European gasoline exports rise in July

Gasoline exports from northwest Europe and the Mediterranean rose on the month to 1.24mn b/d in July.

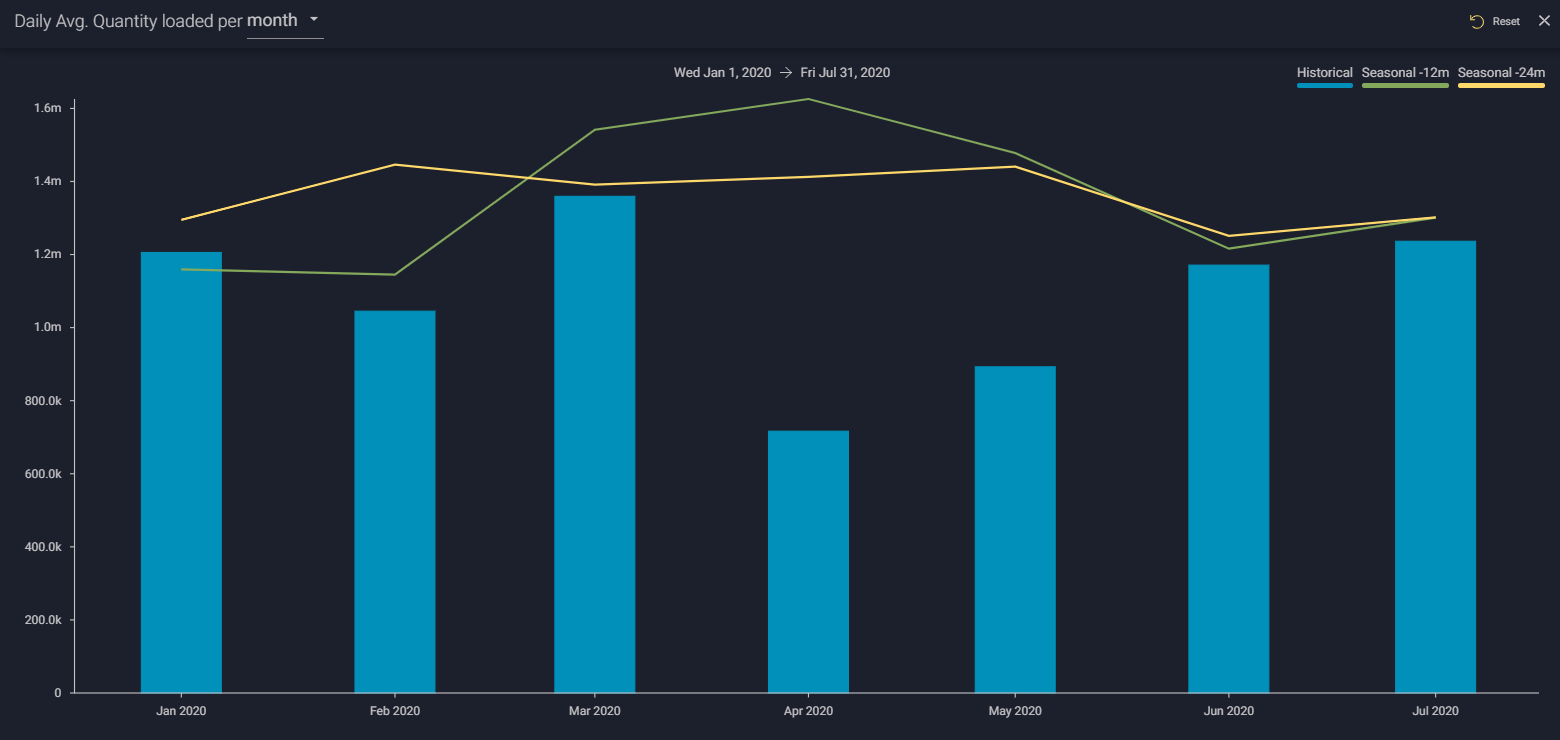

Gasoline and blending component exports from northwest Europe and the Mediterranean rose on the month to 1.24mn b/d in July, the highest monthly total since March. Growing exports, following a drop to multiyear lows in April, underline rising refinery runs from European refiners amid stronger regional demand, but the impact of an increased pull from the US could be short-lived.

Northwest Europe and Mediterranean gasoline/blending component exports (b/d)

See this data in the platform here

Exports rise in July

-

Gasoline/blending component exports from northwest Europe and the Mediterranean have grown for the third consecutive month to 1.24m b/d, but exports remain marginally lower year-on-year (see chart).

-

Preliminary indications for the first half of August show total exports of at least 930,000 b/d, though this may rise during this month.

-

Around 270,000 b/d of gasoline departed for PADD 1 in July, the highest monthly flow for the route so far this year. The largest suppliers to PADD 1 in July were traditional suppliers, the Netherlands, Belgium and the UK.

-

But August exports could trend lower if US demand deteriorates. So far this month, only 120,000 b/d has left from European waters to PADD 1 – and weekly EIA data has shown US gasoline demand to be little changed over the course of July, with PADD 1 gasoline stocks edging up for the third consecutive week.

-

Any drop in transatlantic exports could pave the way for increased flows to west Africa. European exports to west Africa stood at 280,000 b/d in July, up by 13% from June and in line with volumes seen in July 2019. But volumes are still much lower than the 2020 peak of 620,000 b/d in March – when European gasoline demand was likely at its lowest during the peak of the Covid-19 pandemic.

Intra-regional flows uptick

- Amid an overall rise in exports out of Europe in July, intra-regional flows also posted a month-on-month rise, for the first time since April.

- Around 720,000 b/d was redistributed within northwest Europe and the Mediterranean in July, up from a multiyear low of 650,000 b/d in June. However intra-region flows averaged closer to 900,000 b/d in July 2019 and July 2018.

- The main importers in July were the ports of Amsterdam and Antwerp.

Lebanon impact

- Gasoline imports into Beirut hit a 10-month high in July. But this trend is highly unlikely to persist through August following a chemical explosion on 4 August at a storage facility within the Lebanese port.

- In light of recent events,Lebanon’s gasoline imports could be shifted to increase discharge activity at other ports in the country such as Zahrani, Amchit, and Tripoli.

Interested in a more detailed view of our data?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}