Asia floating storage drives global build

Vortexa Snapshot: Asia floating storage drives global build

The sharp ascent of Asia’s crude floating storage has helped lift global levels above previous highs in 2016. The Asian region – which currently accounts for around 45% of total global floating storage – has seen swift builds in offshore stocks, notably off India and Southeast Asia, in recent weeks. The growing clusters of floating storage outside refining centres reflects onshore storage capacity nearing limits, prompting refiners and other players to move incremental barrels onto offshore tankers and float them near consumers to shorten delivery time. The rise in recent tanker bookings for floating storage – many of which have yet to commence their storage period – should see additional strong builds in Asia in coming weeks.

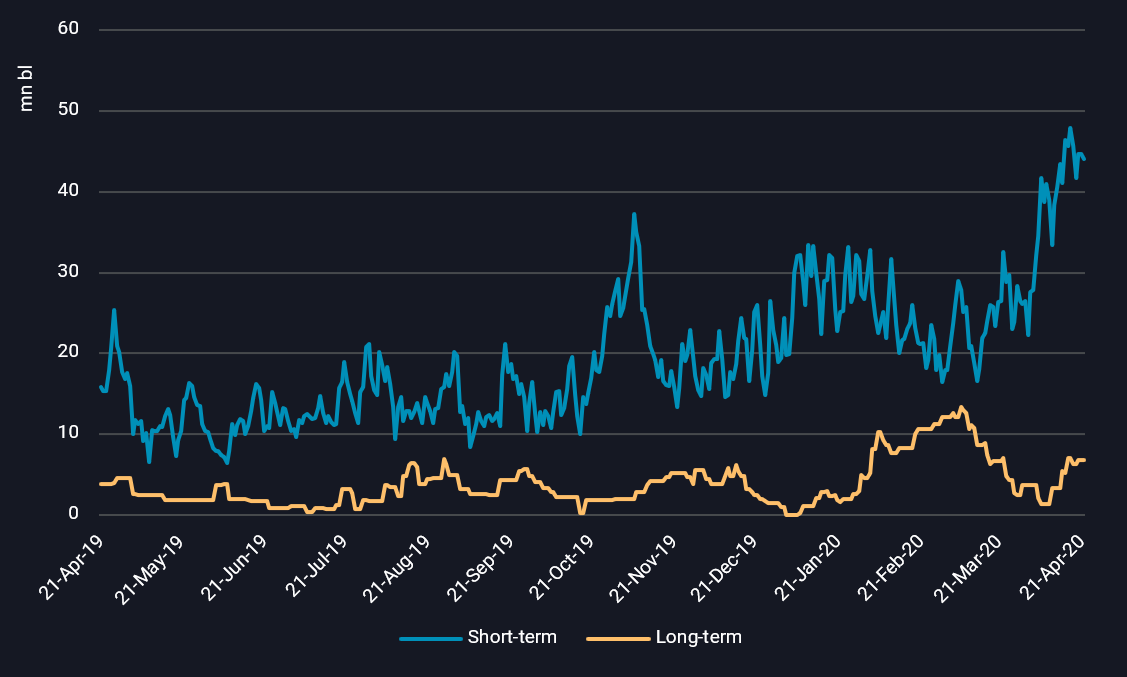

Asia’s floating crude inventory, April 2019 – 2020 (mn bl). Short-term is in storage 7-30 days, Long-term is 30+ days

Asia leads among global floating storage build

- Asia’s floating crude storage rose by 18mn bl week-on-week to 56mn bl on Friday 17 April, the highest in at least four years. Within the region, the hubs of floating storage are currently concentrated around Malaysia, Indonesia, India and China.

- Over 40% (or 7.6mn bl) of the weekly increase was observed in Malaysia, with a flotilla of tankers carrying mostly Mideast Gulf and US crudes anchored near Pengerang and the Straits of Malacca.

- Several other tankers including VLCCs Monte Toledo and Ellinis and Suezmax Gene, have also anchored near Melaka over the last week, and will likely also enter a floating storage state.

- Indonesia is home to the largest floating crude storage in Asia presently, and saw a 4mn bl rise in its floating crude inventory to 16mn bl in the week to 17 April.

- A cluster of tankers comprising of 5 VLCCs, a Suezmax and an Aframax, laden with Mideast Gulf, Caspian and west African crudes has been observed anchored in the Indonesia waters bordering Malaysia, positioning themselves for future deliveries to other import markets rather than domestic processing.

- Elsewhere in Asia, slowing crude purchases by Indian refiners have led to a build-up of around 15mn bl of floating crude inventory as of 17 April, in three key ports – Vadinar, Kochi and Paradip – with a range of crudes, including those from Iraq, the UAE and the US.

- Refiners in India have diverted a portion of their surplus crude to strategic petroleum reserves (SPRs) but that is not enough to quickly soak up all the excess crude arising from their refinery run cuts.

- China’s crude floating storage inventory has declined from the high of 17mn bl observed in early April to 9.8mn bl last week, in part supported by the rise in its refinery runs and an easing of discharge delays.

- But this number could rise with three VLCCs Amundsen, Olympic Life, and Xin Xia Yang, as well as one Suezmax Vilamoura, observed to be anchored near Dongjiakou, Ningbo and Yingkou ports for at least five days, as of 22 April.

Crude floating storage remains commercially attractive

- On a global basis, the rise in floating storage in Asia has helped to lift overall crude in floating storage to above 120mn bl in recent days – surpassing the highs of 2016. Global floating storage is spread across the world holding many different crude types, as tankers wait to discharge. The flotilla of floating storage bookings that will come online in subsequent weeks is expected to lift volumes yet higher, and of these, many are expected to exercise their storage options in Asia.

- Commercial floating storage remains attractive based on the current Brent contango versus VLCC time-charter rates. According to Vortexa calculations, the present VLCC time charter rate of $80,000/day for six months, translates into storage costs of $7.6/bbl, which is lower than the current 6-month Brent contango of $10.90/bbl. However, the rise in floating storage demand would push up tanker time-charter rates, narrowing the arbitrage.

- The agreement by OPEC+ and partners to cut production from May onwards, coupled with the potential of more high cost producers shutting in their wells, would help curb the huge oversupply currently in the market.

- If global crude surplus continues rising, storing crude on tankers even at a loss for operational purposes, could become more entrenched. With this huge inventory build-up, we could expect the surplus to take some time to clear into the market even after demand recovers.

Interested in more of our data and analysis?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}