Americas heavy and medium crudes in focus

Seaborne exports of Heavy and Medium crudes out of the Americas are gaining importance in light of disruptions in Red Sea and TMX start-up

As the Atlantic Basin emerged as the marginal supplier for global crude markets amidst OPEC+ supply cuts, lighter grades remained in the limelight driven by increased light sweet exports out of the US. What is often overlooked is the role of heavy and medium crudes out of the Americas which is as instrumental in keeping oil prices in check as lighter crudes. As logistical difficulties arising out of the Red Sea/Bab-el-Mandeb crisis keep Middle East Gulf barrels into European markets restricted, buyers turn to the Americas to supply these additional barrels.

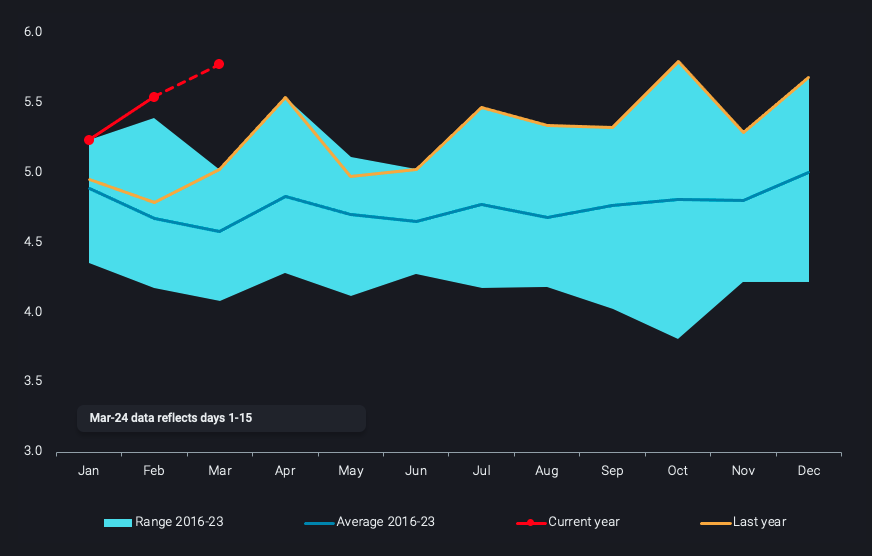

Momentum from 2023 continues into 2024

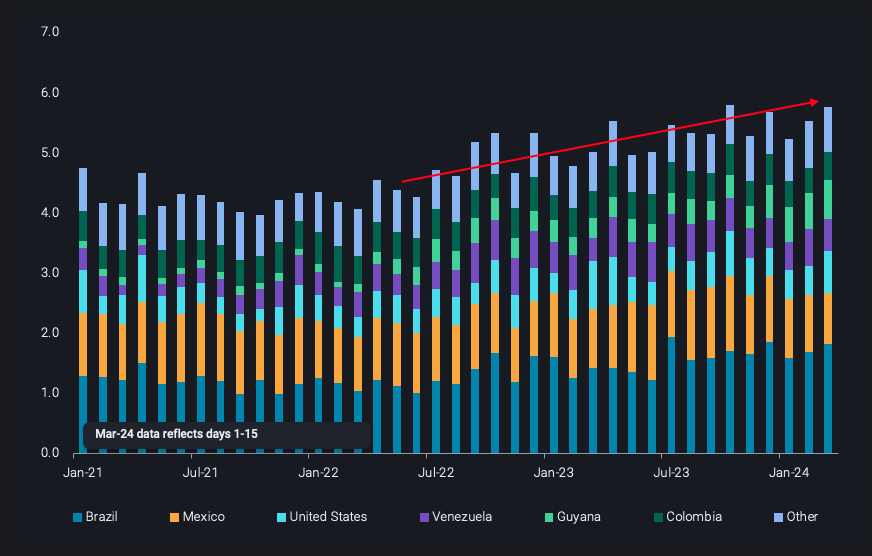

2023 witnessed heavy and medium crude exports set seasonal highs for 9 out of the 12 months and that momentum seems to have carried on into 2024 amidst the Red Sea crisis. February 2024 crude exports increased 16% y-o-y coming in at 5.5mbd with preliminary data for March suggesting even higher exports. Demand for these crudes has only grown within the Atlantic Basin, first as a replacement for Russian Urals and then as additional barrels amidst OPEC+ cuts. As the attacks in the Red Sea have forced Middle East Gulf barrels to take the longer route around the Cape of Good Hope, increasing the transit times,buyers in Europe have turned to Americas to supply heavy and medium crudes instead.

