Asia’s diesel market keeps a fine balance despite export headwinds

Asia’s diesel/gasoil exporters are facing growing headwinds in moving barrels to the West. Despite the challenges, Asia’s diesel/gasoil balances have been moderated by three key drivers – China’s slowing exports, robust regional demand and newbuild VLCC arbitrage – maintaining regional cracks stable.

Asia’s diesel/gasoil exporters are facing growing headwinds in moving barrels to the West amid a narrow East-West arbitrage. European refiners are ramping up refinery runs as margins strengthen seasonally, while US refiners keep South America well-supplied. Strong Middle East diesel flows heading West have further intensified competition with long-haul barrels from Asia.

Despite the challenges, Asia’s diesel/gasoil balances have been moderated by three key drivers – China’s slowing exports, robust regional demand and newbuild VLCC arbitrage – maintaining regional cracks stable.

China’s diesel/gasoil exports restraint keeps regional supplies in-check

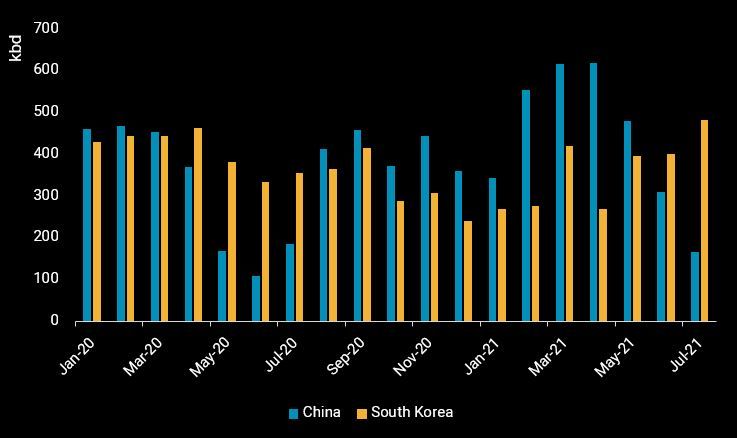

In a way, China’s drastic cutback in diesel/gasoil exports since June has come at a perfect time in regulating regional supplies. With state-owned refiners running out of product export quotas and light cycle oil (LCO) imports drying up after the consumption tax levy in June, the country’s diesel/gasoil exports fell for the third consecutive month to 310,000 b/d last month, almost half the volumes seen in April. Exports are projected to fall even further in July, down to 170,000 b/d, setting a year-to-date low record.

But an uptick in South Korea’s diesel/gasoil exports this month is partially offsetting lower volumes from China. Exports are estimated to be up nearly 20% month-on-month to 480,000 b/d in July, a likely result of more LCO converted or blended into gasoil as demand for the intermediate blend component from China fades. In fact, exports to Singapore have surged three-fold to over 100,000 b/d in July, with several low sulphur marine cargoes headed for bunker demand.

China and South Korea diesel/gasoil exports

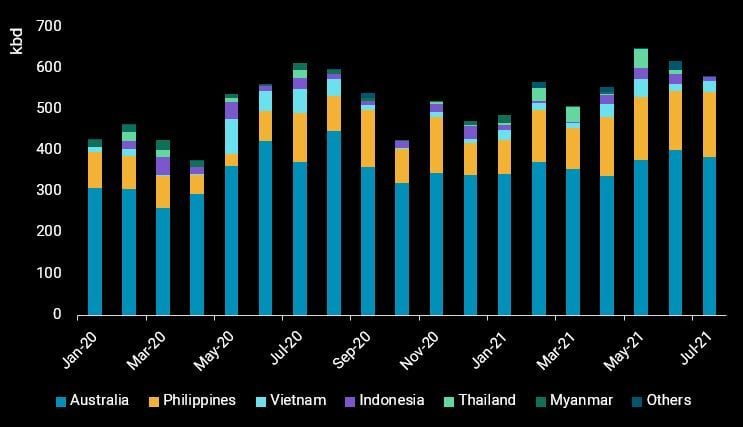

Australia and Southeast Asia’s diesel/gasoil demand holds up

Meanwhile, diesel/gasoil imports into Australia and Southeast Asia have remained robust in recent months despite the raging pandemic. Combined imports into the region, excluding storage hubs Singapore and Malaysia, are estimated at 210,000 b/d in July, holding stable compared to previous months. Stronger imports from the Philippines and Vietnam have compensated for weaker demand from other parts of the region. Imports into Australia estimated at 390,000 b/d in July are on-track to reach the second highest monthly total for this year, as mining activities prop up demand.

Australia and Southeast Asia diesel/gasoil imports

Newbuild VLCCs continue to work the East-West arbitrage, faces rising Middle East competition

Although the East-West arbitrage is thin on paper, newbuild VLCCs improve the economics to move diesel/gasoil barrels to the West by lowering per-ton freight costs. Newbuild VLCC CS Hunan Venture made its maiden voyage in June, picking up diesel/gasoil cargoes from Taiwan, India and the UAE, before heading to Southworld STS for discharge. But thin economics have seen more newbuild VLCCs in the last month bypassing Asia and heading to the Middle East to load crude (i.e. Eneos Dream, C.Brave) or diesel/gasoil (Serendipity). Another six newbuild VLCCs are expected to be delivered this quarter, offering more tonnage supply to carry diesel/gasoil to the West but conditional on a favourable arbitrage.

More from Vortexa Analysis

- Jul 28, 2021 Physical flow highlights: Signals of strength emerging from across the barrel

- Jul 22, 2021 OPEC+ decision: A zero-sum game for VLCCs

- Jul 21, 2021 Diesel remains surplus product in dire search for outlets around the globe

- Jul 20, 2021 Oil markets reality check: Seesaw between supply & demand disappointments

- Jul 15, 2021 High crude prices a double-edged sword for HSFO

- Jul 15, 2021 Middle East crude export surge – but for how long?

- Jul 14, 2021 LR2s keep “cleaning” up throughout 2021