Is term crude at risk after the deepest YoY cuts in China’s refinery runs?

China’s implied refinery runs experienced the steepest y-o-y decline in October. What trends might emerge in the coming months?

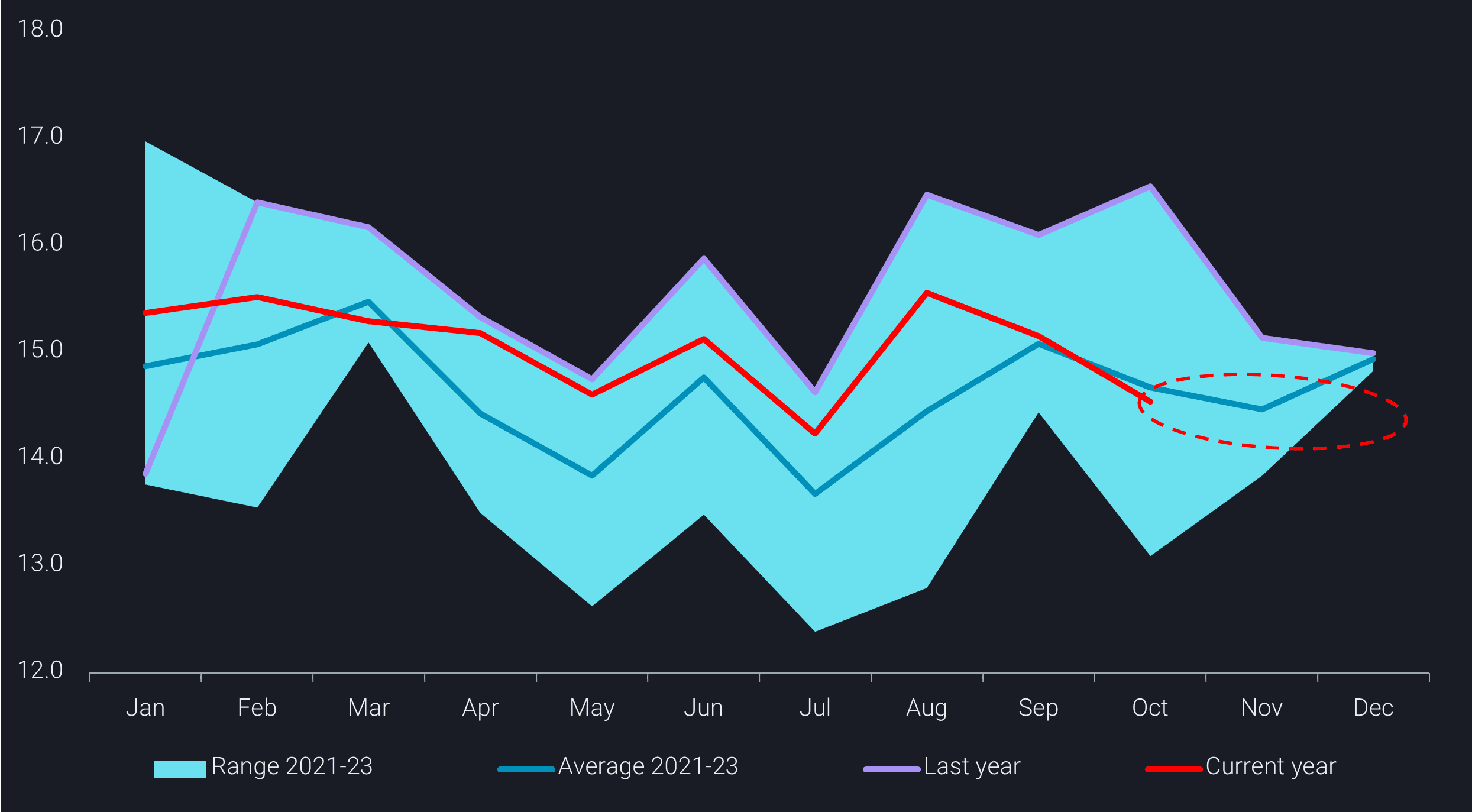

In October, China’s refinery runs dropped for a second consecutive month to 14.5mbd, with seaborne crude imports down to 9.6mbd and crude inventories rising by 150kbd.

This y-o-y refinery run decline of nearly 2mbd marks the most significant reduction since January 2022. Demand had surged last year following the February reopening, reaching multi-year highs around September-October during the first “travel-free” Golden Week holidays, before a marked reversal starting from November.

Having hovered around 15mbd over the past 12 months, refinery runs are expected to maintain similar levels in the months ahead. Starting in November, refinery runs may also align more closely with year-ago figures.

China’s implied refinery runs (mbd) – Net seaborne imports and onshore crude inventory change

Refiners increasingly turn to spot barrels, is term supply at risk?

