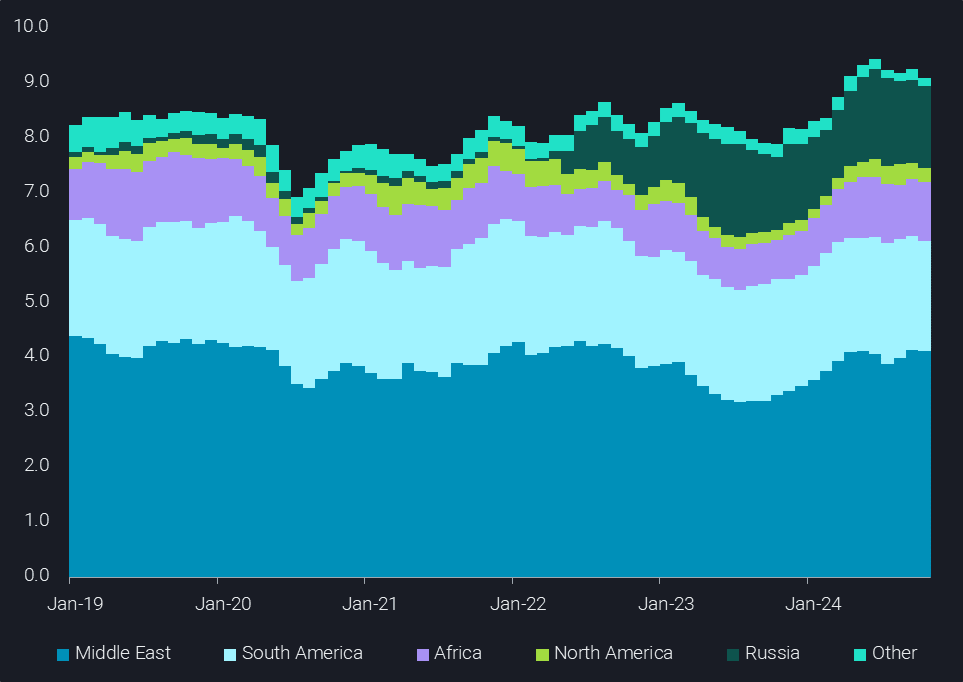

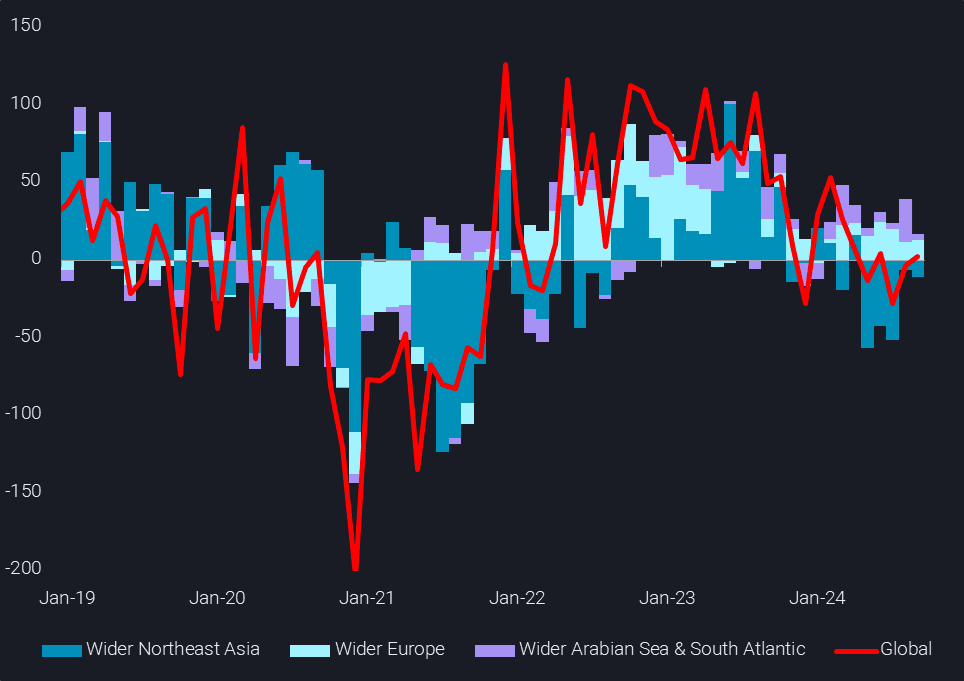

Crude flows, including intra-country movements, have shown quite some disappointment so far this year. In a recent blog, I illustrated that steep import declines in the crucial Northeast Asian and Wider European markets have been only partly counterbalanced by higher arrivals in the Wider Arabian Sea and the South Atlantic. Let’s dig a bit deeper into the drivers as well as the implications for the tanker market, taking also a look forward to 2025.

Crude flow growth markets are dominated by short-haul freight

We will start with the 2024 growth markets. The Wider Arabian Sea – spanning from the Middle East to India’s West Coast and East & South Africa – has seen crude arrivals increase by 700kbd. About 400kbd of this is backed up by higher consumption at refineries in India, as well as a mix of higher refinery runs in Saudi Arabia (Jizan) and more power generation and desalination in the kingdom.

The other 300kbd are due to shifting oil export logistics rather than actual consumption changes with Saudi Arabia routing more barrels to Ain Sukhna in Egypt for flows through the Sidi Kerir pipeline and the United Arab Emirates sending Upper Zakuum to its Ruwais refining complex, freeing up Murban for exports via the ADCOP pipeline and export terminal in Fujairah.

