Omicron infiltrates tankers in the Atlantic basin

Transatlantic rates reached an annual high recently, however are now easing. Vortexa is attempting to analyse the reasons behind this decline and whether this trend will resume.

Transatlantic rates reached an annual high recently, however are now easing. Vortexa is attempting to analyse the reasons behind this decline and whether this trend will resume.

The overall lacklustre performance of the tanker sector in 2021 has been mentioned again and again in our blogs. The fact that each of the main tanker classes reached multi-year lows in terms of rates at some point throughout the year, while earnings were at negative territories for many routes, sums up the current environment.

Yet, in the Atlantic Basin there were two specific freight rates acting as outliers, rallying to reach a 2021-high in mid-December: Aframaxes operating on the US Gulf/Europe route and MR tankers doing the opposite Europe/PADD 1 route. On the one hand, Aframaxes managed to find employment on the persistently high US seaborne exports, at a time where a portion of the fleet was absorbed in Europe, loading Russian crude out of the Baltic and the Black Sea. MR tankers in Europe showed a similar pattern. Healthy refining runs and high levels of gasoline inventories in ARA at a time of low seasonal consumption supported the case of exporting.The demand was matched not only by the US, but also from West Africa, creating a double whammy for MR operators, which saw rates almost doubling since the start of November.

Fast forward to today and rates on both of these routes are easing. More specifically, Aframax and MRs rates have lost 11% and 14% of their value respectively since peaking, according to our freight pricing screen.

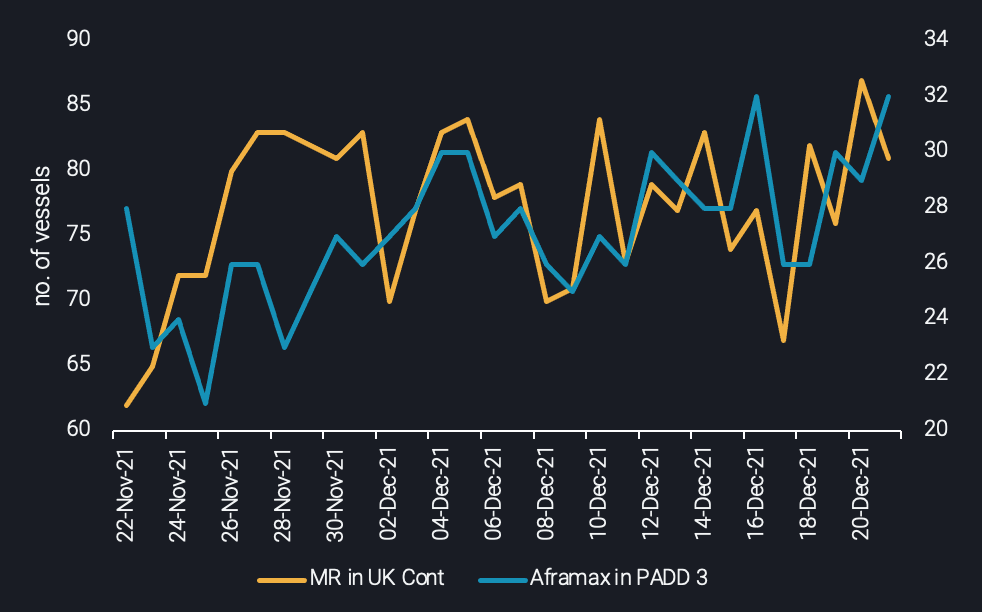

Vessel Availability at specific regions (no. of vessels)

The lower freight rates are matching with the rise in tonnage availability, which is evident over the past week. This raises the question whether lower demand or higher vessel supply is to blame for rising availability? To answer this question we can look at fleet utilisation. When it comes to Aframaxes, employment of vessels in other key regions, like the Baltic or the Black Sea remains at high levels. This eliminates the possibility of vessels ballasting towards the US to compete with the Aframax tankers located in PADD 3. Looking at MRs in Europe, utilisation peaked for the quarter over the last week, but since then it follows a downward trajectory. We conclude that underlying demand is the culprit behind lower rates.

Omicron may well play a role. As European countries impose stricter measures and cases are surging, a decrease in oil consumption will be observed or anticipated by refineries, weighing on runs or at least crude purchasing activities. This will have a dual effect: lower volumes of US crude will find home across the Atlantic, hampering Aframax demand. At the same time, lower runs may translate into lower CPP volumes available for export. Hence, the recent annual peak, a hopeful glimmer will likely prove to be a blip, as operators of Aframax and MR tankers in the Atlantic basin are expected to face a challenging start of 2022 for the short to medium term.

More from Vortexa Analysis

- Dec 21, 2021: Asian refiners find silver linings amidst an ominous Omicron outlook

- Dec 16, 2021: Volatile global flows and hydrogen economics leave Europe short in naphtha

- Dec 14, 2021: 2022: The Freight Forecast

- Dec 9, 2021: Big oil producers shine as refiners

- Dec 8, 2021 Russia and Ukraine: What’s at Stake for Oil?

- Dec 7, 2021 LPG flood reaches Asia and Europe in December

- Dec 2, 2021 Omicron obscures outlook for tanker markets

- Dec 1, 2021 Rising flows, wrong time?

- Dec 1, 2021 What a time(ing)!?

- Nov 25, 2021 Clean tankers battle it out in the Atlantic and the Middle East

- Nov 23, 2021 How helpful is the US-led SPR release

- Nov 23, 2021 Asia’s gasoline cracks make an unexpected U-turn

- Nov 18, 2021 Asia’s crude appetite sweetens in November