A series of Northeast Asian refineries are set to restart operations in the coming weeks following their planned maintenance, but the current weakness in refining margins could restrain their ramp up. Asia’s refining margins have come under pressure in recent months as a closed export arbitrage has kept more refined products within the region, outstripping demand and weighing on product cracks.

China’s implied refinery runs down, South Korea’s robust

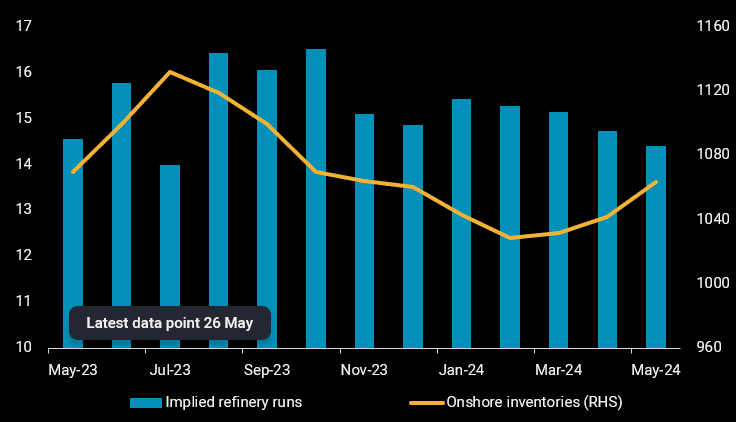

Preliminary calculations show that China’s implied refinery runs sunk to 14.4mbd in May, the lowest since last July, a result of the peak refinery maintenance and lacklustre domestic margins. Average implied refinery runs in Q2 so far are down 5% q-o-q. Vortexa’s implied refinery runs are derived using its real-time crude imports and onshore crude inventory data, providing users with a strong indicator of the strength of refinery runs ahead of customs data.

With domestic demand likely to remain subdued at least until Q3, Chinese refiners may see limited incentives to operate at high utilisation rates in the near-term. State-owned refiners, by virtue of their more competitive refinery operations and having access to the export market, could raise run rates higher than the traditional independent refiners, many of which are turning to heavy residual feedstock in lieu of limited crude import quotas. The delay in the start-up of Shandong’s greenfield Yulong refinery to at least Q4 this year further confirms the bearish refinery margin optics. China’s lower refinery runs in recent months have supported a rebuilding of the country’s onshore crude inventories, rising for the third consecutive month to 1.06bb. The crude stockpiling rate is expected to slow as refineries ramp up post turnaround, and with no signs of a massive step up in crude imports in the months ahead.

China’s implied refinery runs (mbd, LHS) and onshore crude inventories (mb, RHS)

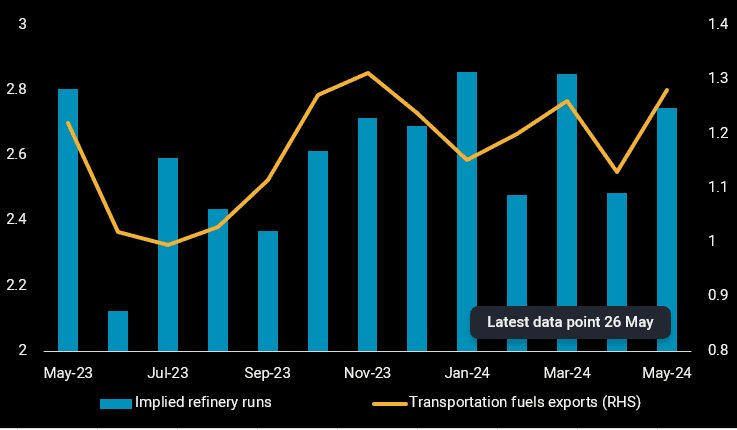

In South Korea, implied refinery runs have averaged 2.68mbd in Q2 so far, down marginally from Q1. Some refiners including GS Caltex and Hyundai Oilbank have reportedly reduced runs marginally amidst weaker margins and a fire incident at the latter, but the country’s overall refinery runs and clean product exports remain robust in May. SK Energy is expected to have shut 240kbd of its CDU capacity for planned maintenance in the week of 20 May, which will likely weigh on its refinery runs through to June.

South Korea’s implied refinery runs (mbd, LHS) and transportation fuel exports (mbd, RHS)

Refinery run cuts on the cards?

Declining seaborne crude loadings to Northeast Asia are hinting at the possibility of a further slowdown in refinery runs in the weeks ahead. Crude exports from OPEC (excl. Iran and Venezuela) to the region in 1H May are down nearly 6% versus Q1, whilst non-OPEC crude exports are on-track to fall by 10% in the same period.

A largely closed middle distillates east-west arbitrage is keeping more refinery supplies within Asia. Additionally, India is pushing more clean product supplies to the East, further weighing on product cracks. More refinery run cuts could be on the cards if demand does not pick up to support margins, and less competitive, export-oriented refiners could be one of the first to make the move.