How Iranian oil is used in China?

We shed light on the flows of Iranian oil into Chinese refineries and tanks, debunking the story of SPR fills.

China’s imports of Iranian crude rallies on stronger demand from teapots

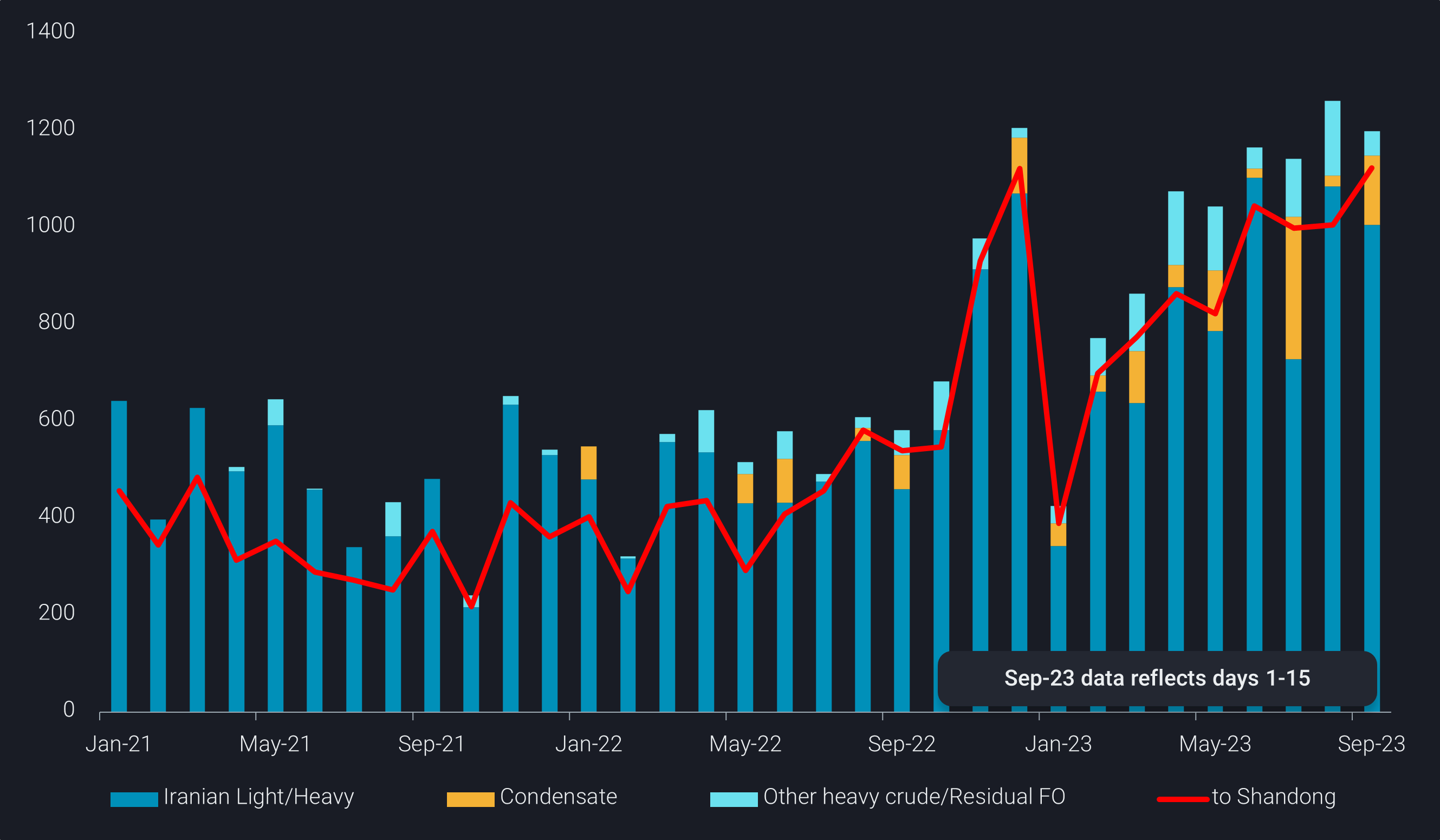

China’s crude imports from Iran have picked up strongly since April this year, following record Russian crude flows into the country. A new group of Chinese buyers, comprising state-run refiners and larger listed private refiners which are still cautious in tapping on US-sanctioned Iranian oil, have ramped up Russian crude imports in Q1. This, together with strong competition from Indian refiners, have tightened the Russian supplies to the smaller private refiners (i.e. teapots), who are traditionally the main buyers of Russian Far East ESPO blend crude. As a result, the teapots turned to more heavily discounted Iranian crude to reduce their overall feedstock costs and boost refining margins.

