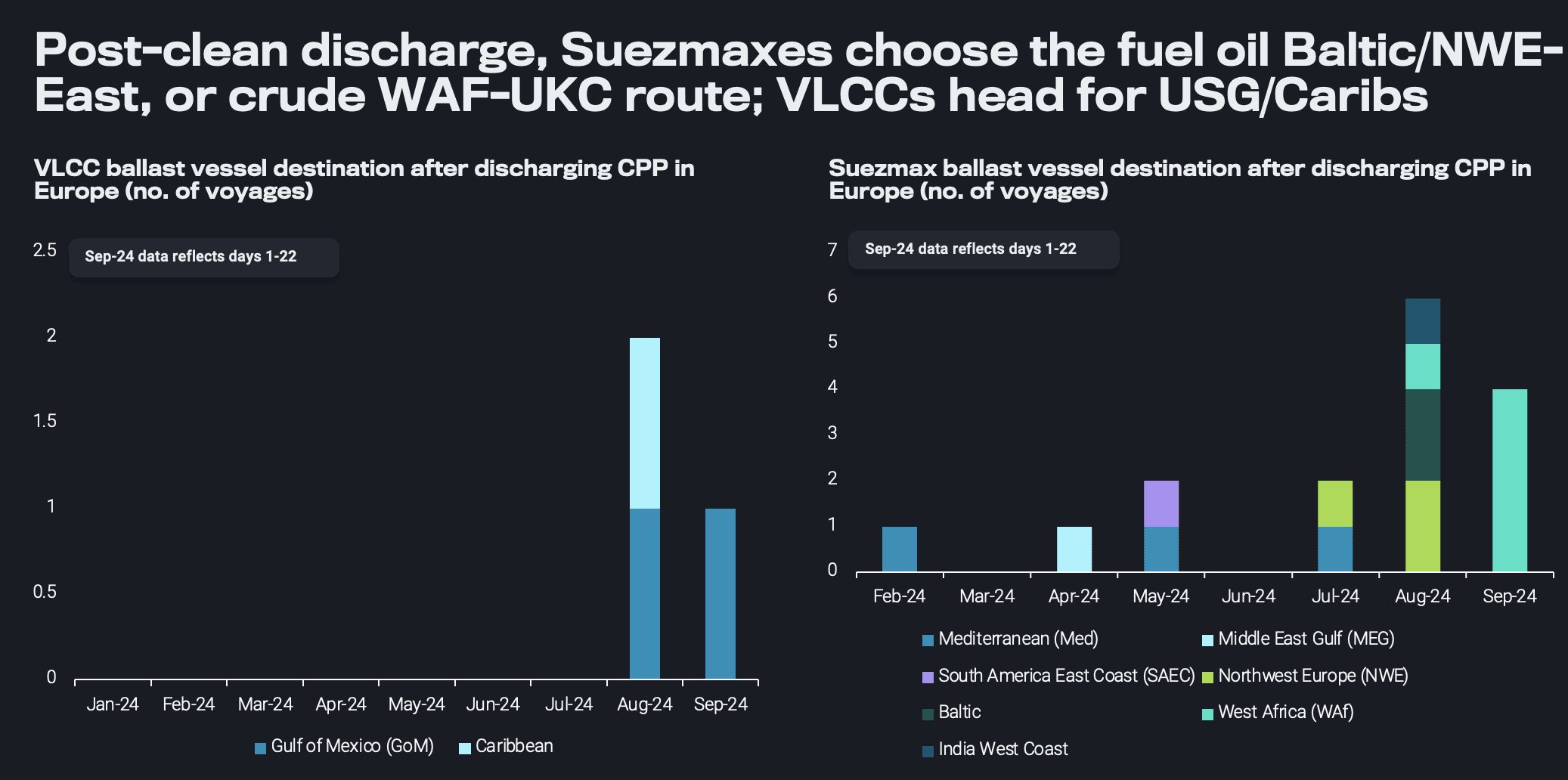

So far, 16 Suezmax and 3 VLCC voyages that switched to the clean service have fully discharged in Europe. Zooming in the behaviour of these tankers, operators are largely returning to the dirty trade. This is likely occurring for two reasons. Firstly, from a safety perspective, as additional clean cargoes could corrode the uncoated tanker hulls and secondly for financial reasons as operators are looking to minimise their ballast legs which has led to participants post-clean cargo discharge seeking a dirty load from the Atlantic Basin. More specifically, Suezmaxes are moving to the Europe-East of Suez fuel oil/condensate routes as well as West Africa-Europe crude routes. Similarly, VLCCs are ballasting to the US Gulf and the Caribbean, seeking for a load towards the East.