Asia’s naphtha supply ample despite growing appetite

Asia’s growing naphtha demand has boosted regional cracks in December, but ample supplies from the East is likely to cap further upsides.

Asia’s growing naphtha demand outpaced arbitrage supplies in December, providing an uplift on regional naphtha cracks against Dubai. But further upside to cracks could be capped going forward, amid a recent rise in naphtha exports from India, steady Mideast Gulf supplies and potentially higher supply from the US in coming weeks.

-

-

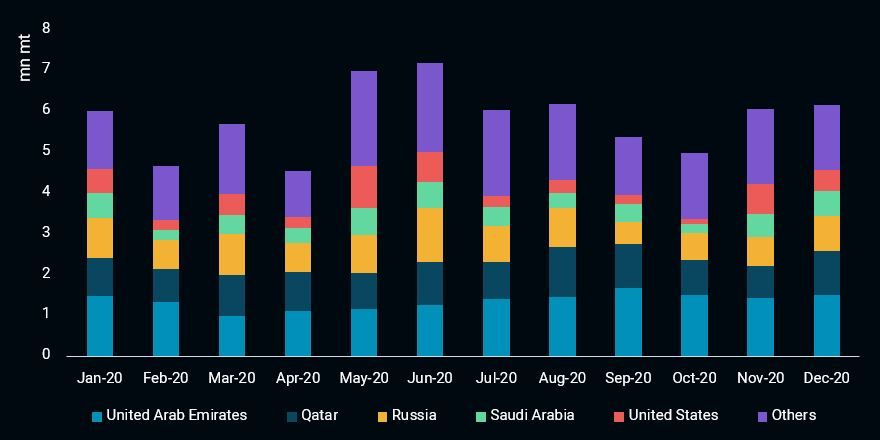

Asia’s naphtha demand ticks up: The return of Lotte Chemical’s naphtha cracker in early December, coupled with a seasonal rise in cracker runs, boosted regional naphtha demand. Premiums of LPG over naphtha that are currently hovering at $70 – $80/t, continue to favour naphtha as feedstock for cracker operators. Around 6mn mt of naphtha is expected to arrive in Asia in December, our data show, up slightly year-on-year. The region’s naphtha imports are projected to receive a further boost from over 3.4 mn mt/year of new naphtha-based steam crackers coming online in China and South Korea next year.

-

India’s naphtha exports rebounds: India’s naphtha exports rebounded to 570,000 mt in November, after reaching a yearly low in October. The export dip came as domestic naphtha demand saw a sharp uptick buoyed by stronger gasoline blending and petrochemicals demand in October, which rolled into November. As Indian refiners stepped up runs in November/December, naphtha exports have seen a recovery, with December exports expected at 680,000 mt on a preliminary basis, albeit lower year-on-year, according to our data.

-

Mideast exports hold steady: Qatar’s naphtha exports reached a 12-month high of 1.25mn mt in November, compensating for declines from UAE. Adnoc’s Ruwais refinery exports have held steady at around 1.2 mn mt over Sep – Nov, helming as the largest naphtha supplier to South Korea, Japan and Taiwan this year.

-

US – Asia arb narrows, but u-turn expected: A narrowing US – Asia arbitrage has stemmed flows to the east with exports from the US trickling to just 110,000 mt in December so far, accounting for 15% of the volumes seen in October’s high. While US gasoline demand is expected to rise with increased road travels during the festive season, naphtha demand for gasoline blending is unlikely to receive a further boost given rising US gasoline inventory levels, which could see the east-west naphtha arbitrage window widen again in Q1 2021.

Asia’s naphtha arrivals

Asia’s naphtha arrivals- See this in the Vortexa platform

Check out our top 10 oil trading themes for 2021 here – including naphtha projections

Want to know more about the Vortexa platform?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3’)}}

Asia’s naphtha arrivals

Asia’s naphtha arrivals