LSFO outlook tightens on recovering gasoline markets

An early rally in global gasoline markets recently is fueling expectations of tightening low-sulphur fuel oil (LSFO) supplies, keeping prices for the residual fuel used in marine fuels and power generation supported over the near term.

For most of last year, refiners have focused on maximizing diesel output as a result of Russia’s invasion of Ukraine as well as weak demand for light distillate fuels. But with recovering gasoline demand and inventories across some of the key storage and demand hubs below seasonal norms, gasoline cracks rallied prompting refiners to increase FCC runs in a move that will divert blendstocks such as low-sulphur vacuum gasoil (VGO) and low-sulphur straight run fuel oil (LSSR) away from the LSFO pool.

In Europe, for example, Argus data shows premiums for low-sulphur VGO, used in the production of gasoline, have been bid higher amid increased demand while those for high-sulphur VGO were under pressure amid excess gasoil supplies.

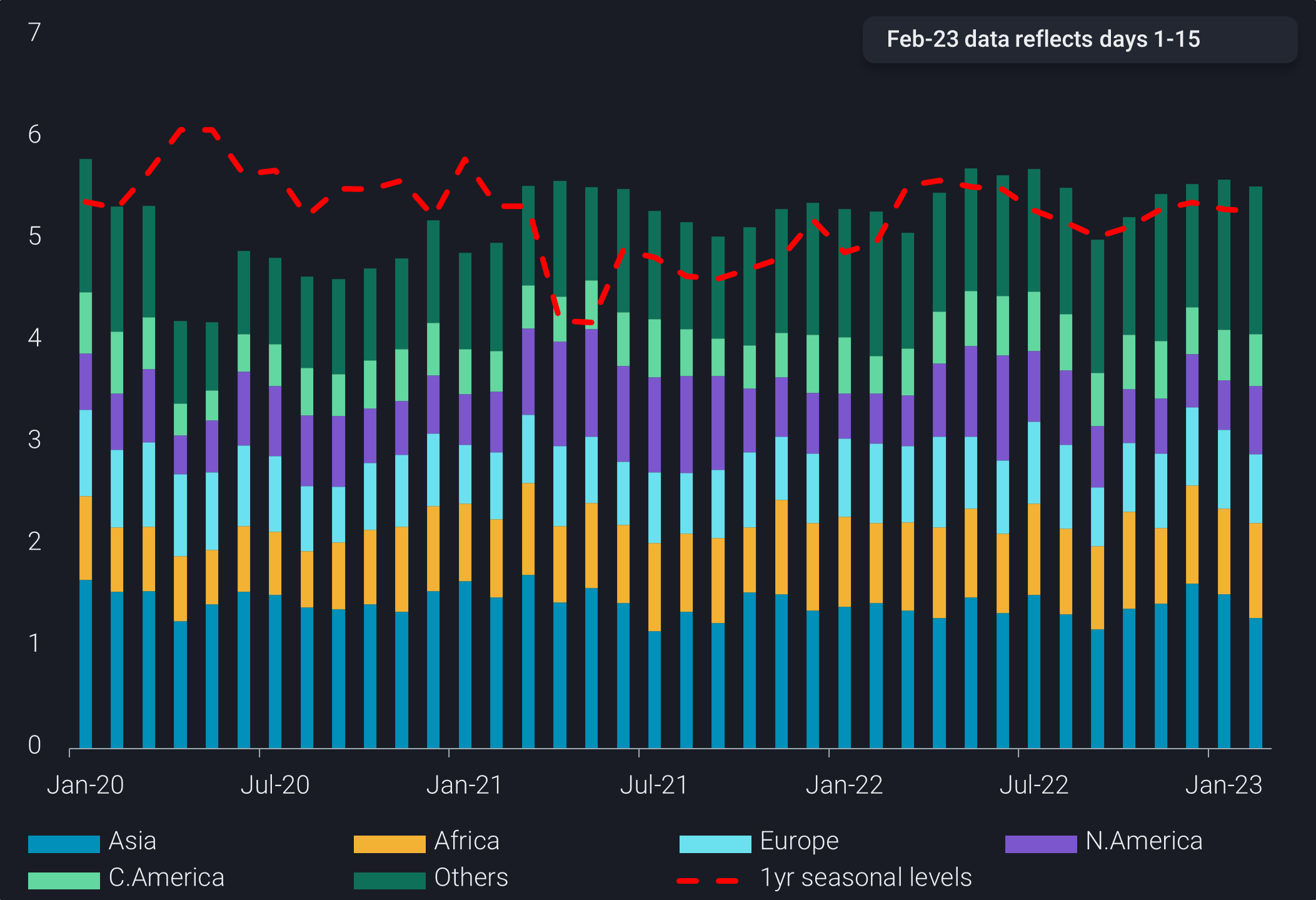

This, in part, has dragged LSFO western arbitrage arrivals (excluding from Russia) into Singapore to a 4-month low of less than 140kbd in 1H February, preliminary data showed. More specifically, Singapore LSFO inflows from Europe are on track to hit a 5-month low of 25kbd this month. Rising freight rates have also tightened arbitrage flows.