A good example of this is the first fully loaded VLCC carrying Brazilian heavy crudes to Europe. Vortexa data suggests the vessel XIN DAN YANG which discharged in Rotterdam on the 10th of March carried cargoes of Albacora Leste, Bravo and Frade grades from Brazil. Another important development was the start-up of Payara Gold field in Guyana which has propelled the country’s crude exports above 600kbd pushing it well ahead of other LatAm producers such as Colombia, Ecuador and Venezuela in terms of seaborne exports.

Talking about Venezuela, we still have uncertainty over the continuation of sanctions waiver after the April deadline which is fast approaching. While uncertainty remains on Venezuela’s crude export status, onshore inventories in the country increased by 20% in March (days 1-15) compared to December 2023, which we covered in our latest edition of Global Inventory Report released last Friday March 15th (Inventories – Vortexa). Another long delayed but important development for heavy crudes is the start up of the Trans Mountain Expansion (TMX) pipeline in Western Canada.

TMX brings new outlet for Canadian crude?

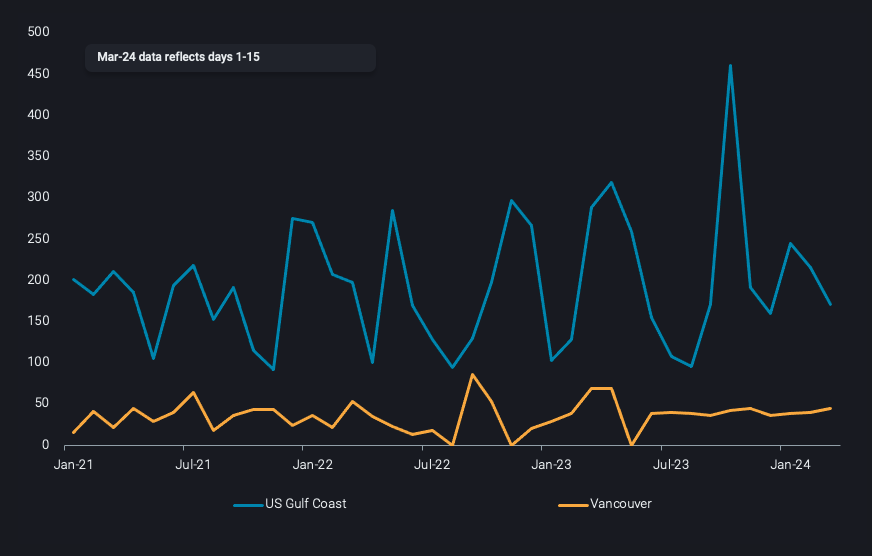

Canadian crude exports from US Gulf Coast and Vancouver (kbd)

The recent news about TMX starting linefill for the 590kbd pipeline in April and May (Argus) with operations to start soon thereafter should open up a new outlet for Canadian crude, narrowing differentials for Canadian crudes in the process. Trans Mountain reports that 80% of pipeline capacity is already contracted (20-yr deal, 10 shippers) and only 20% remains available for spot shippers. Market participants have Asian buyers as the prime candidates for this new flow but logistical constraints and historical data suggest otherwise.

At present, almost all of Western Canadian heavy crude exported to non-US destinations is exported via the US Gulf Coast (2023 avg. ~200kbd) and these volumes far eclipse those currently exported out of Vancouver (2023 avg. ~40kbd), which are mainly destined for refineries on the US West Coast. The Enbridge mainline and other pipelines bringing Canadian crude to the US Gulf Coast play a major role in exports of Canadian crude. The delays and cost-overruns in the TMX pipeline have led to shippers preferring US Gulf Coast over Vancouver to export Canadian crude to Asia.

Another constraint to export crude from Western Canada is the capability of the port of Vancouver to handle high volumes from TMX start up, with restrictions not only on draught (only able to load Aframaxes up to 600kb) but also nighttime transits which are not allowed for laden Afras in Vancouver harbour due to the narrows (connected by the Lions Gate Bridge). Even if these difficulties were overcome, the rough seas of the Pacific Northwest don’t allow for STS transfers which means vessels have to go further south to California or Panama to lighter with larger vessels adding another layer of complexity and costs to the equation. Furthermore, there is also the question of Aframax availability in the region which will have its toll on export volumes from Vancouver.

Going forward, we believe one of the biggest impacts to the TMX pipeline start up will be the supply of additional barrels to US West Coast refiners, pushing out a portion of the barrels from LatAm suppliers such as Ecuador and Colombia while Asian buyers will continue buying Canadian heavies from the US Gulf Coast. As the disruptions in the Red Sea are sustained, European demand for heavy and medium crudes from the Americas will continue and the return of Chinese buying for June deliveries will only help increase these exports.