Science of freight pricing: Why freight pricing used to be an art, not a science… until now

Discovering the significant factors that impact the ever-increasing freight pricing and how this has evolved from an art to a science.

Coffee in hand, perusing shipbroker reports is how I start most mornings. One day a weekly report from a distinguished Norwegian broker made its way to my inbox. As I read through, one sentence in particular caught my eye: “Markets thrive on loose tongues otherwise the benchmarking process of the underlying spot market is significantly compromised”. How true this rang! As I shared it with my colleagues, with whom I had recently worked on bringing freight pricing to Vortexa Analytics, I took a step back and realised, this made no sense to the uninitiated. It was time to address that.

So how are freight prices derived? It’s a simple question with a complex answer.

Making Waves was conceived out of a desire to lift the curtain on the obscure jargon of a very private industry that is nonetheless vital to our everyday lives in so many aspects. This month we’ll be focusing on how freight prices come about, which market participants are involved and what this means for the industry. So how are freight prices derived? It’s a simple question with a complex answer. Firstly, we’ll set some ground rules. If we consider the major shipping trades to be the liner trade (i.e. container ships), the dry bulk trade and the tanker trade, this month’s newsletter will focus on the latter. When it comes to tankers, you can charter a vessel for a prolonged period of time, and pay what is called a time-charter rate which is usually expressed in dollars per day or you can charter a vessel to take a cargo from a port of loading to a port of discharge and pay the prevalent rate on the day also referred to as the spot rate. It is the tanker spot rate we’ll be exploring in more detail.

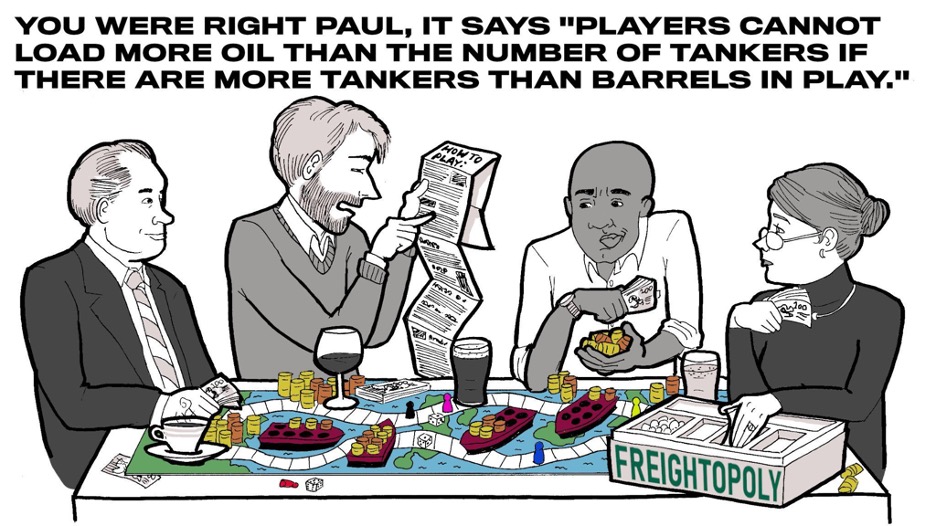

“Freightopoly” by Sheridan Hart

Freight pricing 101 ?

In my previous role working for a large price reporting agency, I discovered there were two types of methodologies when it came to pricing. Both were dependent on the type of commodity assessed (i.e. priced). On one hand you could be working in a highly liquid and transparent market, take benchmark crude oil grades for example (i.e. Brent or WTI), and though the work is complex, information is made available through a series of bids and offers from buyers and sellers or even better trades that prove the value of the commodity at that point in time and allow pricing of the commodity to be “fairly” straightforward. On the other hand you could be in charge of a highly opaque market, where bids and offers were difficult to get a hold on and actual trades rarely happen or are simply kept P&C. Guess in which category shipping fell? The lack of standardisation in the industry has also always been an issue. Whereas one can offer 2 million barrels of crude and agree on the specifications of that cargo, even tankers that fall within the same vessel class or category will have different lengths, dimensions and characteristics. It is now time to introduce the price reporter (also known as an assessor) that makes sense of all of this.

