Is a supply-side shift underway for Atlantic Basin MRs?

In this insight, we explore the recent volatility in US Gulf MR freight rates, where supply-side factors have had the upper hand over strong tanker demand. A shift could be coming in the Atlantic Basin as thin supply in NW Europe could trigger vessel repositioning.

Weaker CPP demand in the US domestic market has pushed supplies to the seaborne export market, propelling June exports well above y-o-y levels and remaining robust in July after minimal disruption to PADD 3 refineries from Hurricane Beryl. US Gulf refiners are incentivised to send exports short-haul due to the lower freight cost, and the Caribbean and Mexico East Coast have absorbed these supplies. This has coincided with a string of refinery issues in Mexico following high refinery runs in the run-up to the election. Thus, the return of Mexico’s road fuel demand has been a boon for PADD 3 refiners.

For MRs operating in the US Gulf, high CPP exports have translated to high tanker demand. However, the short-haul nature of these voyages to Mexico East Coast and the Caribbean is failing to clear available tonnage in the region.

This has caused much volatility in the region’s freight rates, with rates oscillating drastically between big peaks and troughs due to the short voyage duration. Over the last two months, the supply side has outmuscled the demand impetus, and the freight rates trajectory has been driven by rapid changes in prompt vessel supply. This has also coincided with gradually increasing vessel supply in the US Gulf over the past month as vessels were enticed by the high earnings to reposition from elsewhere.

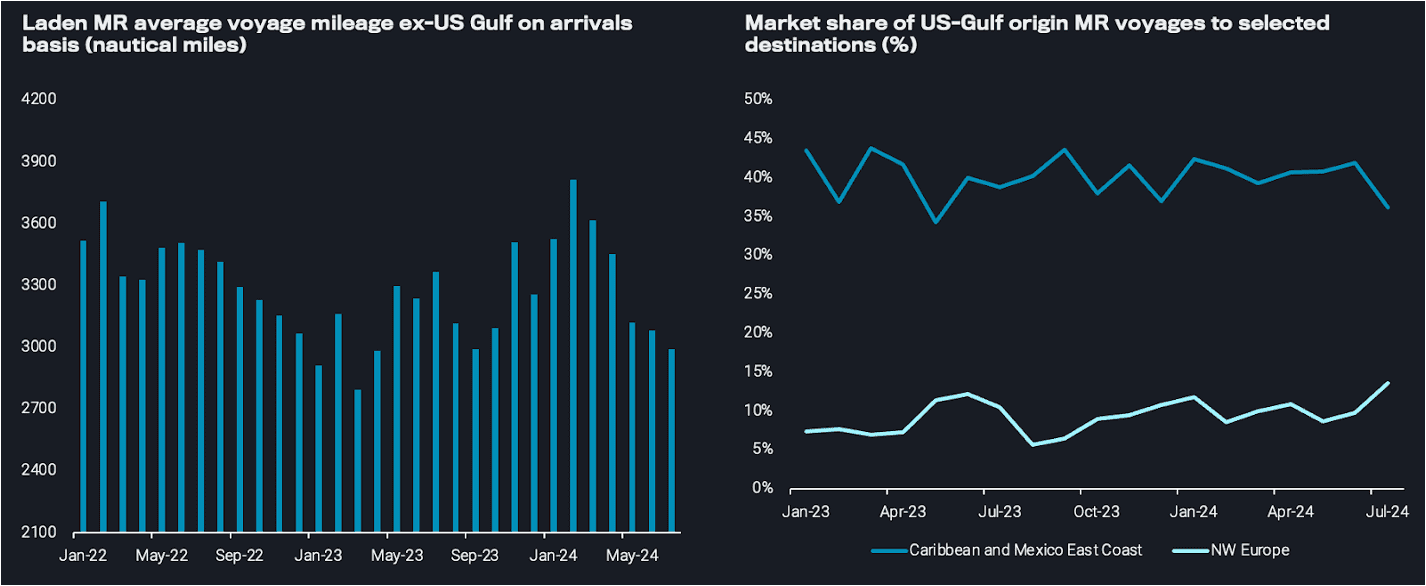

As a result of this high short-haul employment, average voyage mileage for all MR voyages originating in the US Gulf has been significantly lower over the last few months and continues to decline. On average, voyage mileage May-July is 12% less than in April. However, this could be changing, as a softly but persistently open arbitrage for diesel US Gulf-to-Europe (Argus) has increased transatlantic utilisation over the past two weeks. An increase in long-haul utilisation will also alleviate some of the excess tonnage in the US Gulf, which will likely soften the volatility in the freight rates and increase the turnaround time between peaks and troughs in vessel demand.