Gasoline stocks in key demand centers like the US could also soon come under pressure as refiners throttle back runs this year after a surge in refinery utilization rates to a 4-year high of 92% in 2022, according to EIA data. Planned US turnarounds are expected to be elevated this spring and the resulting loss in refined product supplies could boost secondary unit conversion margins, increasing demand for intermediate feedstocks at the expense of LSFO.

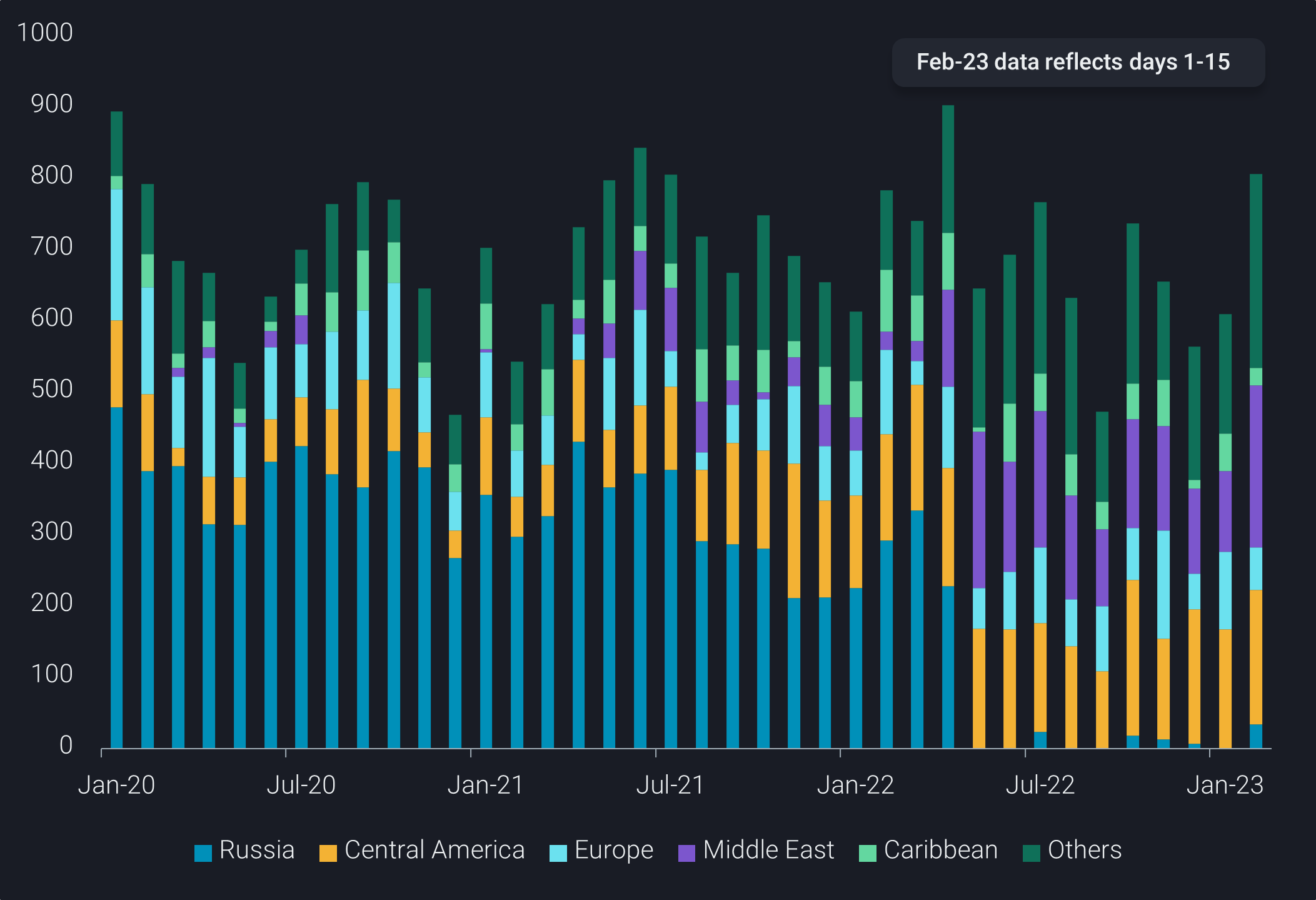

In Asia, gasoline loadings are also expected to narrow as East Asian refiners enter maintenance season in the second and third quarter of the year. Refined product exports from China could also be limited as the country refocuses on satisfying its domestic market demand although increased LSFO output domestically should ease some of the pressure on regional demand.