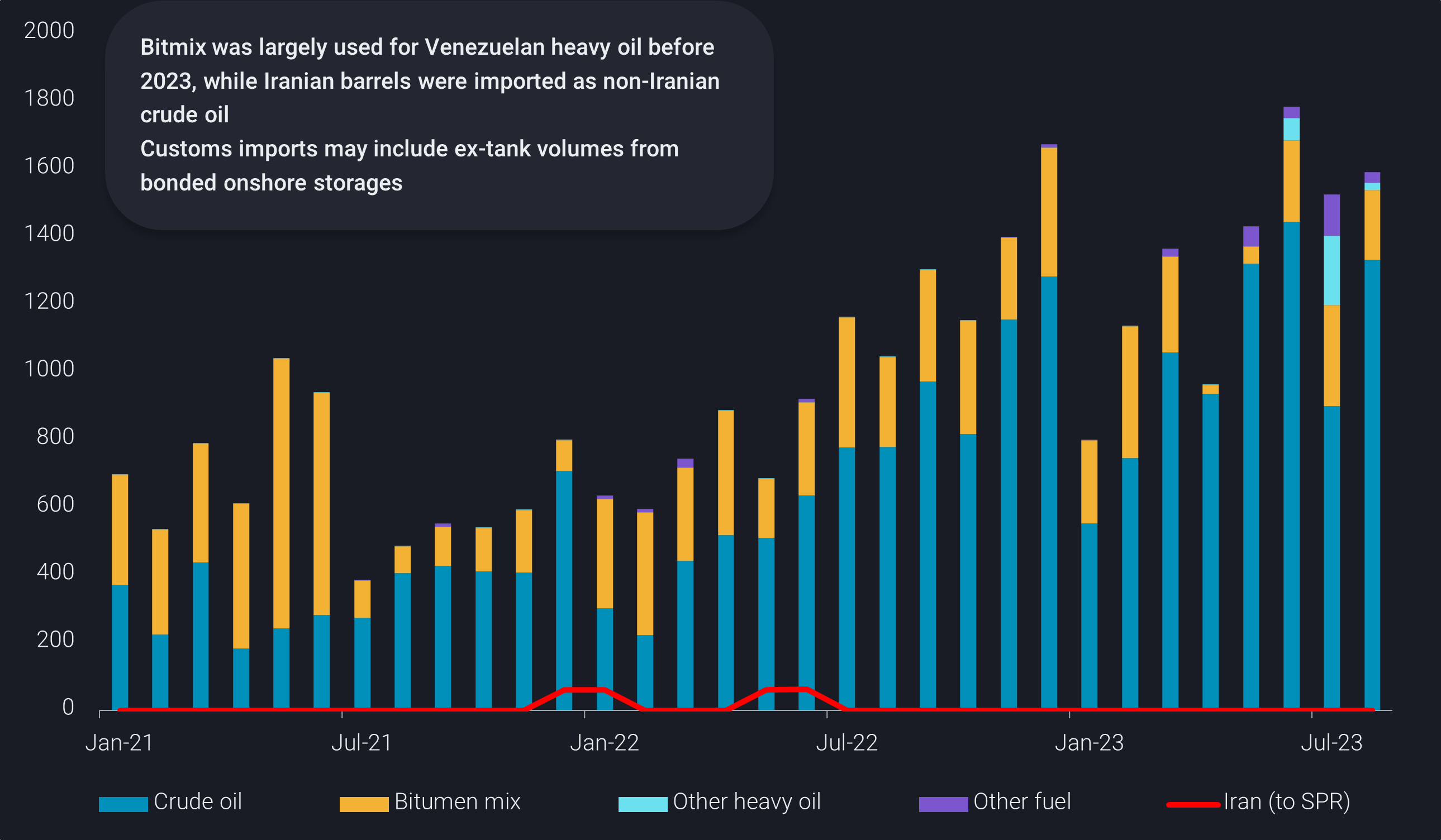

This year, beside teapots’ long-favoured Iranian Light/Heavy crude, other Iranian oil, including condensate, extra heavy crude and residual fuel oil were also discharged into China. These barrels are usually blended before reaching Chinese ports so that they might be imported as non-crude feedstocks such as bitumen mixture and other heavy oil to bypass crude import quotas. The discounts in such barrels were also deep enough to offset the import tax levied on such non-crude categories.

