Vortexa Snapshot: US VGO arrivals rise despite gasoline slump

Vortexa Snapshot: US VGO arrivals rise despite gasoline slump

Arrivals of vacuum gasoil (VGO) into the US will hit a year-to-date high this month, leaving refiners with surplus feedstock for gasoline-producing units at a time where road fuel demand has collapsed. Some of the VGO cargoes that have recently sought to clear towards the US have waited longer to discharge and entered floating storage as a result. VGO demand for marine fuel blending to IMO specifications, meanwhile, offers only a limited alternative outlet in coming weeks, given the sizeable downturn in gasoline consumption.

US VGO arrivals mount in April

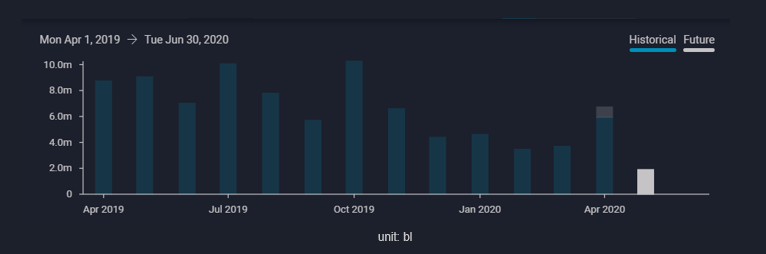

- US imports of VGO, a feedstock used in catalytic cracking units to produce road fuels, are expected at their highest since October 2019 at around 6.7 mn bl in April, Vortexa data show. April arrivals are also up 80% from March volumes, led by higher inflow from Europe and Russia. A more unusual high-sulphur VGO cargo that loaded from India’s Vadinar in February also discharged in the US west coast this month.

- These arrivals come at a time when US EIA data show gasoline demand for the week ending 17 April at just under 5.1mn b/d, down from 9.4mn b/d seen at the start of March and a year earlier. And the latest four-week average for US gasoline demand at 5.5mn b/d is the lowest figure on record since 1991.

- The drop in US VGO demand may be tempered somewhat by redirecting into the bunker market because it is also used as a blendstock for VLSFO production. US bunker fuel demand has so far held up relative to the more aggressive gasoline demand destruction. In fact this dynamic helped VGO prices flip to a premium above gasoline in key producing regions such as northwest Europe last month.

- Another 1.6mn bl of VGO that loaded from Europe and Russia is heading to the US for early May, but arrivals thereafter are thinning given the demand backdrop.

US VGO arrivals, as of 28 April 2020 — Vortexa

US VGO arrivals, as of 28 April 2020 — Vortexa

Excess VGO to build

- Given then the recent squeeze on FCC unit margins in the US, it is no surprise that some VGO cargoes have recently entered floating storage by remaining stationary for seven days or more.

- It is noteworthy that the previous peak for VGO in floating storage in 2016 coincided with the last significant crude floating storage build – the former peaked at just under 4mn bl in early March 2016, according to our data, but almost all of that volume then discharged into the US two months later.

- In the near term, refinery shutdowns across the US do not bode well for feedstock demand. The latest EIA data put total US refinery utilisation rates for the week ending 17 April at 67.6%, the lowest since 2008.

VGO cargoes in the region to note:

- PADD 5

- MR-tanker Clean Thrasher has been sitting outside Los Angeles since 11 April, after loading a VGO cargo from South Korea’s Yeosu in late March. Panamax Fedor is also sitting off shore the US west coast declaring Anacortes, having loaded a Colombian VGO cargo, also in late March.

- PADD 3

- Aframax Briolette arrived to the US Gulf coast on 19 April from Black Sea-Med region, and has discharged slowly over a period of weeks. Aframax Kalahari, laden with Baltic VGO, was previously heading for Houston but slowed to a halt on 27 April, prior to entry into the Gulf.

- Caribbean

- Panamax Inca, which was initially headed into the US Gulf coast with Russian VGO earlier in April, backtracked and has sat offshore Bahamas since 17 April.

- Aframax New Accord, laden with Russian Black Sea VGO, diverted to the Caribbean storage hub of St Croix this month, after initially shaping up for a potential discharge into PADD 3.

Interested in a more detailed view of these flows and supply shifts?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}