Jet/kero imports indicate a potentially bearish outlook

Although 2024 started with a bullish forecast for jet/kero demand growth, we take a closer look at market factors that could offer an alternative view.

During IE week in London and watching the general headlines, there appears to be a strong market expectation of robust growth in jet/kero demand for this year, even upwards of 600kbd. This bullish momentum points to a contrast to what we have observed in the last couple of months using flows data.

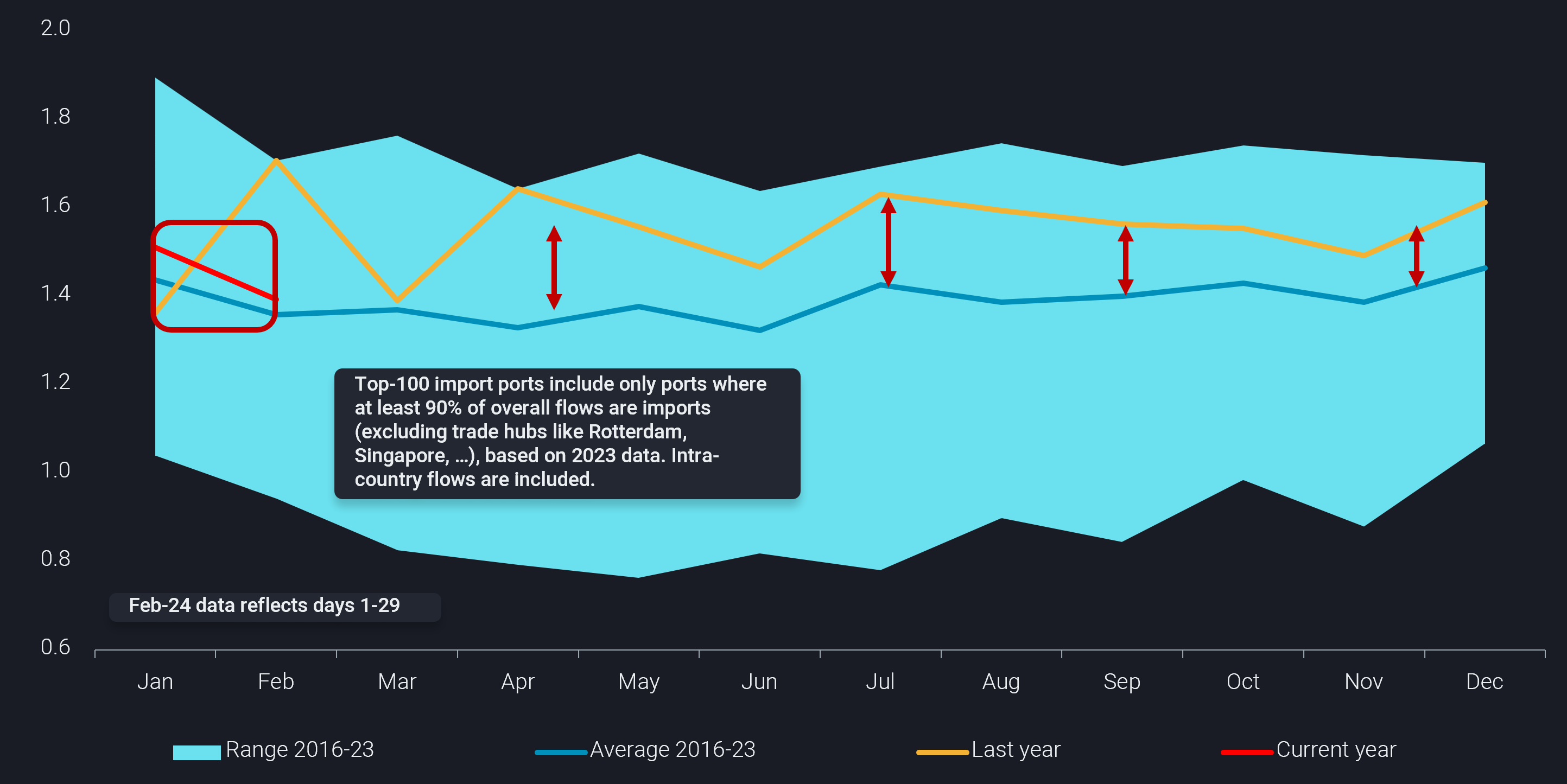

If we look at the largest 100 jet/kero import ports where 90% of the flows are imports, we can see that last years high import volumes (yellow line) relative to the blue line has been coming down gradually over the course of last year and the first two months of this year (red line) are falling close to the seasonal norm (blue line).

This drop is largely underpinned by declining import demand at North American and European ports. US jet/kero import demand peaked in April 2023 at 300kbd but has been on an overall declining trend since then, falling in February 2024 to the lowest levels observed since May 2020 – when airline travel virtually stopped for the pandemic.

Europe has also shown a seven month overall declining trend, though recent levels have not fallen below the lows of 2020. Asia has shown the steepest trend upward in jet/kero import demand growth in 2023 (320kbd in January 2023 with an overall upward trend to 450kbd in December 2023). Meanwhile, January and February 2024 have seen declines.

