China’s seaborne crude imports edged down to 9.8mbd in the first month of 2024, marking the third consecutive month below the 10mbd threshold. Despite recent quotas designed to encourage crude imports and refined product exports for refiners, teapot refiners still grapple with sluggish refining margins.

While Chinese state-run refiners maintained healthy refining operations in January, driven by booming travel demand during the Spring Festival holiday season, teapot refiners struggled to match this momentum.

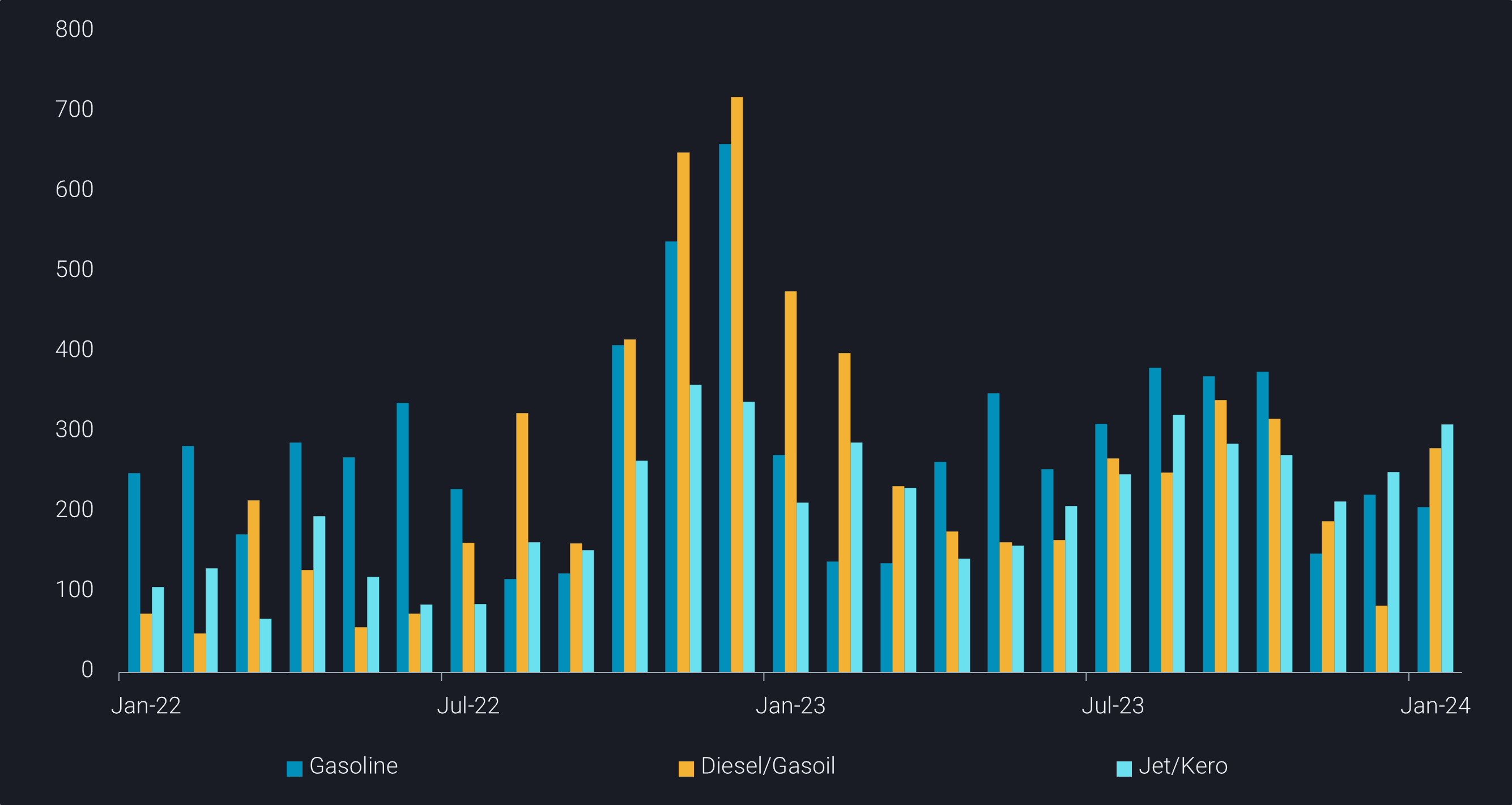

China’s jet fuel exports, including volumes to Hong Kong, surged to a five-month high due to expectations of record-high travel. However, soft export margins and stagnant export quotas kept China’s overall clean fuel exports within the range of 2023 levels.

