Vortexa provides an assessment of the impacts of hurricanes Ida and Nicholas on PADD 3 product and crude flows. Crude imports appear to be in for the greatest impacts.

Hurricanes Ida and Nicholas made landfall in PADD 3 in the past month, bringing heavy rainfall and, in the case of Ida, destructive winds right into the path of the nation’s energy infrastructure. We assess the latest related trends in PADD 3 crude and product trade flows, and give our take on the persistence of the flow turbulence.

PADD 3 products exports

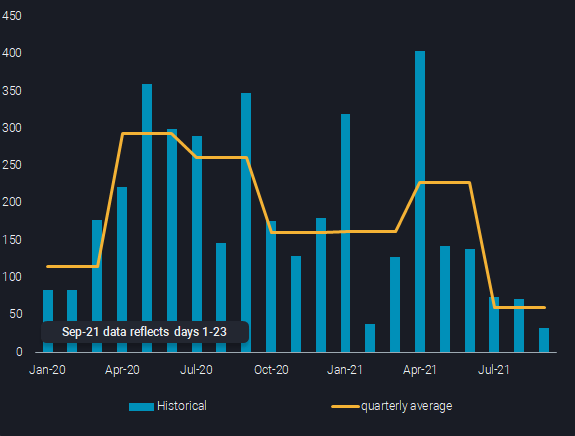

PADD 3 CPP exports have been disrupted by the series of storms to hit the USGC over the last month. Export activities from PADD 3 ports have thus far shown a similar response as to the Freeze earlier this year. In February the freeze reduced PADD 3 transportation fuels exports by about 700,000 b/d. PADD 3 gasoline and diesel exports have similarly been crimped by about 700,000 b/d, though from a larger base. If the recovery from these storms follows that of the Freeze, then we can expect CPP exports out of PADD 3 to return to pre-storm levels in the coming weeks.

PADD 3 gasoline and diesel exports (mn b/d)

PADD 3 products imports

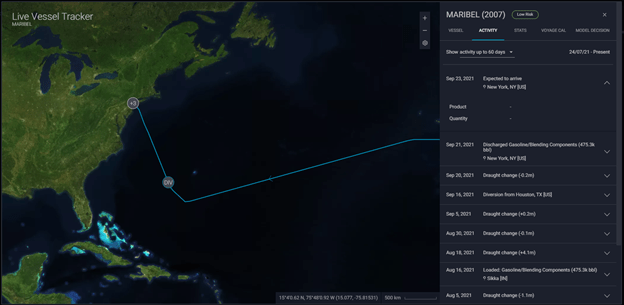

Market players scrambled in the aftermath of the hurricanes to reprogram flows and move product to where it was needed. To that end, we noted a number of interesting diversions in the aftermath of Ida and Nicholas. On September 16 the Maribel diverted her 475,000 bbl gasoline cargo from Houston to New York and the Elandra Oak diverted from NYC to Freeport, Bahamas with 200,000 bbl of gasoline and 200,000 bbl of naphtha. The following day the BW Cougar diverted her 375,000 bbl gasoline cargo from Freeport, Bahamas to Houston, TX.

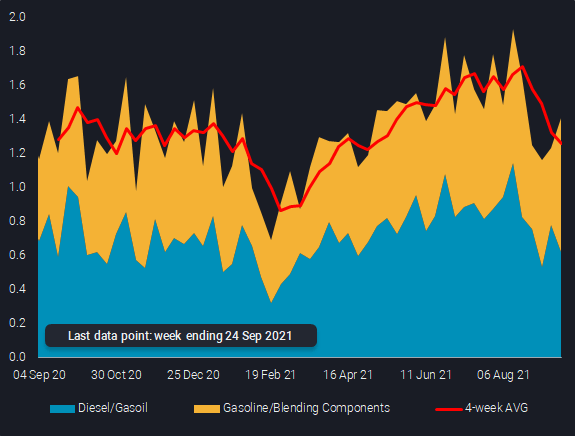

These movements were part of a larger trend that saw an influx of gasoline imports into the US last week, with the EIA data reporting 775,000 b/d of gasoline imports into PADD 1 in the week ending September 17. Given that most refinery outages due to Ida have been resolved for more than a week now, we can expect Gulf Coast supply to domestic US markets to return and lessen the call on imports. Vortexa data shows that PADD 1 gasoline imports are poised to drop off about 300,000 b/d for this week, ending September 24 and reported September 29.

