Tonne-miles need to pick up to sustain rally in dirty freight rates

A rally in rates throughout the month of October was logically followed by an increase in laden crude tankers as seen through Vortexa data. With the physical reality of low tonne-miles settling in however, it remains to be seen whether that rally still has fuel to run on.

A rally in rates throughout the month of October was logically followed by an increase in laden crude tankers as seen through Vortexa data. With the physical reality of low tonne-miles settling in however, it remains to be seen whether that rally still has fuel to run on.

Laden crude fleet vs. Basket of benchmark freight rates

According to Vortexa’s fleet utilisation data, the amount of tankers laden with crude, within the VLCC, Suezmax and Aframax segments, has reached an 11-months high this week. The increase in laden tankers comes from rising OPEC+ supplies and slow-steaming amid lofty bunker fuel costs. This has fuelled a rally in freight rates. A basket of dirty tanker rates compiled by Vortexa using Argus Media data across benchmark routes has risen 35% in the last 2 months.

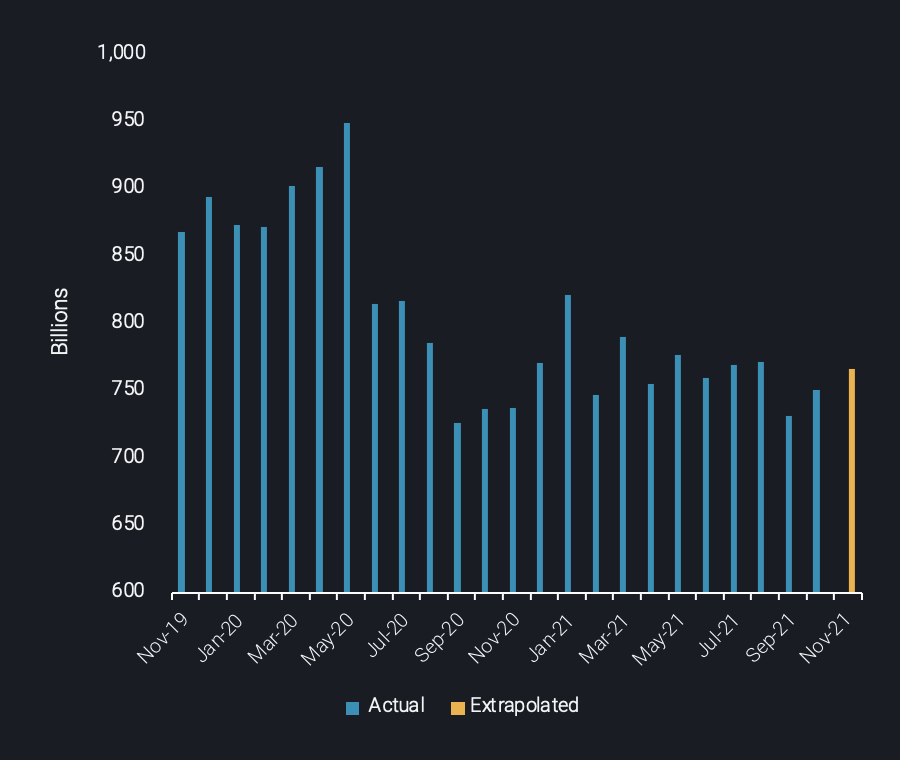

However, from a historical perspective rates are still low. The count of laden vessels also remains below 2019 average levels, not to mention 2020 peaks. A steadily growing fleet is also capping the upside for freight rates. But the most concerning factor is that tonne-miles have not yet picked up at all.

In fact, tonne-miles of crude oil on the three main dirty shipping classes have been recorded at the lowest level so far in 2021 over September and October, at around 750 billion. The Sep-Oct level is still 14% below average 2019 figures. The main reason tonne-miles have stagnated is because the increased activity in crude tanker markets has stemmed from an increase in crude loadings out of the Middle East Gulf towards Asia – a relatively short route compared to volumes from the Atlantic Basin. In addition, structurally declining exports from West Africa take away a lot of long-haul shipments.

But the most important factor explaining low tonne-miles is a lack of crude supplies. A superficial observer of the market would assume otherwise, given voices of 2019 oil demand levels being re-established and the supposed regular addition of OPEC+ barrels at a 400kbd rate per month. But the truth is that seaborne crude loadings in October were only up by a meagre 1mbd vs the Jan-Sep 2021 average. Over recent months, most of the demand growth was met from crude and product storage, with the resulting stock draws constantly pushing up the backwardation in crude and product futures.

The outlook for shipowners hinges on OPEC+ and crude quality

The outlook for dirty freight hinges on a marked change in dynamics. Without higher tonne-miles, not even the recent improvement may be sustained. But the stock-drawing tactics may run out of scope, raising the heat on OPEC+ to deliver. Steep increases in Saudi OSPs have sent an ambiguous signal in this context.

And there is a wildcard for shipowners: crude quality. It may well be that soaring refinery processing costs linked to sky-high natural gas prices (relevant for power, heat and hydrogen supplies) drag light sweet grades (requiring less processing/desulphurisation) to Asia and Europe, while more medium-to-heavy, sour grades are shipped to the US, where gas prices are only a fifth or less of the level in Asia and Europe. Potentially involved flows include: Middle Eastern and Russian crude to the US, US light sweet crude to Europe and Asia, Caspian and other Atlantic sweet crudes to Asia. Some of these flow changes are starting to become visible but they are not yet pronounced enough to make a real difference.

More from Vortexa Analysis

- Nov 10, 2021 Does supply provide a cure for record LPG prices?

- Nov 10, 2021 Global diesel market braces for tight winter as inventories draw

- Nov 4, 2021 What’s behind Asia’s gasoline crack surge?

- Nov 3, 2021 A sweet-sour situation for OPEC+

- Nov 2, 2021 China scrambles for diesel to avert another power crunch

- Oct 28, 2021 FSU fuel oil exports decline in October

- Oct 27, 2021 Asia’s chase for naphtha amidst a global shortage

- Oct 26, 2021 Crude floating storage shows diverging trends

- Oct 21, 2021 The case for higher refinery margins

- Oct 20, 2021 A last hurrah for global gasoline cracks? Probably not