Meanwhile over in the South Atlantic – made up of West Africa and the east coast of South America – the start-up of the Dangote refinery in Nigeria has directed an extra 220kbd to the related Lekki port. This pretty much equates to the net increase in the entire region.

From a tanker market perspective, these increases in Wider Arabian Sea and South Atlantic flows are not particular helpful, as they are largely met from local supplies, requiring short-haul, or even shuttle-type shipments. The only outside supplier to these markets is Russia, but not much changed there from a year-on-year perspective in 2024.

China 2024 disappointment unlikely to be repeated in 2025

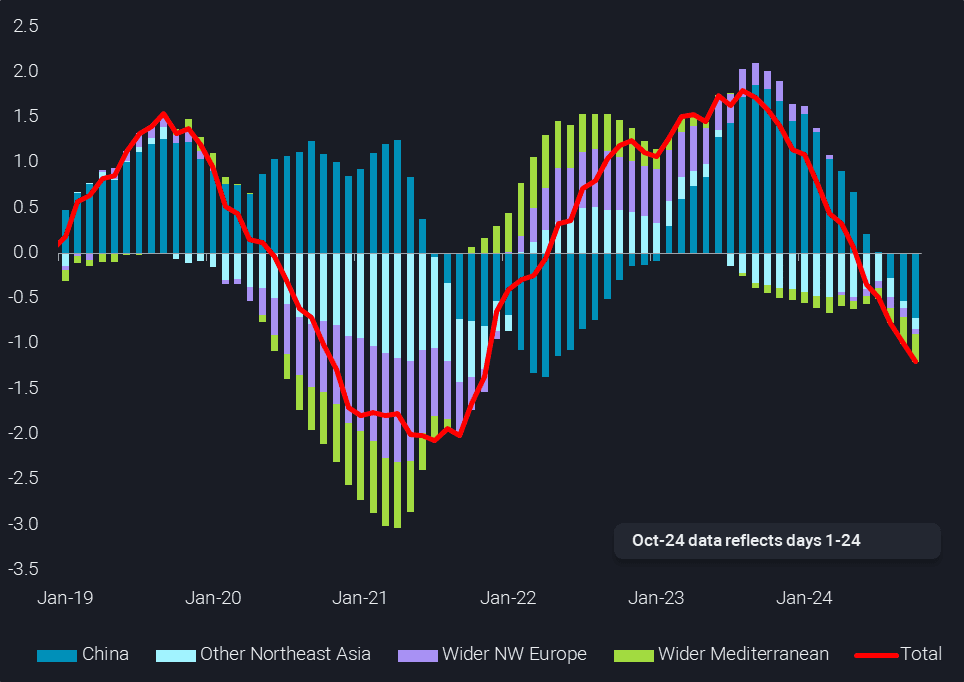

What matters much more from a tanker perspective is the dramatic decline in crude arrivals in the crucial import markets in Northeast Asia and Wider Europe (Wider Mediterranean and Wider Northwest Europe). Jointly, these markets saw a whopping 1.2mbd decline in crude inflows over the last 12 months, made up by 800kbd to Northeast Asia and 400kbd to Wider Europe.

What most would have judged as close to unthinkable is that China alone essentially accounts for 700kbd of the 800kbd decline in Northeast Asia. A huge shift in trucking from diesel to LNG, as well as the swift electrification of passenger transport are two culprits of this development, joined by various structural problems of the economy in a global challenging environment. At the same time, refining margins and government policies kept Chinese refiners from exporting their product surplus, resulting in year-on-year declines in refinery operations in nearly every single month in 2024.

But how likely is it that this extraordinarily poor Chinese performance will be repeated in 2025? While many of the challenges remain, another 700kbd decline in imports appears very unlikely, with refinery and petchem expansions, and a likely much slower LNG truck expansion probably being sufficient to support year-on-year growth in Chinese and potentially overall Northeast Asian crude imports.

Wider Europe is much more likely to face additional pressure

At the same time, the Wider European market is likely to see a marked decline in crude imports in 2025. Already now a handful of refinery shutdowns are announced. And refinery margins are under pressure from two fronts. A flood of diesel and jet fuel from the Wider Arabian Sea is continuously hitting the area, while diesel inflows from the US and Russia remain ample as well. And outlets for the surplus gasoline will be hard to find after the successful start-up of the respective secondary units at the Dangote refinery in Nigeria, while North American export markets are shrinking.

More Atlantic Basin crude flows to Asia should support dirty freight in 2025

Crude flows in 2025 are likely to be driven by stable to growing import needs in Northeast Asia and possibly markedly declining arrivals in the Wider European market. With supply growth dominated by the Atlantic Basin, this will require a rerouting of US and other regional crude grades to Asia, creating substantial additional tonne-miles demand.

During the last 12 months, Northeast Asian crude arrivals accounted for about 5.2 trillion tonne-miles per month. This is roughly twice as high as the combined tonne-miles to Wider Europe, Wider Arabian Sea and the South Atlantic, underpinning the relevance of Northeast Asia, and in particular the respective long-haul flows. Therefore, a shift in destination of Atlantic Basic crude from Europe to Northeast Asia has the potential to be the transformational aspect in 2025 dirty freight markets, providing a welcome upside to a recently pressured tanker demand environment., especially on the bigger tanker classes.