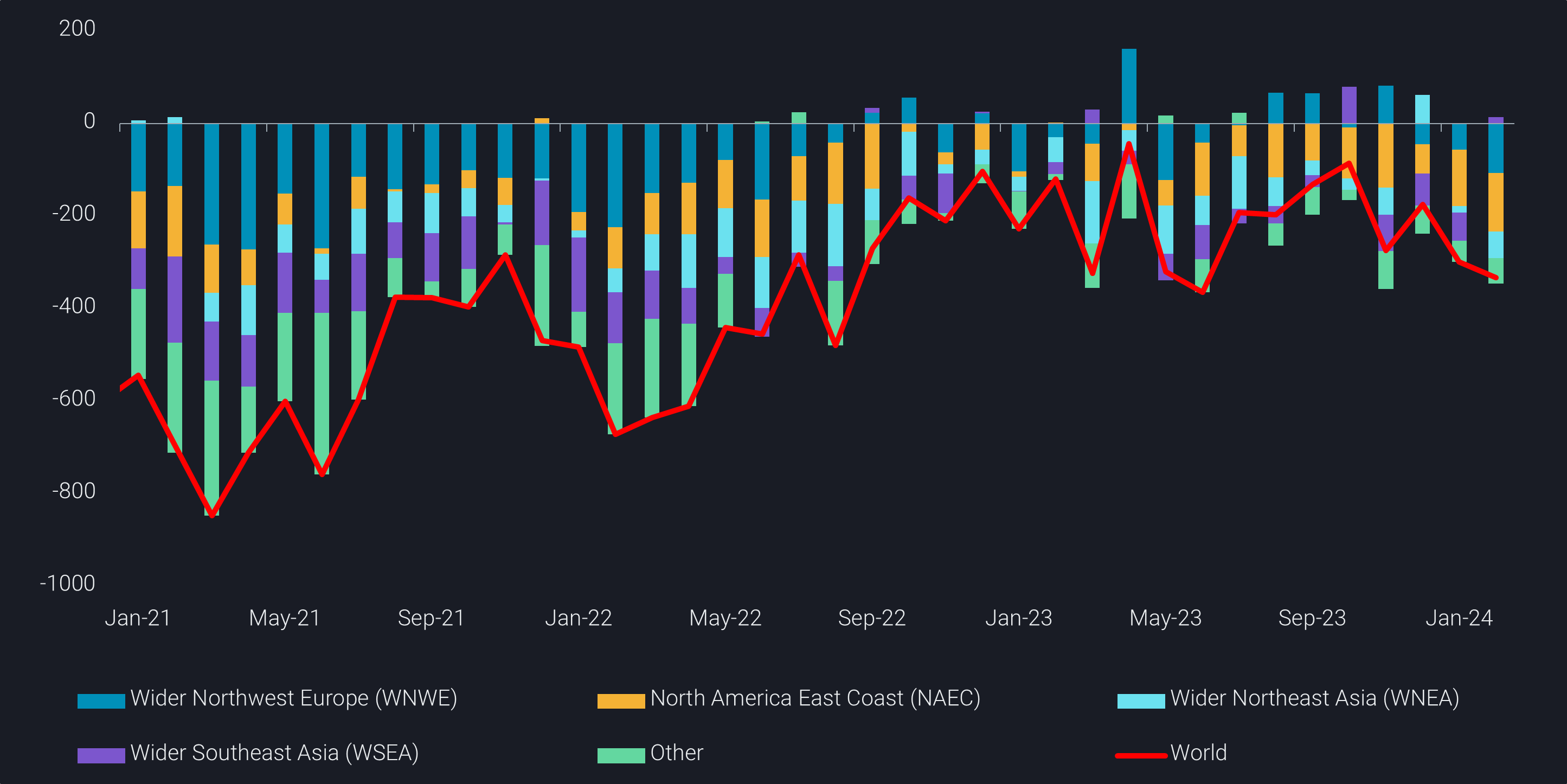

The following chart shows a similar trend, global jet/kero imports into any country by destination shipping region versus the 2019 average. The jet/kero market (similar to other markets) has not come back to the 2019 levels. In fact, imports had basically reached a level of 100-200kbd below the 2019 average as early as late 2022. However since then, there has not been any additional growth. And over the last four months, a trend toward the downside has set in.

Air travel has picked up in the last few months, but various types of improvements to the industry could have happened to cope with underlying increase in passenger demand especially in Europe. These include more efficient flying schedules, larger, more fuel efficient aircraft or optimising higher passenger load factors (Argus Media). It is possible that the strong growth of jet/kero import demand is, at least for the near term, now behind us. The off-season demand will likely be supported more so by business travel, but this may also underpin the decreased jet import demand. For example, the increased usage of video conferencing solutions available is structural in nature, and capping the business travel segment’s longer term growth potential.

On the supply side, despite slowing import demand, healthy jet/kero margins could remain in the medium term. This is especially true for regions like Europe where there is a net short dependent on either higher production regionally or resupply from the East of Suez where the marginal barrel has become more expensive due to higher travel costs around the Cape of Good Hope.

Despite the logistical constraints in the Red Sea which are keeping some of these barrels out of Europe, the overall incentive for refineries to produce jet over diesel has fallen and remains at relatively low values historically, indicating that jet/kero is not in short supply relative to demand.