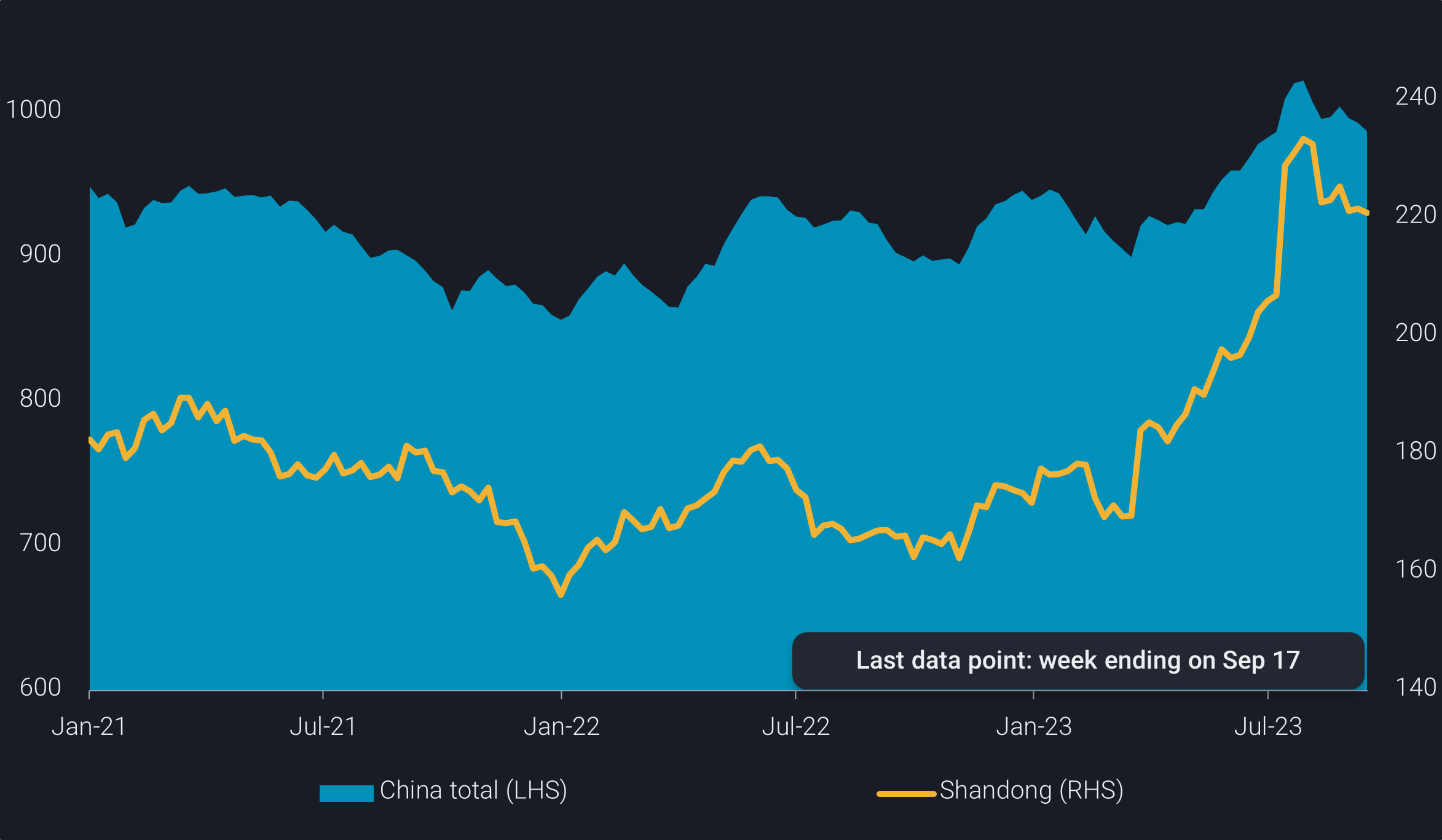

Iranian crude and fuel oil imports reached 1.2mbd in 1H September, just shy of August’s record, with volumes to Shandong province surging to year-to-date highs. Around 85% of the Iranian barrels imported by China had been discharged into Shandong province so far this year, while the rest of the barrels went into commercial storages across the country and were subsequently delivered to end buyers via land or intra-country seaborne trade.

China’s crude oil and residual fuel oil imports from Iran (kbd)

High crude imports, high inventories, but who are the end users?

China’s crude imports and refining throughputs have largely recovered from the pandemic this year, but refining performances have diverged between state-run and private sectors. Oil majors’ crude throughputs have extended gains over Q3, peaking at 3-year highs in September as new product export quotas spur production, while teapots’ run rates stayed below seasonal norms since June, starting to pick up only in September.

Shandong teapots without sufficient crude import quotas had faced challenges importing feedstock from the seaborne market and ex-tank deliveries since April, resulting in more than 50mb stock build in Shandong’s onshore crude inventories that reached an all-time high at end July.

Vortexa flow and inventory data also records Iranian barrels discharging into commercial tanks outside Shandong in April-July this year, as teapots and traders stored spot barrels in (bonded) commercial tanks in other storage hubs across the country, amidst a ban on bitumen mix imports – a non-crude grade that teapots usually use to import Venezuelan heavy oils. None of these tanks belongs to state-run refiners – who also operate the country’s strategic reserves – and intra-country seaborne loadings from these tank terminals to Shandong ports suggest that the end users of all Iranian oil were teapot refiners. China’s SPR storages only added 7mb during this period, ranging within historical norms.

China re-allows non-crude imports, a compromise to its GDP target?

Chinese authorities recently rolled out a series of incentives to encourage teapot refiners to boost run rates. These include the early issuance of the third batch of crude import quotas, re-permitting imports of bitumen mix under certain conditions and allowing some Iranian barrels that do not meet bitumen mix specifications to be imported as other heavy oil.

This has eased the inventory pressure at Shandong ports, allowing teapots to ramp up operating rates, as margins of processing heavily discounted feedstock to produce gasoline and diesel alongside bitumen are good.

Customs statistics of selected products from Malaysia (kbd)

However, this brings to fore the concern that many old, inefficient and idle refining capacities are now coming back online, defeating the original intent of the crude import quota mechanism. In order to phase out the inefficient refining capacities and keep teapots’ crude imports and throughputs under control, China may release the fourth batch of crude import quotas estimated at around 13mt for 2023 in end September or early October on a selective basis. Non-crude imports may be tightened again by then, which may cap China’s Iranian oil demand as well.

The consistent stock draws in the past 6-7 weeks and rapid Iranian floater buildup in Singapore OPL already hint at capped teapots’ appetite for fresh seaborne Iranian imports.