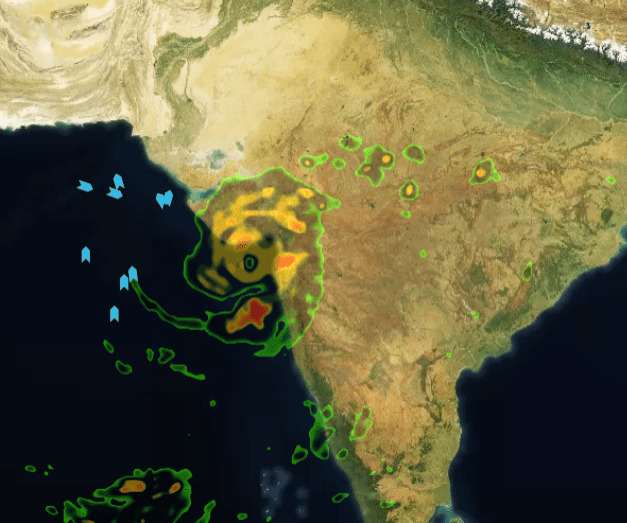

Crude tanker delays as cyclone hits WC India

Vortexa data shows at least 12mn bbl of crude has been delayed in discharging into key ports along India’s west coast, following the arrival of Cyclone Tauktae.

Vortexa data shows at least 12mn bbl of crude has been delayed in discharging into key ports along India’s west coast, following the arrival of Cyclone Tauktae.

-

The ports threatened with the most disruption in the region are Sikka, Vadinar and Mundra. Sikka is home to Reliance’s 1.4mn b/d Jamnagar refinery and Nayara own a 400,000 b/d refinery at Vadinar. Crude imports at Mundra enter a pipeline distribution network feeding other Indian refineries.

-

All port operations in the vicinity of the cyclone have been suspended and vessels awaiting discharge or scheduled to load are being told to sail back out to high seas.

- From a freight perspective prolonged crude discharge delays at these ports are likely to impact VLCC tankers the most, then Suezmax tankers.

-

Of the nine crude tankers lying just offshore WC India (pictured), five VLCC tankers, one Suezmax and one Aframax (amounting to around 10mn bbl) have Sikka as their next destination.

-

Combined crude imports into Sikka, Vadinar and Mundra totalled 3.11mn b/d for the week ending 16 May.

- Meanwhile, product exports will also be affected, which comes at a time Covid-19 is seriously affecting domestic demand. All these developments do not bode well for refining operations in India.

Want to get the latest updates from Vortexa’s analysts and industry experts directly to your inbox?

{{cta(‘cf096ab3-557b-4d5a-b898-d5fc843fd89b’,’justifycenter’)}}

More from Vortexa Analysis

- May 12, 2021 Mega shipments cannibalising the LR2 market

- May 11, 2021 LNG flows reviving in line with global recovery

- May 10, 2021 Colonial outage – Implications on seaborne trade

- May 6, 2021 China’s crude imports slow. Due for an imminent rebound?

- May 5, 2021 Saudi Arabia ramps up DPP imports in April