Will the surprise OPEC+ cuts affect the already short global sour crude markets?

Imports of sour crudes remain strong especially in Asia while surprise cuts from OPEC+ members could open the doors for other suppliers in a market short on sour crude

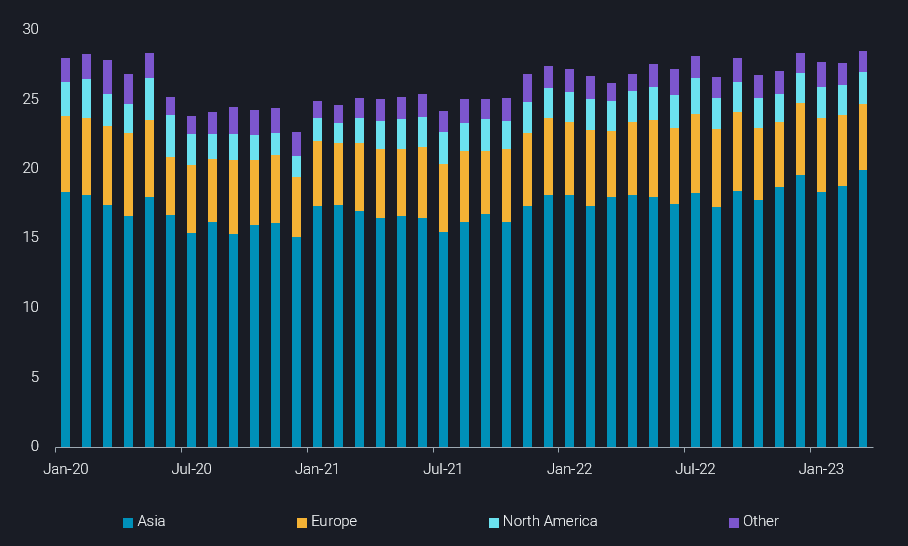

Global markets have remained short sour crude as refining hubs rushed to capitalize on high middle distillate margins. Global imports of sour crudes increased by 870kbd in March m-o-m with imports into Asia reaching 20mbd in March, the highest since 2016 according to Vortexa data. On the other side of the Suez, sour crude imports into Europe decreased by 280kbd even as European refiners looked to replace Urals from Russia.

Even though March remained a strong month for sour crude flows, the surprise voluntary production cuts from select OPEC+ countries have somewhat raised questions on whether these flows will continue and helped rally sour crude differentials across the globe.

OPEC+ voluntary cut surprises the market, but will it impact seaborne exports?