(Left) Laden MR average voyage mileage ex-US Gulf on arrivals basis (nautical miles, LHS) – (Right) Market share of US-Gulf origin MR voyages to selected destinations (%, RHS)

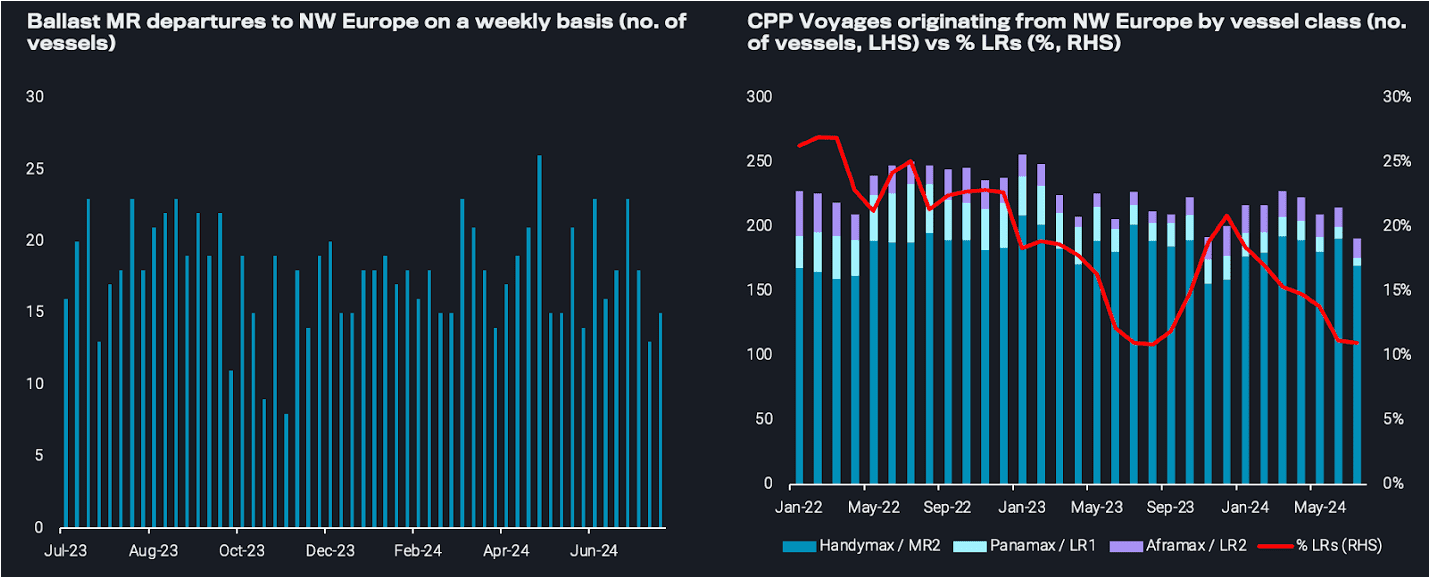

Additionally, one factor which could ease the tonnage imbalance in the US Gulf is the increased likelihood that the vessels carrying cargo to NW Europe will stay and trade in Europe. Prompt vessel supply in NW Europe thinned during July, and freight rates increased around 35% in the last month (TC2). Also, the number of ballast vessels departing for NW Europe has decreased over the past month, pointing to a likely tightening supply and therefore higher earnings. Higher rates in Europe due to the scarcity of tonnage could stem the tide of vessels repositioning to the US Gulf to take advantage of higher rates.

At the same time, MRs in Europe may benefit from less competition from LRs as the segment has been pushed towards the East due to the competition from supertankers cleaning up on the East-to-West flow (read more here). More specifically, competition from LRs in NW Europe is currently at the lowest it has been recorded for at least two years, occupying only 10% of the voyages out of the region, half of the market share in December last year.

(Left) Ballast MR departures to NW Europe on a weekly basis (no. of vessels) – (Right) CPP Voyages originating from NW Europe by vessel class (no. of vessels, LHS) vs % of LRs (%, RHS)

Although we may see some of the volatility in US Gulf rates drop as MRs are attracted by the NW Europe market, it is very unlikely that the PADD 3 CPP export picture will change drastically. US CPP demand is likely to remain muted, giving us every indication that these barrels will continue to be absorbed in Mexico and the Caribbean and keeping MR demand at strong levels. This could only be tempered slightly in the very short-term by last week’s decline in PADD 3 refinery utilisation (EIA) due to outages affecting gasoline production units, which could translate into a slight decline in available exports. If this decline does materialise, the tonnage relief provided to the US Gulf as vessel supply shifts towards Europe will have come at the right time, providing further equilibrium on the MR dynamics.