China’s oil market cools post new policy changes

A series of domestic policy changes and market headwinds in recent months has upended China’s refining industry, putting a tight lid on the country’s crude imports and product exports. Vortexa sheds light on evolving trends in the country’s crude imports and product exports.

A series of domestic policy changes and market headwinds in recent months has upended China’s refining industry, putting a tight lid on the country’s crude imports and product exports. Despite more refineries restarting from seasonal maintenance, seaborne crude imports into the country rebounded only marginally month-on-month to 9.1 mn b/d in June, albeit down over 20% from a multi-year high a year ago.

From reduced crude import quotas (for independent refiners) to stricter scrutiny on jet and diesel domestic sales, as well as a potential reduction in the upcoming product export quotas, Chinese refiners are facing increasing headwinds with ramping up their refinery runs to the utilisation levels that they previously operated at. This, coupled with adequate crude and diluted bitumen stockpiles and the current high crude price environment have curbed refiners’ buying interests on crude, and many are adopting a wait-and-see approach to decide on their next moves.

OPEC+ regain market shares from arbitrage flows

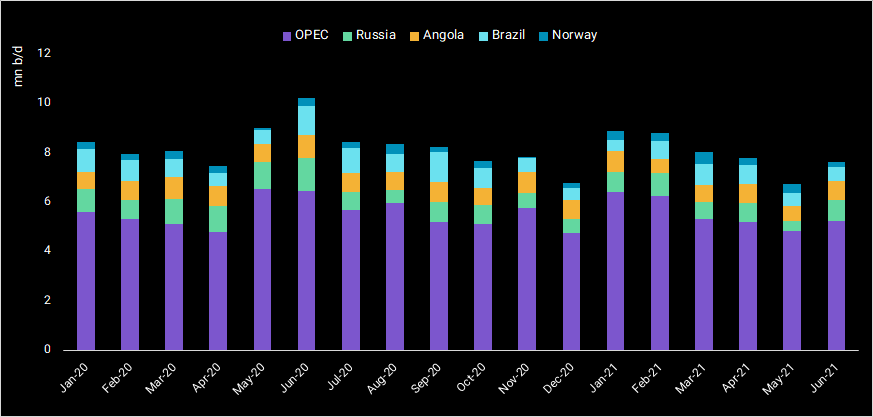

Amid the slowdown in China’s crude imports, arbitrage crude flows from Angola, Brazil and Norway, have seen the largest month-on-month declines in June, as the widening of Brent-Dubai differentials have reduced the attractiveness of these Brent-linked grades relative to Middle East grades.

Combined seaborne arrivals of the crudes from these origins are down over 12% to 1.5 mn b/d in June, compared to 1.7 mn b/d in the first five months of the year. But Russia’s Brent-linked ESPO grade has been an exception, with seaborne arrivals surging over 85% month-on-month to 570,000 b/d in June, as the short-haul gasoline-rich grade has been a favourite among Chinese independent refiners. This uptick may be capped by the rising ESPO premiums against Brent (on a delivered Shandong basis), at $2.3/bbl this week, up $1/bbl from end-June, according to Argus’ price assessment.

In contrast, OPEC producers have maintained stable crude exports to China, with around 5.2mn b/d of crude arriving in the country in June. Should OPEC+ come to an agreement to raise production in the coming months, Chinese refiners will look towards substituting more of their West of Suez arbitrage crude imports with the discounted Middle Eastern grades.

Crude arrivals in China by origin (in mn b/d)

Slowing product exports intensify domestic competition

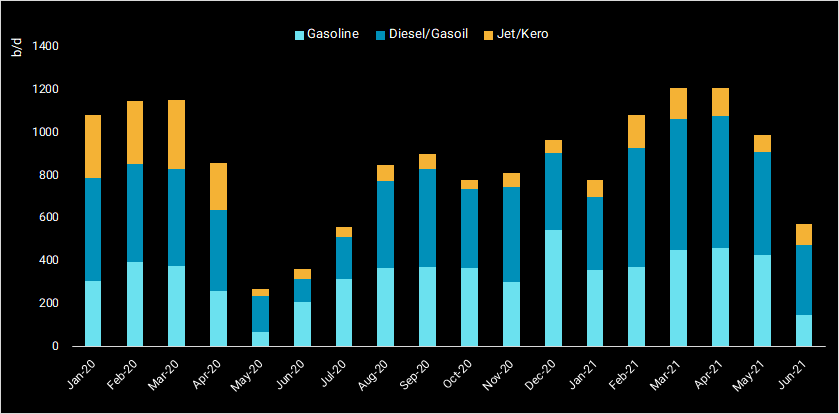

In the oil products market, refiners have seen margins rise since early June from tighter domestic gasoline and diesel supplies pushing up wholesale prices after the consumption tax levy on mixed aromatics and light cycle oil imports came into effect last month. The strength of the domestic market relative to export market, coupled with limited export quotas, have led to state-owned refiners cutting back on clean product exports to an 11-month low of 580,000 b/d in June, according to Vortexa’s data.

China gasoline, jet/kero and diesel/gasoil exports (in b/d)

With more refineries scheduled to restart from maintenance this month and product export quotas running even lower, more gasoline and diesel supplies are expected to stay within the country, potentially weighing on domestic margins.

Additionally, a new value-added tax levied on jet fuel not sold to aviation firms since 10 July, will push refiners to increase jet/kero regrade to diesel. Large independent refiners that typically sell their jet fuel supplies to non-aviation sectors, including oil blenders, will be the hardest hit. With the rise in diesel supplies unmatched by demand that is currently at a seasonal lull before construction activities pick up in Q3, diesel margins will be under pressure, in turn limiting refinery runs.

China’s crude imports will remain subdued in the coming months, with a recovery expected in September – October when gasoline and diesel/gasoil demand are expected to see a pick-up. Until a fresh batch of product export quotas are being issued, exports are expected to be restrained.

More from Vortexa Analysis

- Jul 8, 2021 The curious case of declining VLGC rates – a blip or a trend?

- Jul 7, 2021 Illustrations of naphtha and gasoline strength

- Jul 1, 2021 Q2 2021: Freight Market Update

- Jun 29, 2021 Two truths – why OPEC+ is hesitant

- Jun 24, 2021 Surging diesel flows – a pull or a push?

- Jun 23, 2021 $100 barrel of crude: boon or bust for tanker markets?