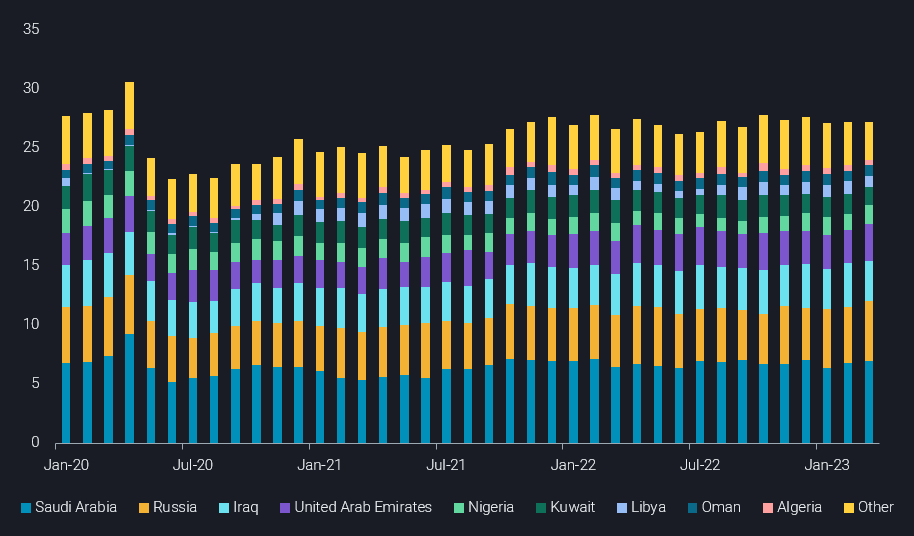

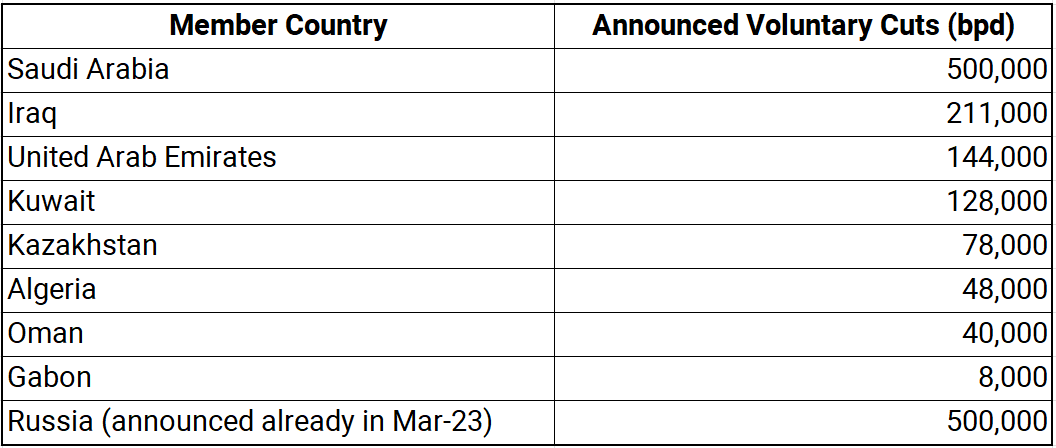

The surprise announcement of a subset of the organizations’ members ahead of a formal meeting surely raised various questions, but makes very clear that the proponents have been unhappy about oil price developments so far in 2023. The following members have announced voluntary cuts along with the 500kbd announced by Russia already:

But the crucial question is how/if this will materialize into lower seaborne supplies? The most recent OPEC+ production cuts have had little-to-no impact on seaborne exports. When viewed in the context of recent seaborne exports (Mar-23) the magnitude of the cuts become clearer where Saudi Arabia is leading the group in its intention to cut 500kbd but on a proportional basis (relative to seaborne exports), the cut could be more meaningful for Kuwait and Algeria

Given all these scenarios and keeping in mind the global demand for sour crude barrels, this exercise could be driven by the intention to raise oil prices and it seems to be working with East of Suez markets especially in the line of fire given the quantity of crude imported from these OPEC+ coalition members.

Where will the market source its additional sour barrels?

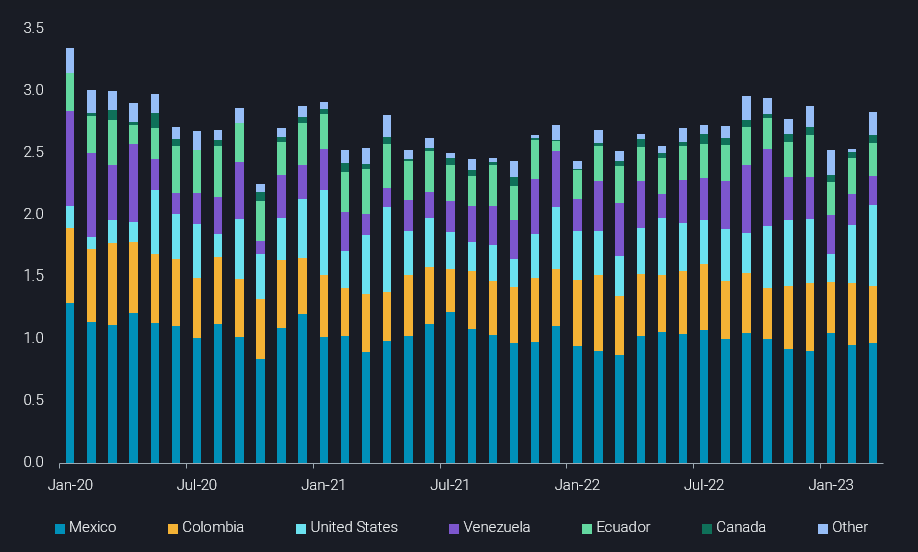

Now making the assumption that these cuts will actually translate into lower sour crude seaborne exports, where will the market turn to source these additional sour barrels? One piece of the puzzle seems to be offshore Gulf of Mexico where BP’s Mad Dog Phase 2 and Murphy Oil’s Khaleesi, Mormont and Samurai fields came online in 2022, which took Jan-23 production to 1.9mbd according to EIA’s latest numbers. Additionally, other projects and tie-ins are expected to come online in 2023-24.

Supply from Canada is currently being drawn from stocks but with the end of spring/summer maintenance in May/June production will return to normal. Mexico is also expected to see growth in production, with Eni’s Mizton field which came online in 2022 and additional discoveries expected in the medium to long term. Supply from Colombia and Ecuador, the other sour crude producers in LatAm has had its issues but managed to remain more or less stable. If we also take into account the growing medium sweet supply from Brazil and Guyana, the Americas seem to be in a good position to supply a global market short on sour crudes.