US Crude – The Rise of South Texas

US Crude Oil Exports – The Rise of South Texas

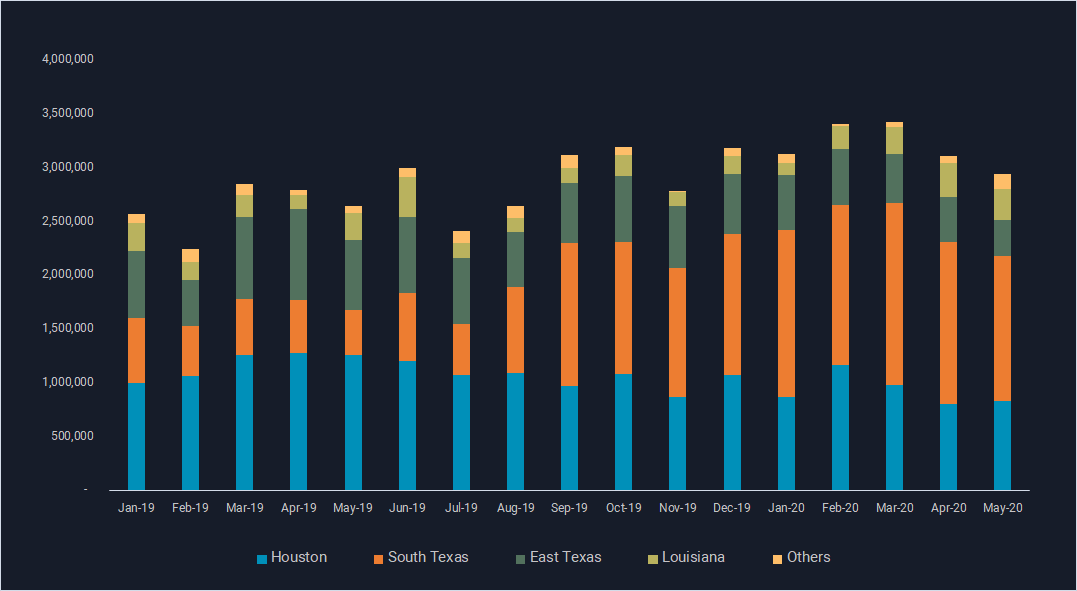

US crude oil exports have remained strong despite market headwinds in recent months. The regional distribution of these exports has undergone a huge transformation as volumes from South Texas terminals have surpassed those coming out of Houston.

US crude exports still holding firm

- US crude oil and condensates exports have remained remarkably strong despite recent market turmoil, growing to an average of 3.1mn b/d so far in 2020, up from 2.8mn b/d in 2019.

- The upward trend is likely to continue as global refining demand for light crude oil returns, as transportation activity picks up again post Covid-19. The recent return of light crudes trading at premiums to medium and heavy grades is also likely to support to US exports in the coming weeks.

US Crude Oil Exports by Region (b/d)

Houston vs. South Texas

- South Texas holds the top spot as the largest exporting region for US crude, a title it has held since September 2019 according to Vortexa data. Exports from September 2019 to May 2020 averaged 1.4mn b/d, up from less than 650,000 b/d during January-September 2019.

- Growth in South Texas exports has dislodged Houston from its top spot, a position it had held largely undisputed since January 2016.

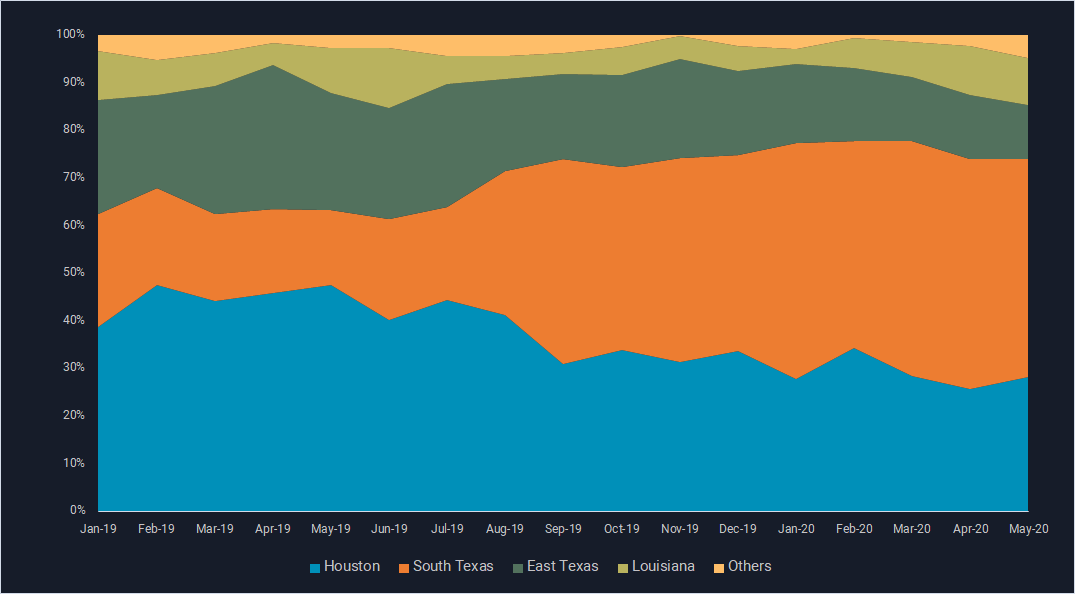

- The share of US crude oil exported from Houston terminals has fallen from nearly 40% at the beginning of 2019 to approximately 20% as of May 2020 (see chart below). The decline is a result of South Texas exports growing from 25% to 45%.

- This trend is likely to hold firm and possibly grow given the proximity of South Texas terminals to crude production in the Permian Basin.

US Crude Oil Exports by Region (share)

Interested in a more detailed view of our data and associated flows?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}