Global diesel market braces for tight winter as inventories draw

The global diesel market is tight and refinery supplies are struggling to keep up with rising demand, leading to a draw on inventories across key storage hubs.

The global diesel market is tight, and it could get even tighter. Refinery supplies are struggling to keep up with rising demand, leading to a draw on inventories across key storage hubs with limited buffer for any demand upside or supply disruptions.

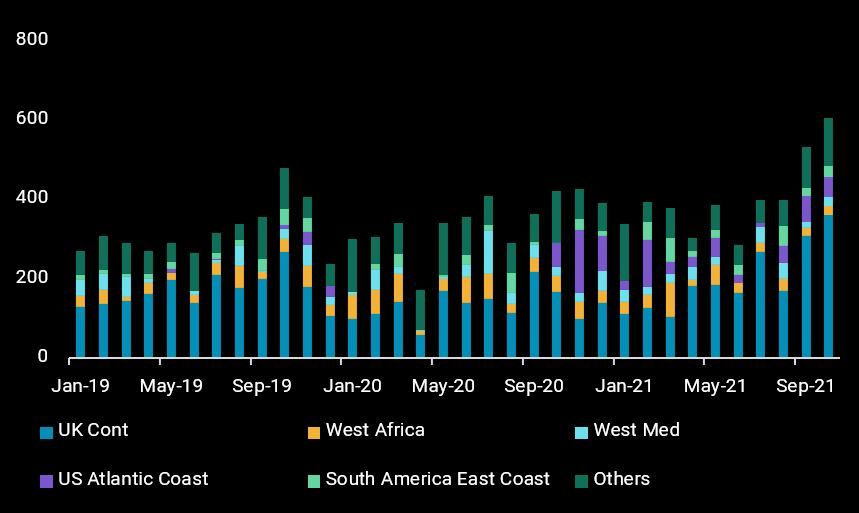

ARA diesel exports surge to multi-year high, draining inventories

Diesel exports from the ARA region soared to at least a four-year high of 610kbd in October, driven by a strong pull of cargoes from the UK Continent (UKC) in addition to stable arbitrage exports to its usual markets. An open reverse arbitrage also saw nearly 50kbd of diesel heading to the US Padd 1, a trend that is likely to continue if Padd 3 supplies remain tight. Even before the onset of winter, diesel inventories in the ARA region are already at the lower spectrum of the five-year average, raising the prospect of further supply tightness if a colder-than-normal winter sets in.

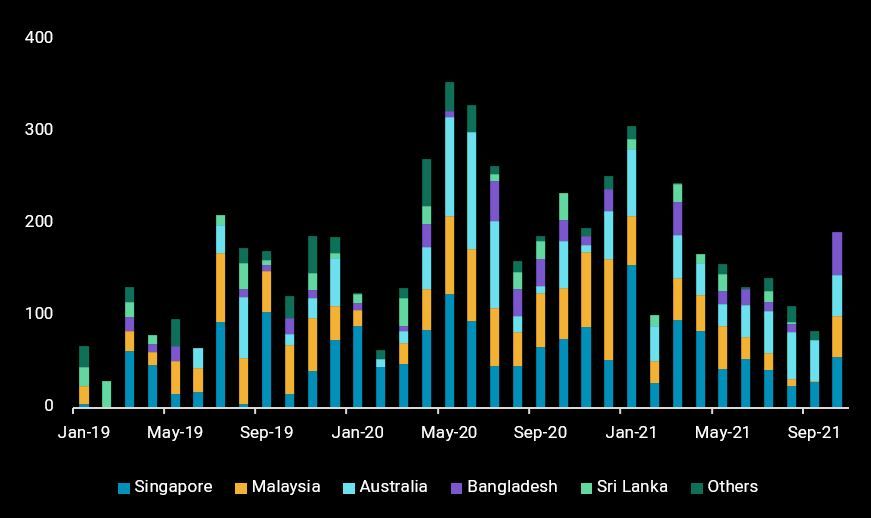

Growing East of Suez tightness keeps more barrels within the region

Although diesel exports from East of Suez (EoS) to Europe have been climbing in recent months, future flows could be constrained by growing tightness in Asia. China is cutting diesel exports amidst its domestic demand surge, whilst import appetites from Australia and Southeast Asia have been on the rise. Against this backdrop, net diesel exports from Singapore have risen to a five-month high of 240kbd in October, and inventories have drawn to the lowest seen in 12 months, according to data from Enterprise Singapore. More Indian diesel barrels were also seen moving to Asia and Australia last month, up 130kbd mom, pulling away longer-haul arbitrage volumes. On this current trajectory, Asia’s diesel tightness is expected to linger.

India diesel exports to Asia and Australia (b/d)

Navigating through the global tightness

Much stronger diesel exports from Russia’s Primorsk this month will provide some relief on Europe’s tightness, but this is likely to be already priced in. US Padd 3 could also see diesel exports rising as refineries recover from outages. While there is still room for refineries to raise crude runs, the upsides to higher diesel production may be limited. Stronger light distillate cracks than diesel would encourage refiners to optimise yields for the former where possible. Higher feedstock and energy costs are also posing challenges to less competitive refiners in raising crude runs. Accordingly, diesel and other product cracks do still have more upside, especially if and when demand picks up more as currently illustrated in Asia.

More from Vortexa Analysis

- Nov 4, 2021 What’s behind Asia’s gasoline crack surge?

- Nov 3, 2021 A sweet-sour situation for OPEC+

- Nov 2, 2021 China scrambles for diesel to avert another power crunch

- Oct 28, 2021 FSU fuel oil exports decline in October

- Oct 27, 2021 Asia’s chase for naphtha amidst a global shortage

- Oct 26, 2021 Crude floating storage shows diverging trends

- Oct 21, 2021 The case for higher refinery margins

- Oct 20, 2021 A last hurrah for global gasoline cracks? Probably not

- Oct 20, 2021 Flow highlights (EMEA): Supplies pick up on record pricing

- Oct 14, 2021 Scrubber-fitted VLCCs quietly gain market share