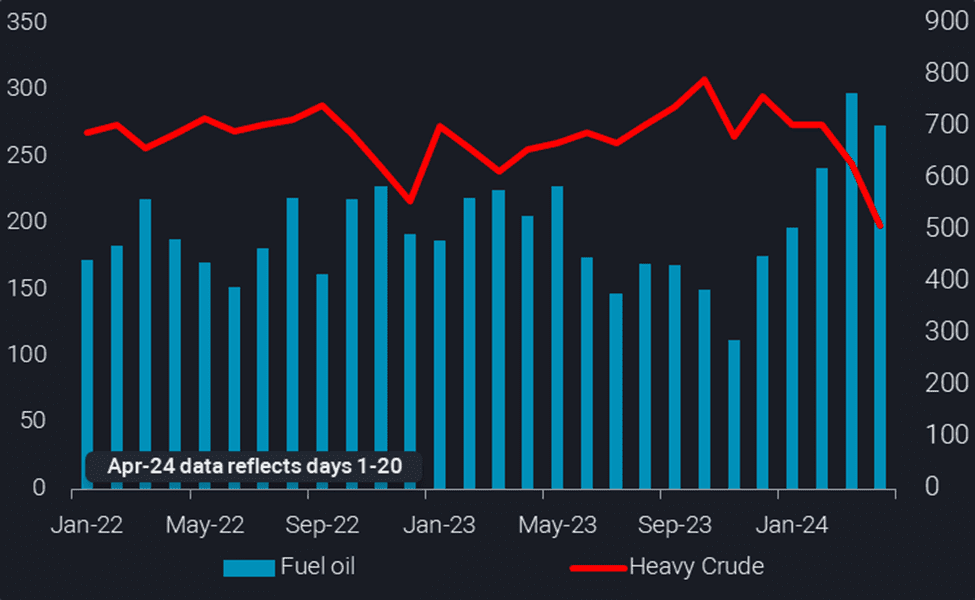

Russia’s seaborne fuel oil exports on a four-week moving average have declined sharply over the past two months from over 750kbd to under 670kbd in mid-April. Exports first fell under 600kbd in late January this year after Ukraine launched multiple attacks on Russian refineries. Russia’s offline refining capacity due to the drone strikes and planned maintenance rose to approximately 1mbd in April, further restraining the country’s ability to sustain fuel oil exports at historical average levels.

Although Russia’s refinery maintenance typically begins in April and ends in July, the country could potentially delay turnarounds and boost output from refineries to supplement its lost refining capacity. Russian refiners have also reportedly installed anti-drone nets recently in an attempt to protect their refining infrastructure from further attacks.

In addition to lower fuel oil exports from Russia, Kuwait is expected to halt fuel oil exports until the end of May, excluding cargoes for term contracts, to stock up for its summer power generation demand, and upgrades at the country’s Mina al-Ahmadi and Mina Abdullah refineries have also resulted in lower HSFO exports. Elsewhere in the Middle East, fuel oil demand is similarly expected to rise, which would likely crimp exports from the region, putting a further squeeze on supplies to Asia.

Declines in heavy crude supplies put downside risks on fuel oil production

Exports of South Sudan’s Dar blend, a heavy sweet crude grade for VLSFO blending, slowed to a halt in March, after a force majeure was declared in February due to damage to a pipeline connecting South Sudan to Sudan.

Increases in Mexican fuel oil exports are negated by lower crude exports

Recent months also saw substantial changes in Mexican crude and fuel oil outflows. Exports of fuel oil rose by 160kbd from last November to April this year but these volumes were offset by a 170kbd decline in heavy crude exports in the same period. Higher fuel oil exports are not related to the announced startup of the Dos Bocas refinery as they are not coming out of the related Paraiso port. Instead it is higher refinery runs at the aging and ailing existing refineries that are driving the changes in exports. The additional fuel oil will be used in US Gulf Coast conversion set-ups to somewhat ease the growing shortfall of heavy crude supplies (OPEC, Venezuela, Canada TMX pipeline start-up).

Declines in heavy crude supplies put downside risks on fuel oil production

In the global crude market, the share of heavy crude loadings fell from 15.5% last October to 13.9% in March this year, the lowest since at least 2016. Conversely, the share of light crude loadings increased from 30.4% to 32.2% in the same period. The supply landscape has shifted towards lighter grades as US producers have been increasing output amidst cutback of heavy-sour barrels from OPEC+ producers.

Overall, the combination of tighter heavy crude and fuel oil supplies, as well as seasonal rise in power generation demand is expected to push up fuel oil cracks in the weeks ahead.