PADD 3 crude imports

The impact of Ida on PADD 3 crude imports will last well after hurricane season closes on Nov 30. In the initial aftermath of the storm a neatly offsetting 1.7 mn b/d of offshore crude production and 2 mn b/d of refining capacity were offline. While the refineries have largely come back online, crude production has been much more stubborn to return. Further, with the announcement that service will not be restored to the 300,000 b/d Mars pipeline until Q1 2022 there is a sizable gap in the supply-demand balance opening up that will need to be met by alternative grades.

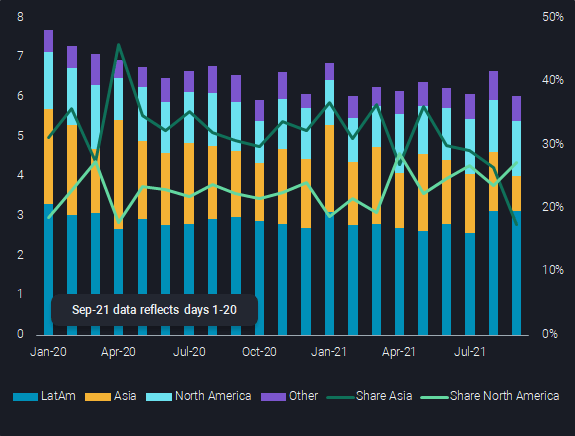

Look for Latin American grades such as Isthmus or Roncador to be processed in Gulf Coast refineries as well as the possibility of increased flows of medium-sour grades such as Russian Urals. Also more Middle Eastern crude, especially from Saudi Arabia, could hit US shores again, as the latter is strongly spear-heading OPEC+ efforts to increase supplies. Rising Middle Eastern supplies, strong US interest for regional grades, as well as limited demand in Asia have all been behind the trend of lower LatAm crude flows to Asia over recent months (see chart), depressing also dirty freight rates on lower tonne miles.

Latin American crude shipments by destination (mn b/d, %)

PADD 3 crude exports

Crude export infrastructure was largely spared by the storms save for a rainy day or two as Nicholas blew through. The lone exception to this is the Mars pipeline damage referenced above. Only about 60,000 b/d of Mars crude was exported during Q3 before the storms after upwards of 225,000 b/d left during Q2. Now that the storms have passed we are seeing weekly export figures again approaching 3mn b/d and expect activities to continue apace for the coming weeks. Constrained US refining activity – due to the seasonal maintenance schedule amid lower demand – and healthy Canadian crude production levels, should underpin crude exports from US ports further.

In conclusion, the longest lasting repercussions from the storms (as of now, the season is ongoing) should be on US crude imports, where alternatives for the lost Mars volumes are set to be looked for. Volume-wise, the biggest impact is currently seen on gasoline and diesel flows, where a short window of opportunity has opened for alternative suppliers, in particular in Europe, to both the US East Coast and Latin America, where supplies have been temporarily missing from lower Gulf Coast refining operations. But overall, repercussions will be far less dramatic as it looked like in the two weeks after Ida’s landfall, with Nicholas being due to follow through.

For a thorough and insightful analysis on the current and future state of the tanker market, please tune in to our freight webinar by clicking here.

More from Vortexa Analysis

- Sep 20, 2021 Flow highlights: Tight supply continues to support prices across the board

- Sep 16, 2021 LatAm road fuel imports set for decline after hitting record

- Sep 15, 2021 Can Asian gasoline sustain their strength in Q4 2021?

- Sep 15, 2021 Reality check: is China ready for U-turn after weakness in last months?

- Sep 9, 2021 The Atlantic Basin pulls diesel into the spotlight

- Sep 8, 2021 Collapse in West African supplies hits dirty freight segment hard

- Sep 7, 2021 Physical flow highlights: Supply-side restrictions boost prices across the board in spite of poor demand

- Sep 2, 2021 VLCC Clean Maiden Voyages: a trend coming to an end?

- Aug 31, 2021 Physical reality check: How strongly are Asian oil flows affected by COVID-19 waves?

- Aug 26, 2021 Summer of 2021 brings LNG players heatwaves, empty dams and a longing for Nord Stream 2