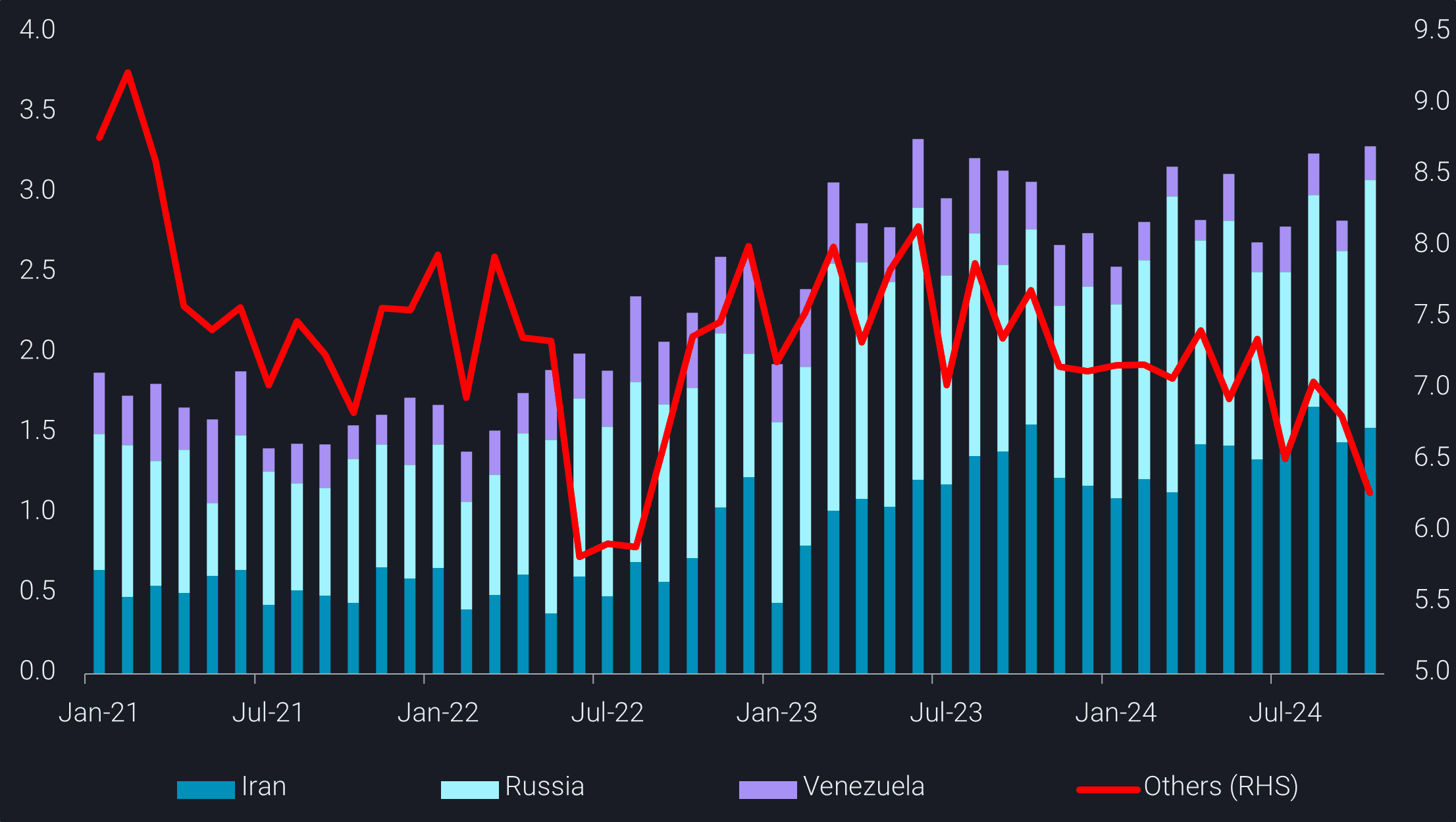

Despite a broader decline in crude demand, Chinese refiners are increasingly favoring cheaper spot crude to improve margins. Private refiners are primarily turning to heavily discounted Iranian and Venezuelan barrels, while state-run refiners are limiting their exposure to Russian crude. Imports of discounted barrels from Iran, Venezuela, and Russia remain robust, often at the expense of other crude grades.

For refiners limiting exposure to US-sanctioned crude, Canadian heavy-sour barrels from Vancouver port, via TMX pipeline, offer an attractive alternative.

China-bound loadings via TMX reached 210kbd in October, out of a record 410kbd in TMX-linked exports, with state-owned Sinopec and private refiner ZPC leading the purchases.

TMX barrels are expected to remain a favoured choice, potentially impacting demand for heavy-sour crude from the Middle East (excluding Iran). Some refiners may even consider reducing term crude volumes next year, as official formula prices set by the producers have, at times, exceeded expectations this year.

Term crude producers look to offset potential losses with new refining capacity

Producers of term crude are looking to offset any potential demand losses by supplying China’s new refining capacity expected next year, including the 400kbd Yulong refinery and Sinopec’s 220kbd expansion at the Zhenhai refinery.

The full launch of the Yulong refinery is also likely to pressure margins for nearby Shandong teapot refiners, limiting demand for discounted spot barrels and potentially stabilizing the market share of term crude suppliers.

Additionally, the SPR mandate to add 60mb of crude by March has yet to result in a sizable stockpile. If there is a delayed start, the timeline may be extended by several months, as seen previously, potentially leading to an increase of 200-300 kbd in crude imports. The Middle East (excluding Iran) and Russia are the most likely sources to fulfill such an increase.