What will Trump’s re-election mean for the US and global energy markets?

As we look toward inauguration day January 20, 2025, when President-elect Trump enters his second term as US president, what impact will his administration have on US and global seaborne energy flows?

Trump has reiterated his support to drill more oil and increase US production. Any short-term increase in US oil production will more likely be driven by price incentives to drill, a direct function of demand and supply for crude (as opposed to policy measures). Despite declining global crude supplies in an environment of high geopolitical tensions, weaker demand prospects have kept a lid on global oil prices, which have been fairly rangebound for 2024 hovering within the $70-$80/bl range.

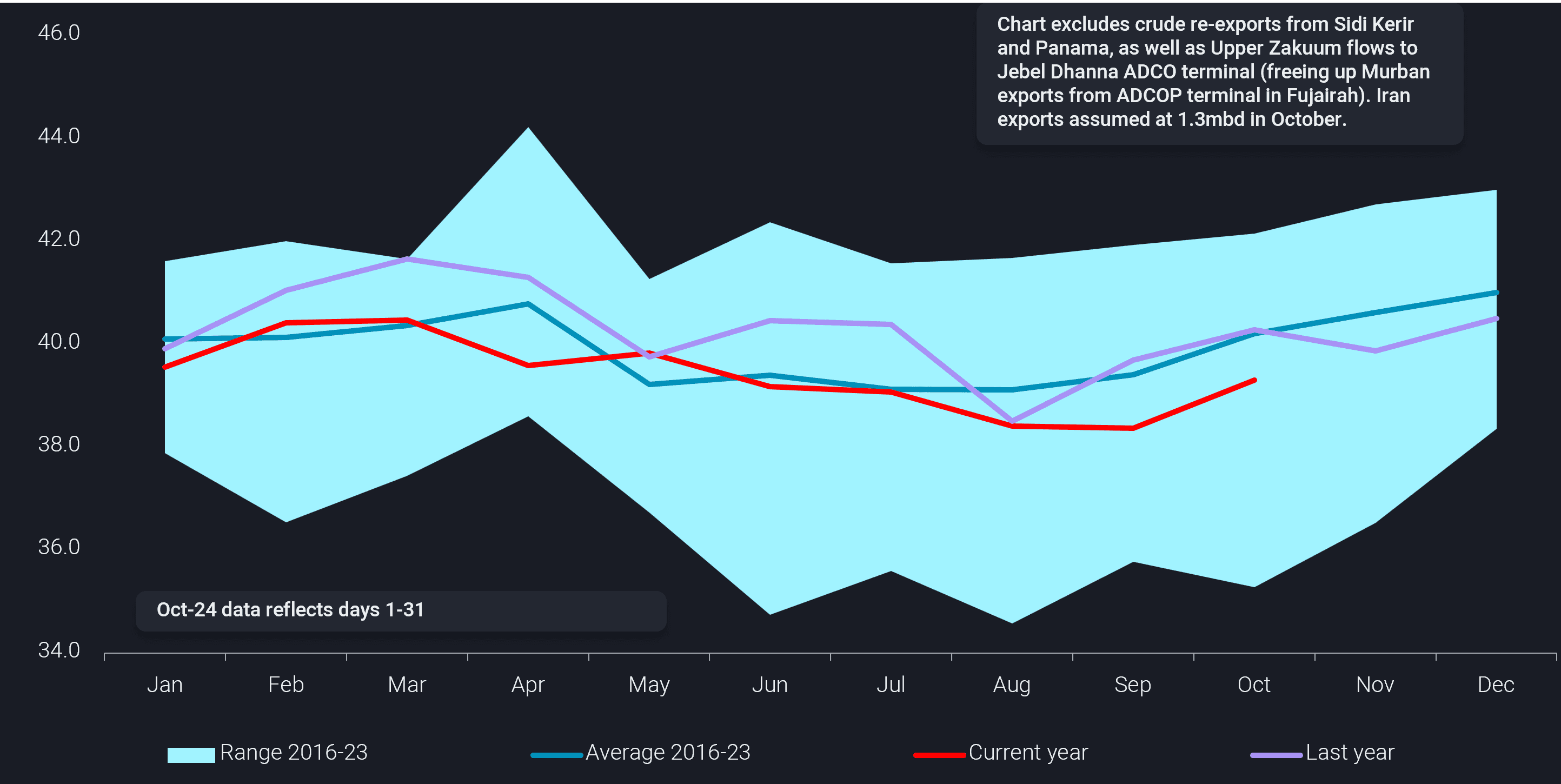

To illustrate how low seaborne exports have been this year, according to seaborne export data (see chart), global seaborne crude liftings/supply have been lower y-o-y for 9 months this year, and crude in onshore floating roof tanks and tankers has fallen to the bottom of the five year range.

Additionally, OPEC+ continues to delay its decision to unwind production cuts based on consistent downward revisions to demand which has been seen in some of the biggest markets including China and Europe.

Therefore, if the US increases production resulting in higher exports of seaborne energy, it could likely place additional pressure on top of an already well-supplied market, pushing prices down and even which could lead to a lower production.

