US Crude Exports Holding Steady

Vortexa Snapshot: US Crude Exports Holding Steady

US crude exports have held up through the effects of the global pandemic, despite US crude production drops. The mismatch in lockdowns between the US and Asia – with the latter easing restrictions earlier – has helped sustain buying interest in a key demand region. But another factor is that cargoes hitting the water now may have been booked months in advance. In this scenario, we should expect crude exports to decline in response to the slump in global demand.

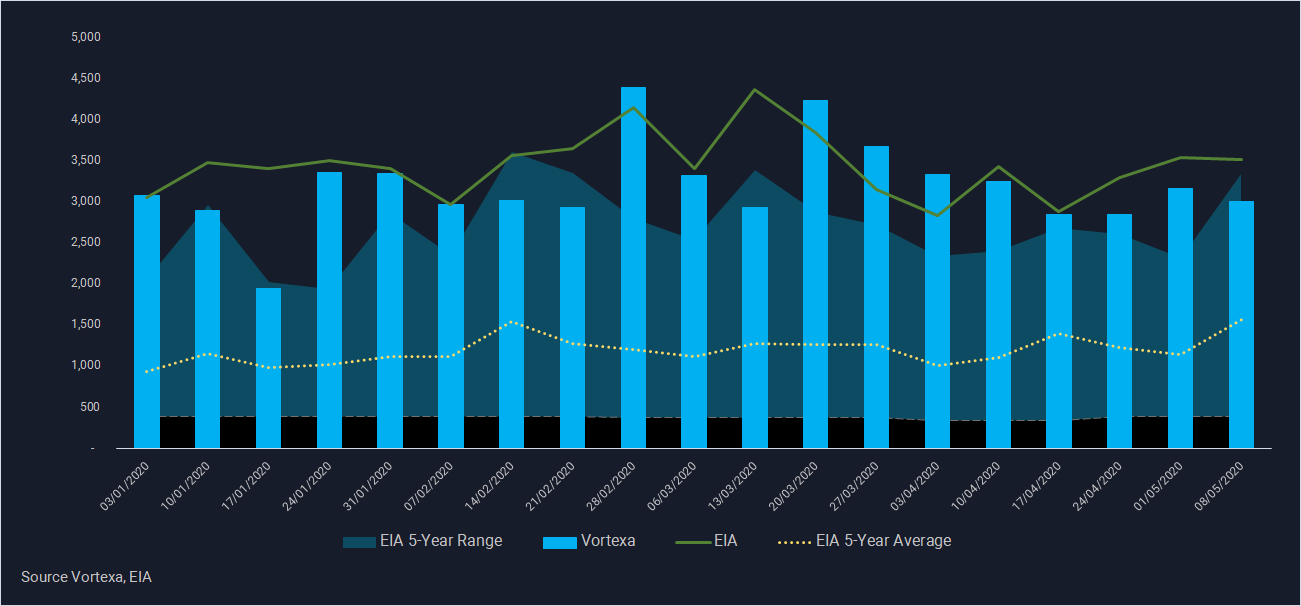

US crude exports keep above 5-yr average

- EIA data show that US crude oil exports are up 5.3%, or 178,000 b/d versus the same period last year, as of the week ending 8 May.

- US crude oil exports have been higher than the 5-year average throughout 2020, rarely even breaking below 5-year maximum levels as confirmed by Vortexa weekly movement-based estimates (see below).

US crude exports vs. 5-yr average (kbd)

Trading cycle, and lockdown mismatch

- US crude oil exports have persisted through the first two months of Covid19-related lockdowns. This could be the result of physical cargoes trading and booking several months forward, in which case exports may be poised to drop as vessels booked during the lockdown begin to hit the water.

- Another possible factor in consistent US crude oil exports could be a mismatch in the timings of lockdowns in Asian markets and those in the US. Under this scenario Asian refineries were returning to operations as their restrictions subsided in mid-to-late March, when the US was beginning to slowdown, leaving more barrels available to head East and supporting growth in crude oil exports.