Signs of muted oil demand from teapots

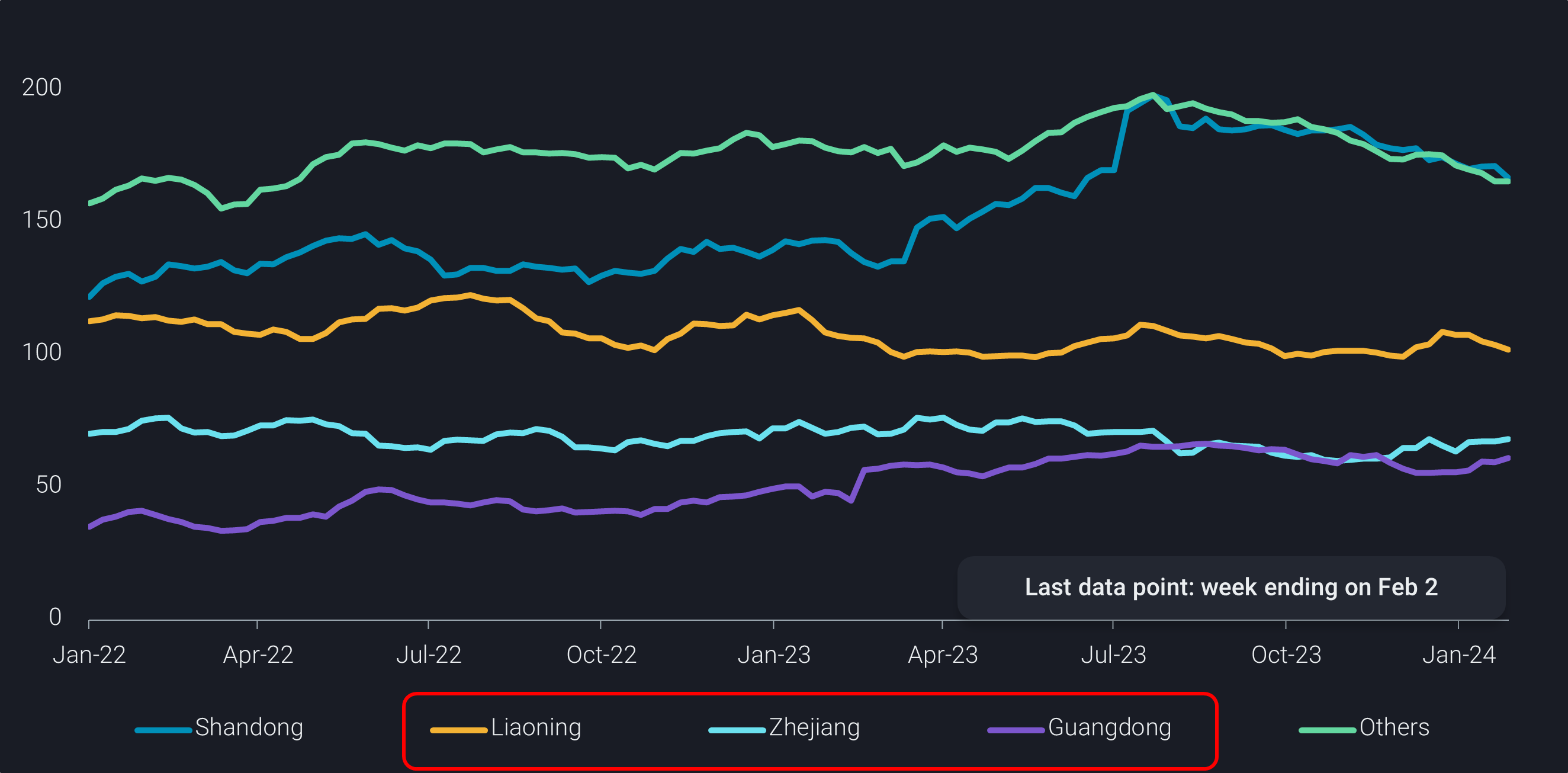

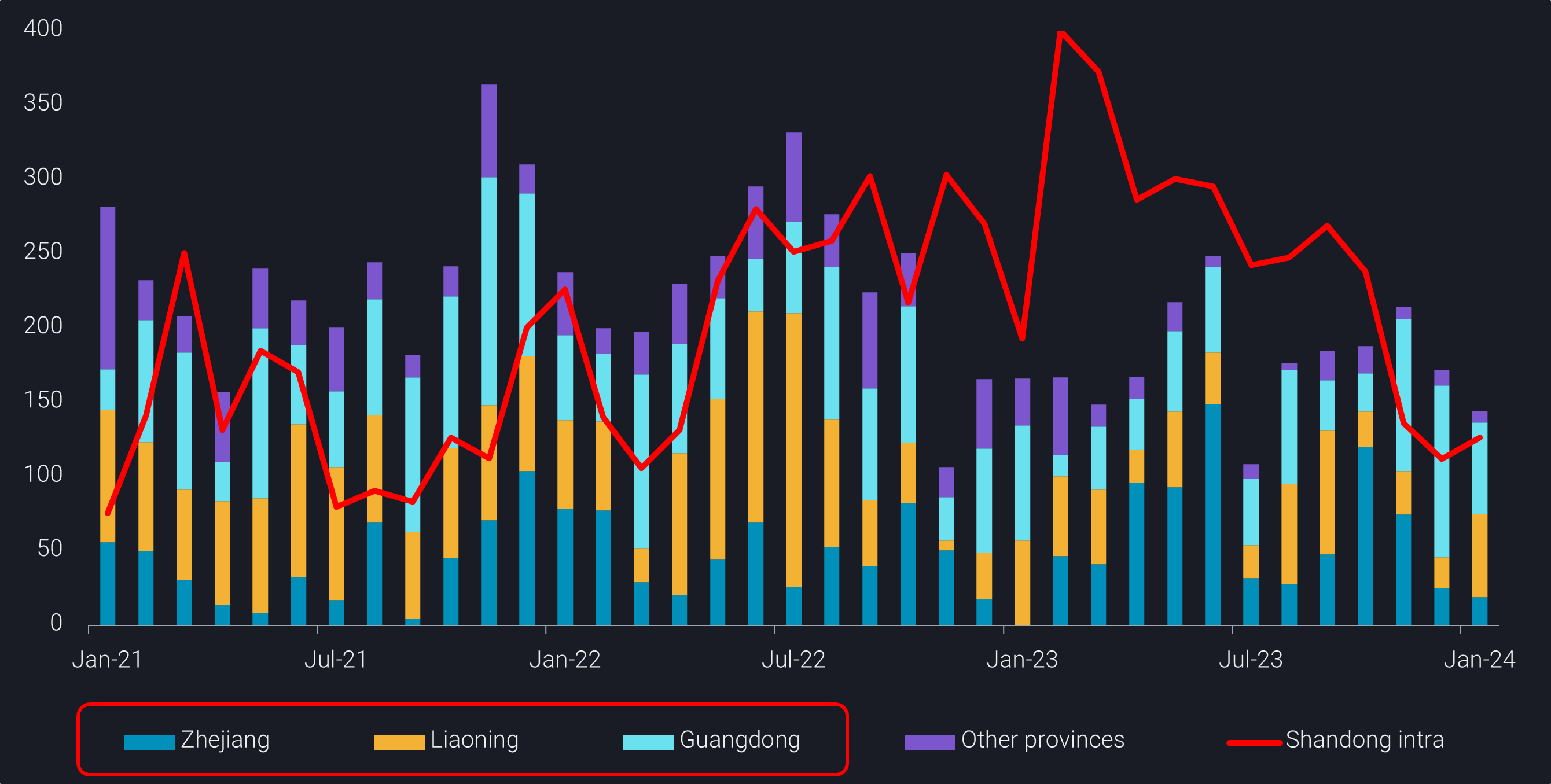

Last month, China allocated the remaining crude import quotas for 2024, providing refiners with full-year allowances at the year’s outset to stimulate refining operations. However, Shandong’s seaborne crude imports continued to decline year-on-year, as narrowing discounts in teapots’ preferred crude grades, coupled with soft domestic demand, particularly for diesel and bitumen, restrained consumer interest.

Shandong teapots opted for commercial storages near their facilities instead of procuring feedstocks from the seaborne market. This strategic shift led to a rapid drawdown in Shandong’s onshore commercial crude inventories, with the withdrawal rate surging to over 230kbd since mid-December, up from just 100kbd in the preceding 15 weeks.

Soft teapot demand not only limited intra-flows of crude and other refining feedstocks towards Shandong, but also contributed to the build-up of crude inventories at other key commercial storage hubs, including Liaoning, Zhejiang, and Guangdong.

With abundant crude storages nationwide and fresh import quotas enabling the use of inventories from bonded storage, teapot demand for seaborne cargoes is expected to remain constrained, exerting downward pressure on China’s overall crude imports.

On the domestic and global economic fronts, there appears to be little optimism on the horizon. While there are hopes that the manufacturing downturn in the US may come to an end, Vortexa data reveals that key global import statistics for gasoline, diesel, jet/kero, and naphtha were all below year-ago levels in January, prolonging and partly deepening the lackluster performance observed throughout Q4 2023.

Compounding the situation is the logistical hiccup in the Red Sea, which further complicates matters. Additionally, a swift recovery of the Chinese economy currently seems out of reach, adding to the prevailing uncertainty and subdued outlook.