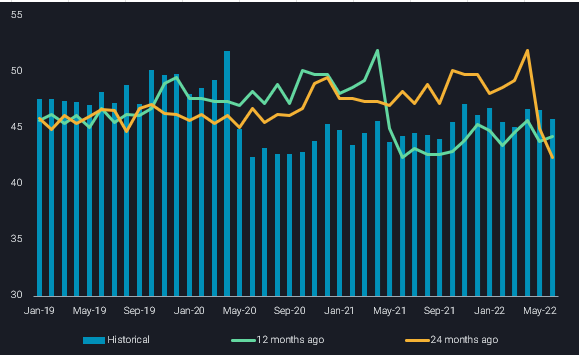

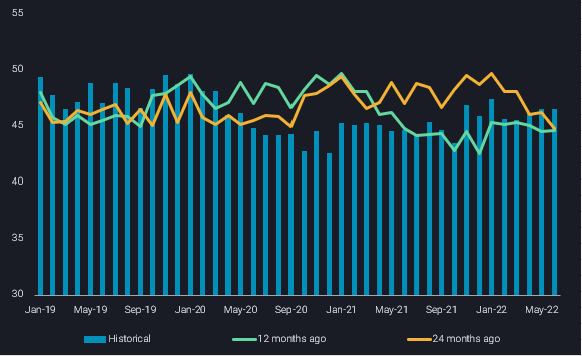

Global crude/condensates liftings fall in June as arrivals stabilize

Global seaborne liftings fell, while arrivals of crude/condensates were flat m-o-m in June, reinforcing limited global spare capacity concerns.

Global seaborne liftings of crude/condensates (excluding Iran and Venezuela) fell m-o-m, while arrivals were flat, as the global crude market contends with already low spare capacity shrinking further. Apart from Saudi Arabia and maybe UAE, all other OPEC countries have little-to-no spare capacity left, while non-OPEC producers such as the US have resorted to SPR releases for additional supply recently.

Key takeaways for June loadings:

- Crude/condensates liftings from Saudi Arabia for the month of June fell by 40kbd m-o-m. In comparison exports from other OPEC member countries fell by 80kbd m-o-m in June – signs that OPEC spare capacity is almost non-existent now. Decline in liftings from Saudi Arabia are also tied to increasing domestic pull from crude burn for power generation as seasonal demand for air conditioning rises.

- US crude/condensate exports have stayed flat m-o-m in June, as SPR releases supplied additional barrels to the market. Exports to Asia declined by 80kbd m-o-m as more sweet barrels went to Europe instead.

- Guyanese crude oil exports have more than doubled since March, when the FPSO Liza Unity started production. June exports came in at 300kbd with more than half of those flows headed to Europe.

- European imports of sweet crudes increased by 140kbd as refiners sought replacement for lost Russian barrels. European refining demand for Brazilian and WAfr crudes has strengthened.

- Libyan supply issues continued in June, as port and field blockades affected the country’s crude exports. Loadings from Es Sider and Ras Lanuf ports were under force majeure. Vortexa’s latest data for July indicates even lower supplies going forward – only 490kbd was loaded during 1-10 July, down 31% m-o-m.

- Venezuelan crude exports to Europe resumed in June as Repsol and Eni received waivers as part of the crude-for-debt deal. Exports in June headed to Spain and Italy, with additional loadings observed in July. Heavy Venezuelan crude could potentially help Spanish/Italian refiners reconfigure their crude slate as they seek to reduce Russian crude imports.

- Chinese and Indian imports from Russia came in at a record high of 2.1mbd in June, as both the nations sought to capitalize on discounted Russian cargoes. Over the course of May/June we have begun to observe dark STS activity off the North Atlantic coast (Azores) as a new method to send Russian Baltic crude East of Suez.