French lockdown hits CPP flows

Vortexa sees a marked shift in clean product flows in and out of France in the aftermath of the country’s recent nationwide lockdown.

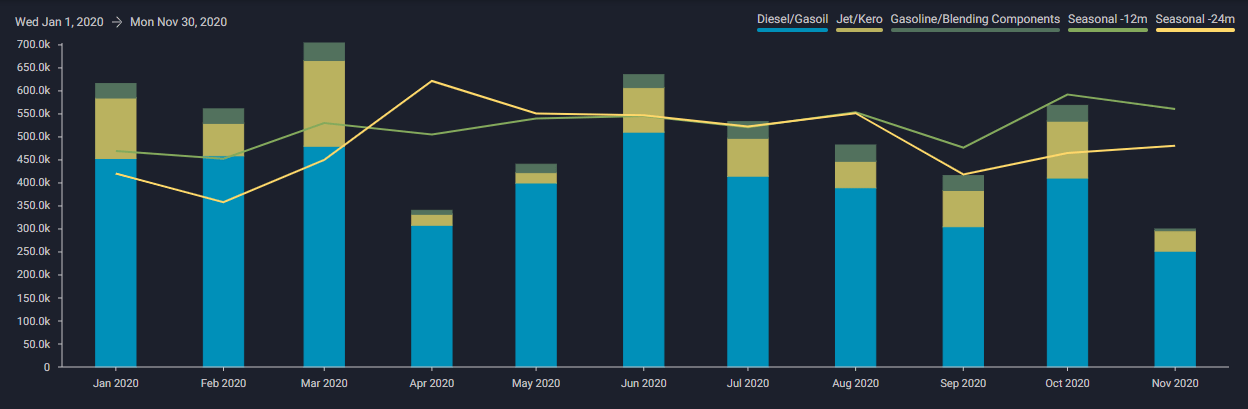

France’s imports of diesel, jet fuel and gasoline/blending components dropped sharply in November as the country endured a second national lockdown. Combined imports for the three transportation fuels fell to 300,000 b/d in November, surpassing the previous multiyear low of 340,000 b/d in April this year, according to Vortexa data.

French transport fuels imports (b/d)

Diesel

- Holding one of the highest shares of diesel use in its passenger car fleet, France is a key importer for the global diesel market. And so it comes with little surprise that diesel incurred the biggest brunt of France’s recent national lockdown. Diesel/gasoil imports into France fell to just 250,000 b/d in November, the lowest total since at least the beginning of 2016, Vortexa data show.

- Among the key diesel exporters to France, cargo volumes from Russia held relatively stable (month on month) in November. But flows from the Middle East and from the ARA region have each fallen to less than 60,000 b/d, down by around 50% and 30%, respectively.

- Looking ahead, diesel consumption will no doubt rise following the lifting of restrictions. But it is unclear if this will be sufficient in drawing an uptick long haul imports given ample regional supply.

- A rise in French diesel imports could also curb arbitrage opportunities for Russian Baltic and ARA diesel cargoes to head transatlantic.

Gasoline

- The lack of domestic road fuel demand in November also translated into a jump in gasoline exports. Around 111,000 b/d of gasoline/blending components departed from France in November, the highest monthly total seen by Vortexa since December 2018.

- This jump in exports during November has boosted total flows headed to PADD 1. Two MR cargoes are due to arrive into New York Harbor during this week, having loaded from Port Jerome in late November.

- France typically imports a small amount gasoline blending components from the ARA region but activity ground to a near standstill in November. French imports of gasoline/blending components stood at less than 4,000 b/d, the lowest monthly total since January 2016, and down from 34,000 b/d in October.

Jet fuel

- French jet fuel imports fell to 44,000 b/d in November, retreating from the seven-month high of 124,000 b/d the previous month.

- The French port of Le Havre serves as a major pricing and storage hub for the northwest European jet fuel mark, given its pipeline connectivity to inland consumers. But the port was also seen exporting around 22,000 b/d of jet to destinations such as the UK, Ireland and Sweden in November.

- The only jet fuel discharges into France during November comprised of a single jet fuel cargo previously in floating storage, along with a single cargo from Ruwais and another from Jubail. A single LR1 carrying jet fuel from Kuwait is due to discharge into Le Havre this week having changed its destination from Rotterdam in late November.

- Persistently weak airline passenger demand in the wider northwest European region means France’s jet fuel imports are unlikely to swing into recovery in December. However increased consumption for winter heating fuels may continue to provide some small pockets of demand for kerosene in the coming weeks.

Want to see more unique Middle Distillates insights?

Check out our recent Special Report: Top Middle Distillate Trends

Or want to know more about these flows?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3’)}}