According to the Dallas Fed Energy Survey, large exploration and production firms (with crude oil production of 100kbd+ as of the fourth quarter of 2023) require a $58 per barrel price to profitably drill, compared with $67 for small firms (fewer than 100kbd).

Considering WTI fell to around $67/bbl at the end of September 2024, this suggests that demand will need to return in order to incentivize higher prices and therefore new and sustained production.

US seaborne energy exports continue to hover at the top of the five year range and despite US seaborne crude exports peaking this year to 4.33mbd, US seaborne crude exports are down 2% y-o-y from Jan-Oct. Considering the main destinations for US crude are Asia and Northwest Europe, both of which suffered y-o-y declines in crude consumption during 2024, it could be a lengthy wait until demand picks up again.

Trump has promised a tax/tariff of up to 20% on goods from other countries and up to 60% on all imports from China

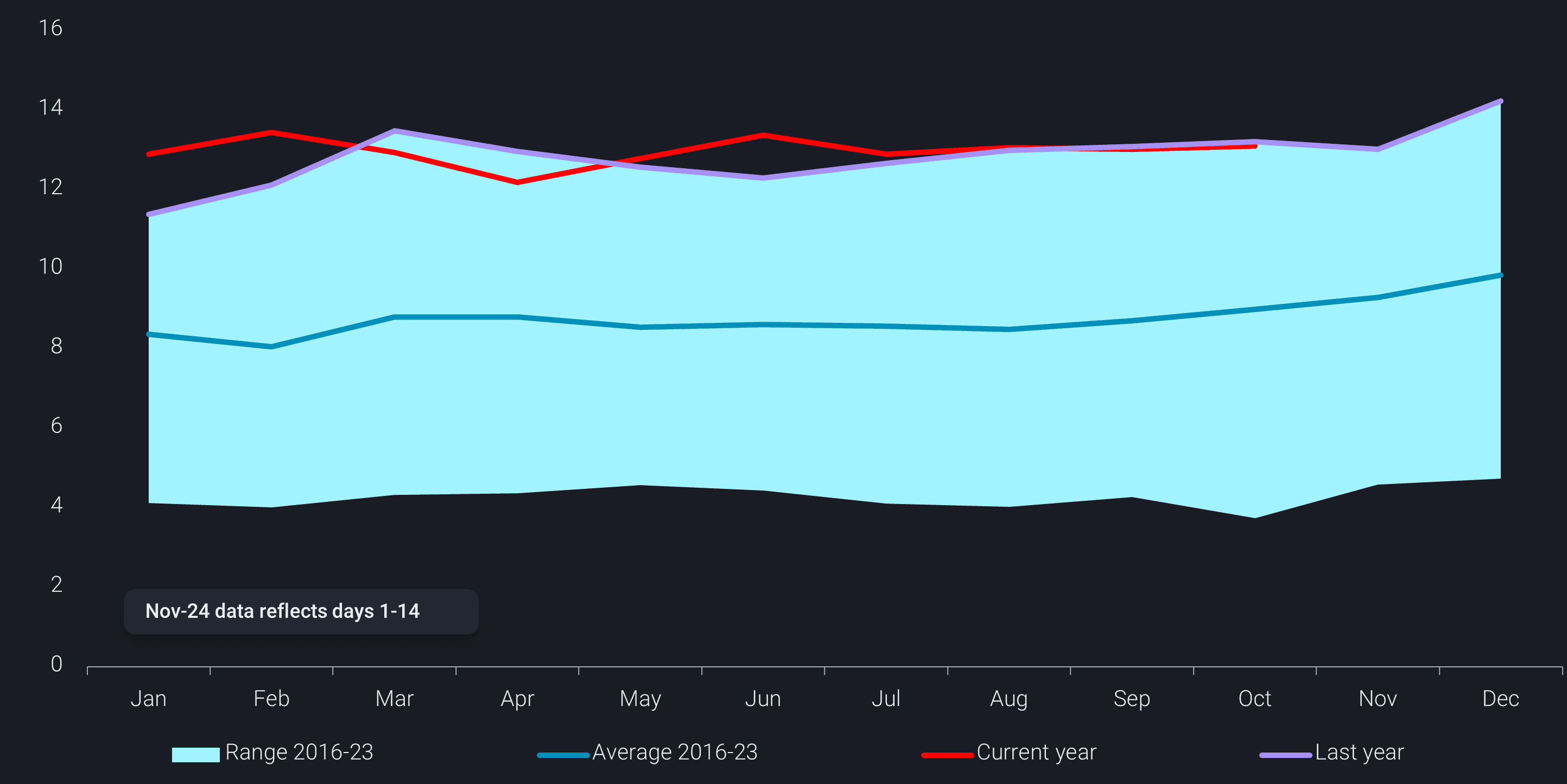

Despite US seaborne energy imports on a long-term declining trend (see chart below), any level of implementation of a tax on US petroleum imports would have huge negative consequences for the entire US oil production and refining industry, leading to higher product costs and inflation and potentially more problems for the US refining industry.