In a previous edition, I wrote about The Baltic Exchange, with whom we partnered to bring together prices and analytics in one screen, as shown below. The Baltic Exchange price reporters, or assessors in their case, rely on the indications of shipbrokers that are in turn in close contact with charterers and shipowners across the routes they assess. Those indications are then used in order to derive the respective freight assessments. In the example below, we can see one of their benchmark routes called TD3C which refers to freight rates for VLCCs to carry a cargo of crude oil loading in the Middle East Gulf and discharging in China and corresponding rates in Worldscale (a standardised pricing system in tanker markets), $/ton rates (preferred by traders and charterers) and lastly, Time Charter Equivalent or TCE, as measured in $/day for shipowners to better assess their daily earnings on a route.

Vortexa’s Freight Pricing Analytics

The price reporter will be involved deeply with the market. He will spend a lot of his day communicating with market participants, from shipbrokers to charterers and shipowners. He will have an idea of what is happening at a fundamental level, if for example there are more ships in a given region compared to yesterday and what that should mean for prices. He will know what was the last offer from a shipowner for a given cargo and what counter-offer the charterer submitted. He will know what was the last done deal, and what price that deal, or fixture as it is known in tanker and dry bulk markets, was concluded at. And yet, even with troves of information there will be an element of experience, subjectiveness and deep knowledge that will allow the price reporter to produce the spot rate that will be used as a benchmark for the industry for the next done deal. Imagine days where information is scarce and how the difficulty increases, especially when conducting that assessment (a different name for a price, hence assessor) across dozens of different trade routes and vessel classes. Which is why freight pricing involves a certain je-ne-sais-quoi, akin to making it an art in which industry experience and knowledge has always been vital. Though I believe that this will always remain the case I also believe transparency in freight pricing is undergoing a revolution, fuelled by data.

Fuel of the future: data ⛽

Why is freight pricing complex? Why does it require companies with a thorough understanding of the industry including relationships that take years if not decades to build? Because information is hard to come by and the markets are far from transparent. On the supply side we have come a long way from having to spot ships from afar with a pair of binoculars in a few hubs to now enjoying satellite tracking to locate ships across the globe. On the demand side, the exact details of cargo quotes in the daily market will still remain closely guarded secrets, only shared with shipbrokers, some of them exclusive to their principals. But all the information available remains fragmented, made worse by limited accessibility even from within the shipping industry.

This is where data comes in and most importantly the analysis surrounding data. By harnessing the power of technology, it is now possible to aggregate billions of data points and identify the trends that matter. It is now possible to combine freight pricing, from a historical as well as real-time perspective, with supply and demand metrics themselves real-time as well as forward-looking. The resulting screen in our case allows not only to provide the user an immediate view of the market, saving hours of reaching out by email or telephone, but also processing of that data in spreadsheets or notes in a notebook. These descriptive analytics for metrics such as pricing and utilisation are now combined with predictive analytics such as the ones revolving around future availability. If anyone watched the F1 Grand Prix of Brazil two weeks ago, you’ll know that following an engine change, the Mercedes car of Lewis Hamilton charged ahead of all his rivals, earning him a first place finish, from last on the grid at the start of the sprint race. Harnessing technology and data when it comes to market dynamics such as pricing will have the same effect and leave anyone that still relies on outdated processes in the dust.

In summary ?

Whether you are fresh to most of the subjects I write about or already a veteran, there is so much still to be done when it comes to transparency in shipping markets. The level of granularity when it comes to the factors that impact freight pricing is ever-increasing, and we are racing as a company to make that data available to the market in the most transparent way. When it comes to future applications of this technology, our imagination remains our only limitation, and freight pricing has evolved from an art, only mastered by those with the right knowledge and experience, to a science, one that can be excelled at with the right tools at one’s disposal.