Is SPR stockpile enough to support China’s crude imports?

China has planned a new round of SPR filling from July to March. Will this new government mandate reverse the current soft crude import demand picture?

China’s crude imports disappointed again in June, with seaborne volumes sliding 14% year-on-year to just shy of 10mbd. Many refineries, both state-run and private, cut runs at their operating units due to weak domestic and export margins.

Meanwhile, China’s onshore crude inventories built a moderate 8mb month-on-month to 954mb in June. This resulted in China’s implied refinery runs extending the y-o-y contraction for a fifth straight month. June run rates were 1mbd below last year’s level, compared to 300-400kbd differences in the previous four months, reflecting that refiners may extend run cuts even post maintenance season, given a lack of effective incentives from the government.

China’s implied refinery runs (mbd)

New SPR mandate likely to cement Russia-China flows

China has recently planned a new round of SPR stockpiling, aiming to add 8 million tonnes (58.5mb) of crude oil in majors-operated storages by March 2025. This translates to about 220kbd of additional crude demand, equivalent to 2% of China’s seaborne crude imports, if state-run refiners fulfill the government mandate evenly from July to March.

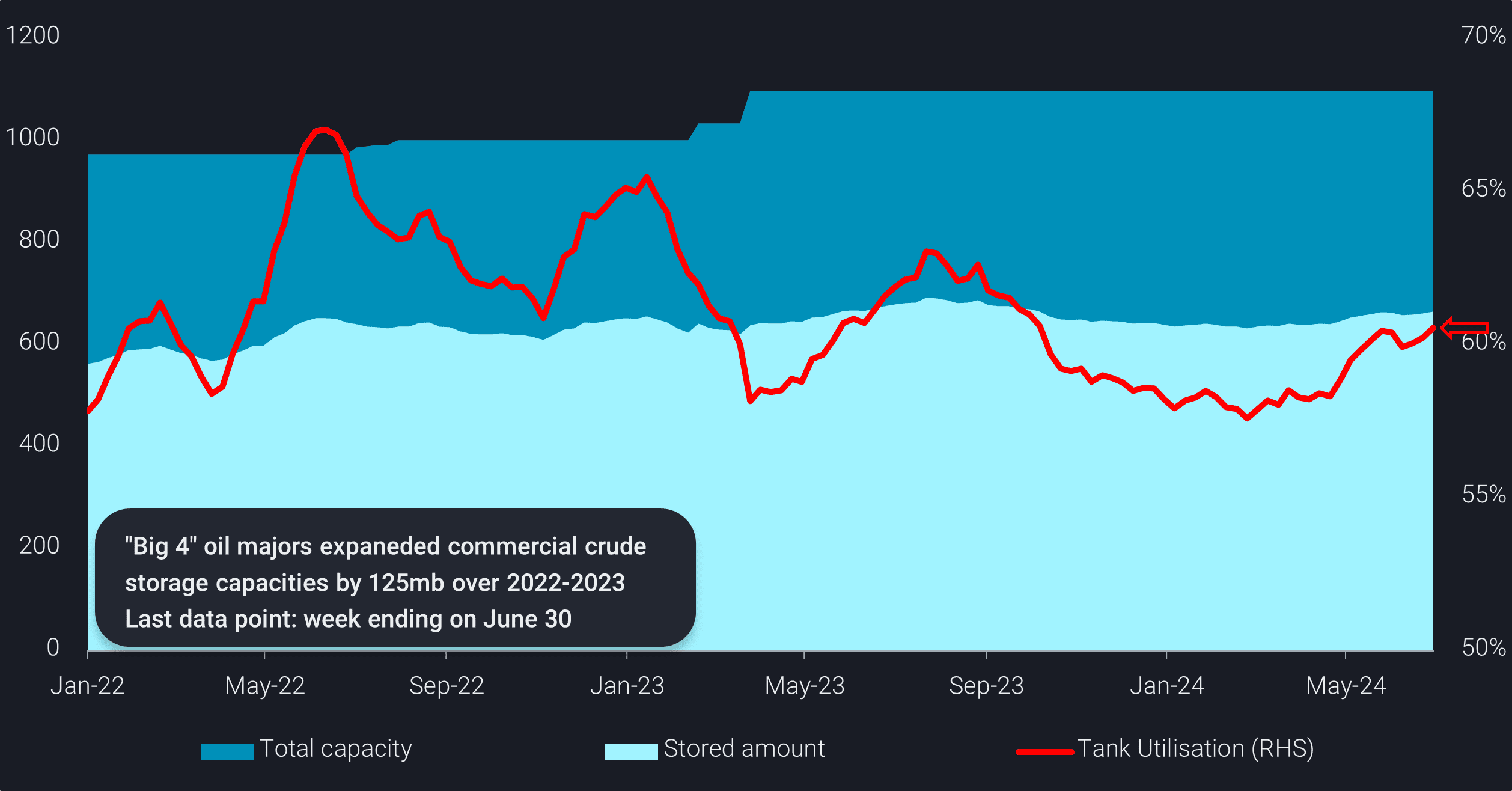

By the end of June, Chinese Big-4 (PetroChina, Sinopec, CNOOC, and Sinochem) had stored 665mb of crude oil in their above-ground oil tanks, in addition to 100-110mb in underground SPR caves operated by these oil majors. Tank utilization has just breached 60%, suggesting that the oil majors may fulfill the target using existing storage bases.

Between November 2023 and March 2024, CNOOC pumped around 10mb of Russian Far East ESPO Blend crude into its Dongying storage in Shandong Province under a previous round of SPR mandate (news link), while crude storage levels in other majors-controlled bases continuously declined.

The new SPR mandate will likely support Russian crude imports into China, as oil majors are cautious about touching other US-sanctioned discounted crude grades, while oil benchmark prices breaching $85/b will challenge the stockpile economics.

China-bound VLCC freight rates (TD3C, TD15, TD22) have been declining since mid-May, reaching year-to-date lows on July 4, implying that an imminent rebound is unlikely.

Teapots’ ESPO imports slump to multi-year low amidst bearish margins

Unlike oil majors who benefit from Beijing’s support and have international exposure, Shandong teapot refiners continued to experience weak domestic demand in June. Many teapots remained offline or ran at low rates after completing maintenance to avoid losing money, leading to multi-year low demand for key feedstocks in the Shandong and Jiangsu areas.

ESPO crude imports into Shandong and Jiangsu came at only 270kbd in June, the lowest since May 2021, resulting in some cargoes diverting to Indian buyers, although Chinese oil majors showed continuous support.

Russian ESPO exports by destination (kbd)

China’s refining industry, especially the private sector, is expected to suffer persistent weakness in Q3, as domestic demand is slow to recover.

China’s National Bureau of Statistics PMI remained unchanged from May at 49.5, suggesting that the market needs more policy guidance and substantive encouragement. It may also increasingly be the question whether this is just a prolonged cyclical slowdown, or whether there are substantial structural elements involved, leading to persistent weakness in oil import demand of the historical growth engine of the global oil market.