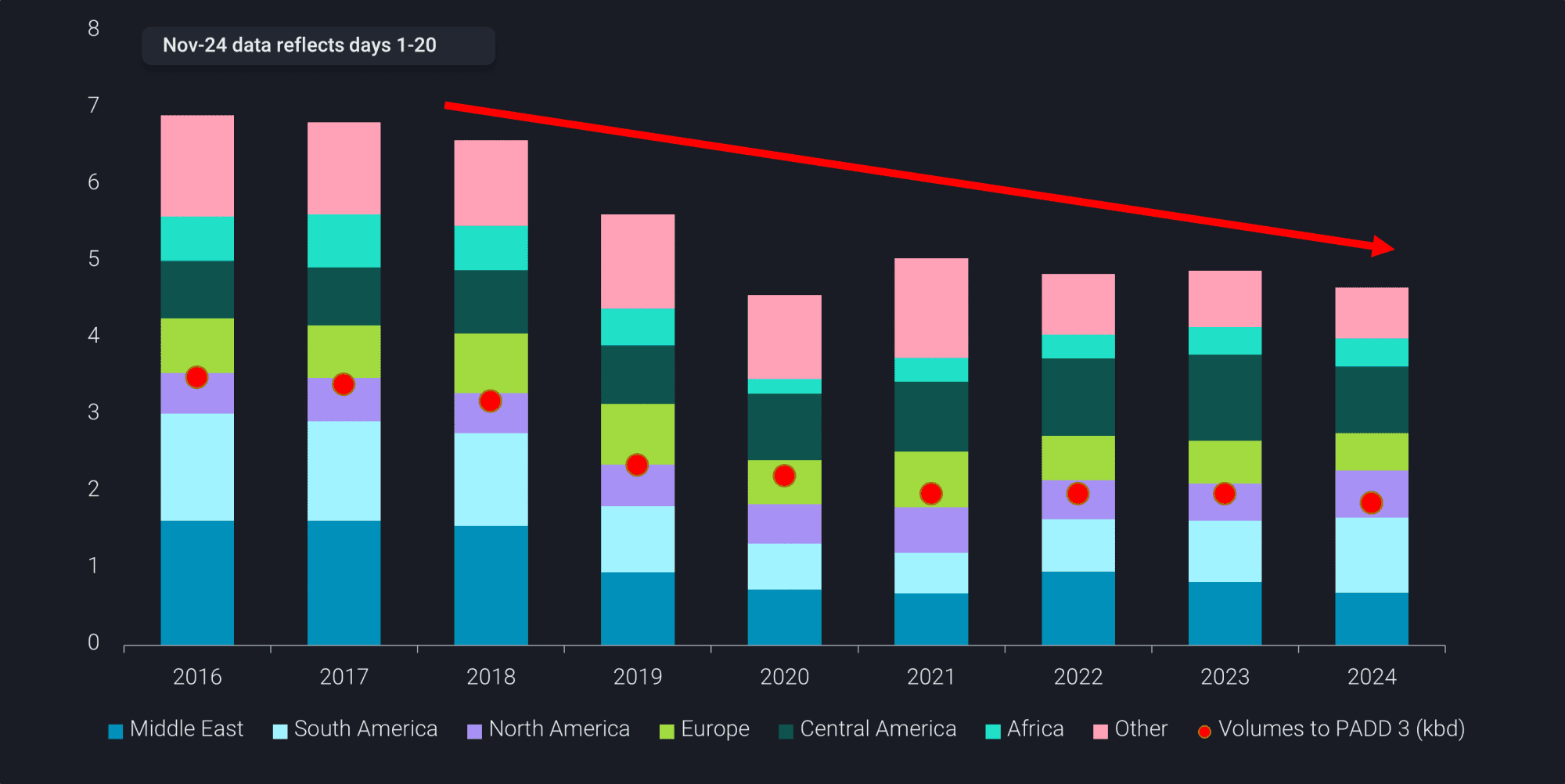

Although there is doubt as to whether this tax will be applied to petroleum imports, heavier crude grades and fuel oil are needed by USGC refineries amid an oversupply of lighter domestic crudes. Over 44% of the total seaborne crude imports into the US arrived to PADD 3 in 2024, mostly to feed USGC refineries. Fuel oil imports (71% of US imports discharged in PADD 3) mainly come from Latam and the Middle East, serving as an important feedstock where it is necessary to run the secondary units at these refineries to optimise margins. A price hike to these important raw materials could force already struggling refiners towards economic run cuts or closures.

Added taxes on energy imports would also result in rising PADD 1 gasoline prices. Over 84% of the total gasoline seaborne imports into the US arrive into PADD 1 due to lack of refining capacity and infrastructure constraints to move volumes around in a market where supply (PADD 3) is dislocated from the demand center (PADD 1).

Looking forward, additional tariffs on US petroleum imports (backing out additional global crude supply) and an increase in US crude production will only contribute to already toppy market conditions. With only maybe a slight demand recovery expected from China sometime next year, supply pressures look to be bigger than demand can be supportive.