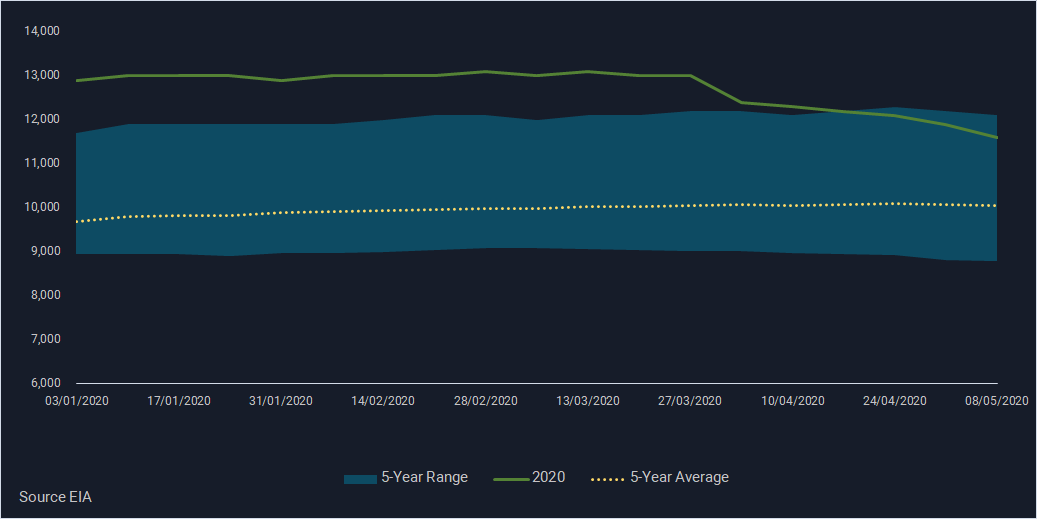

- Our data show that US crude oil exports have remained at historic highs for the past two months even as weekly crude production has dropped some 1.5mn b/d, from 13.1mn b/d earlier in 2020 to 11.6mn b/d for the week ending 8 May, according to the EIA.

US crude production (kbd)

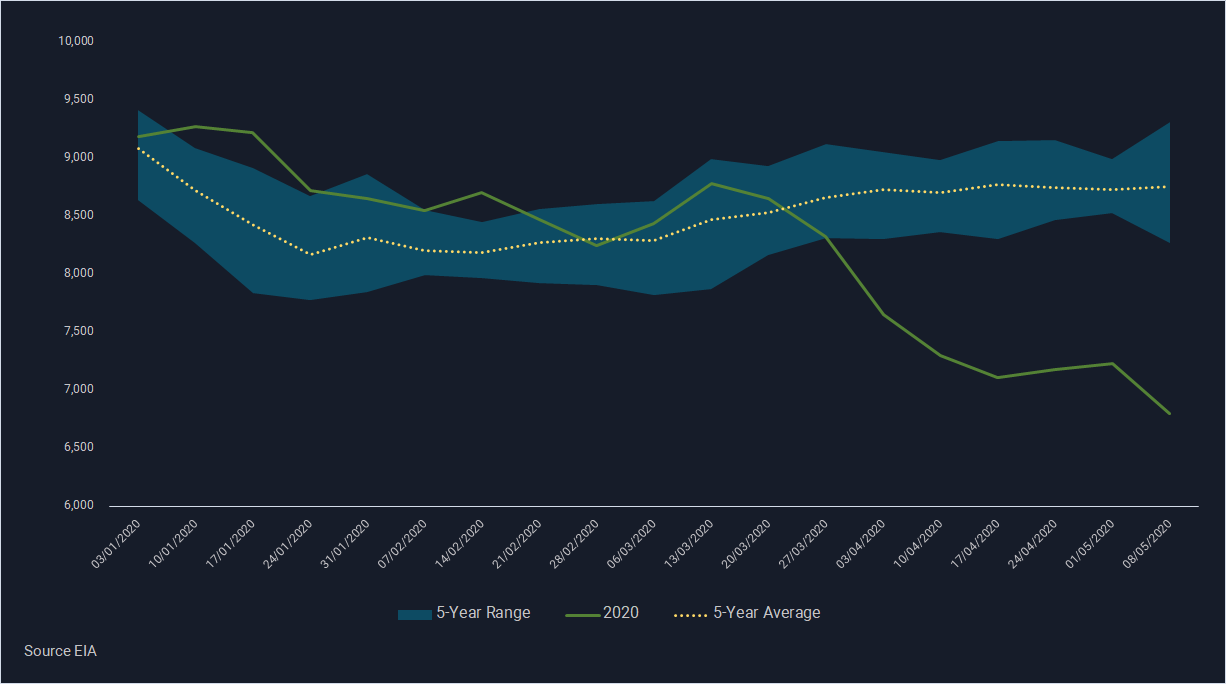

- While reduced production could have led to diminished barrels available to export, US Gulf coast (PADD 3) refinery runs have collapsed, possibly counterbalancing the fall in production.

- EIA data show that PADD 3 refinery runs began the year at strong levels at or near the 5-year maximum level. But crude inputs to refineries in the Gulf coast have dropped approximately 1.5mn b/d between the last week in March and the week of 8 May, ending at 6.8mn b/d.

- Taken together, these two offsetting factors could explain the relatively flat US crude oil exports our data indicate due to steady availability of excess barrels.

PADD 3 Refinery Crude Oil Inputs (kbd)

Interested in a more detailed view of these flows and supply shifts?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}