Diesel demand recovery signals in Asia

Vortexa Insight: Diesel demand recovery signals in Asia

Several countries across Asia are cranking up industrial activities amid the gradual lifting of travel restrictions. Vortexa data reveals that China’s diesel exports fell last month, imports by Australia and Vietnam ticked higher and more floating diesel cargoes have recently cleared into Southeast Asia – all potential signs of oil demand recovery. But while net diesel exports from Singapore have grown month-on-month, a rise in flows from India to the region’s key storage hub are keeping stocks elevated.

Mixed fortunes for key importers

Asia’s main diesel import markets – Australia, Indonesia, the Philippines and Vietnam – have shown varying levels of demand recovery.

- Imports into Australia rose by 25% month-on-month in May, fueled by the rise in road travel with easing of travel restrictions.

- Vietnam registered an 18% month-on-month increase in diesel imports to 110,000 b/d in May, as it reduced lockdown measures ahead of some other Asian countries in early May, supporting a stronger demand recovery.

- Indonesia’s diesel imports were relatively flat month-on-month in May, as domestic diesel demand was subdued with economic activities restricted up until early June.

- In the Philippines, diesel demand has also been muted with imports holding at near four-year lows of around 50,000 b/d in May, despite both refineries in the country shutting down.

Floating diesel discharging into Asia

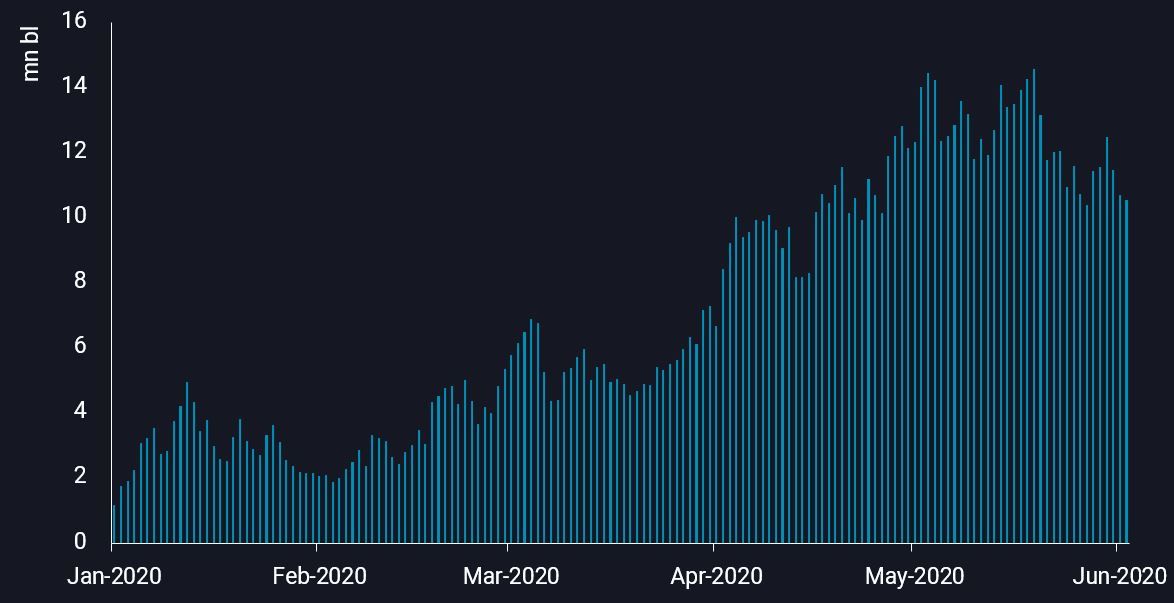

- Asia-origin floating diesel volumes have declined from a peak of 15mn bl on 19 May, according to Vortexa data, to 11mn bl (as of 1 June) – cargoes are classified as floating storage after they remain stationary for seven days.

- A rise in floating diesel cargoes discharging into Southeast Asia and Northwest Europe, coupled with fewer cargoes entering floating storage over the last two weeks, gives an early indication of a demand recovery and raises the prospects for market tightening.

Asia-origin floating diesel inventory, Jan 2020 – Jun 2020

India, China exports to Singapore

Diesel arrivals from India into Singapore jumped last month, partially offsetting a slight decline in imports from China. Singapore’s total diesel net exports rose to 220,000 b/d in May, up from 166,000 b/d in the first four months of this year, lifted by demand recovery from Southeast Asia and Oceania.

- Around 130,000 b/d of diesel from India arrived in Singapore in May, the highest seen in the last 18 months, according to our data.

- Weak domestic demand in India, and tepid buying interest from its typical customers in Europe and Africa due to abundant supplies, left Indian refiners with limited options for discharge locations.

- Singapore’s diesel imports from China meanwhile were marginally lower in May at around 45,000 b/d.

- With a rise in China’s domestic demand, but a lingering supply glut in the wider Asia market, Chinese refiners have cut diesel exports in May to a provisional 185,000 b/d, Vortexa data show, at least a four-year low, and down by 60% versus January to April levels.

- Despite this downward trend, Singapore still serves as an important export market for China’s diesel exports. Singapore accounted for 18% of China’s diesel arrivals in the first five months of this year, up from 10% over the same period in 2019.

Interested in a more detailed view of these flows?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}