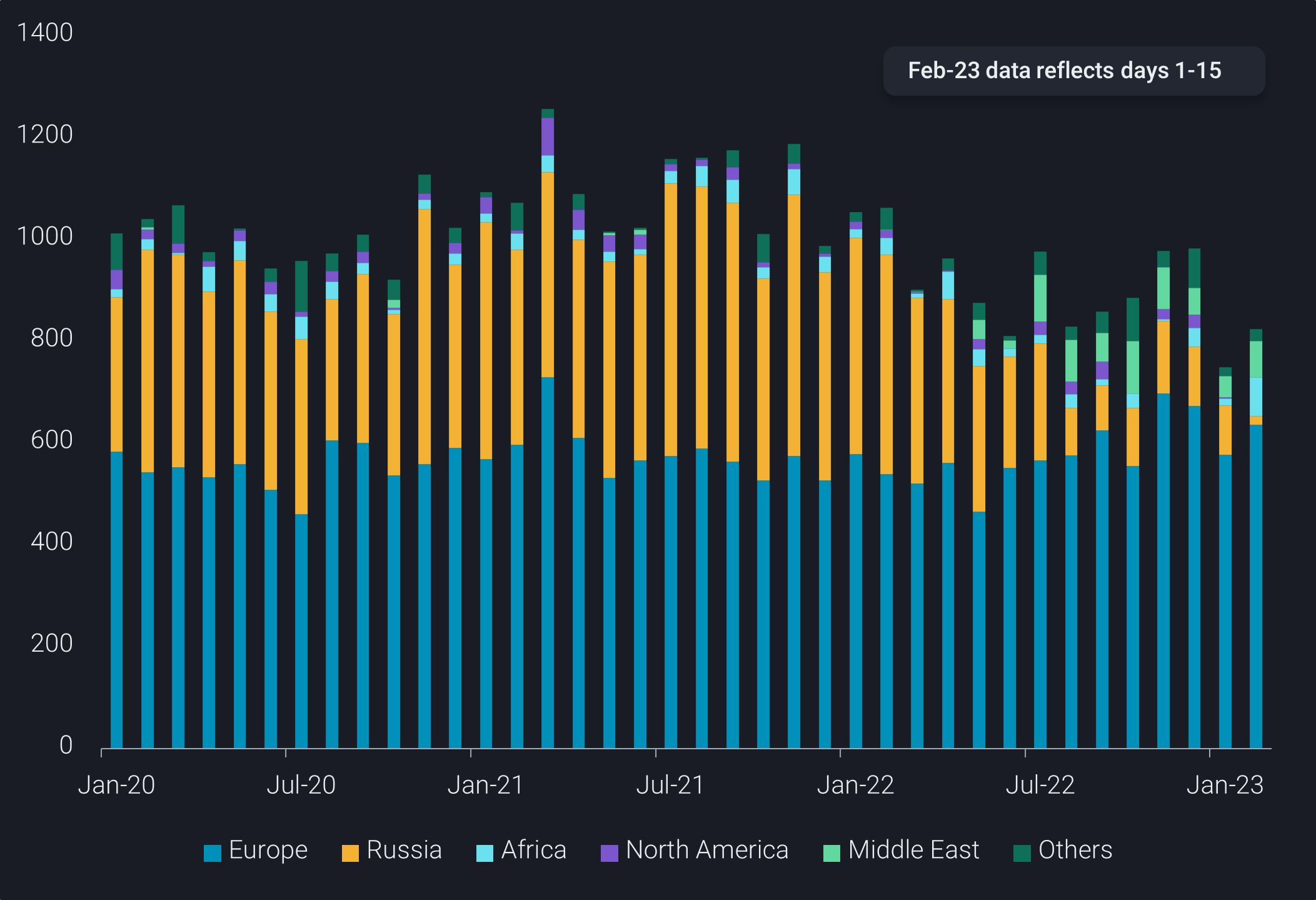

In Europe, tightness in residual fuels is also more pronounced now since the ban on Russian product imports came into effect earlier this month, cutting off streams of refining feedstocks or LSFO blending materials.

Important sources of intermediate feedstocks are also expected to dry up this year with the anticipated commissioning of secondary units in newer refineries like Saudi Arabia’s Jizan and Malaysia’s Pengerang, which on average have exported 90kbd and 50kbd, respectively, of feedstocks in recent months, mostly to the west.

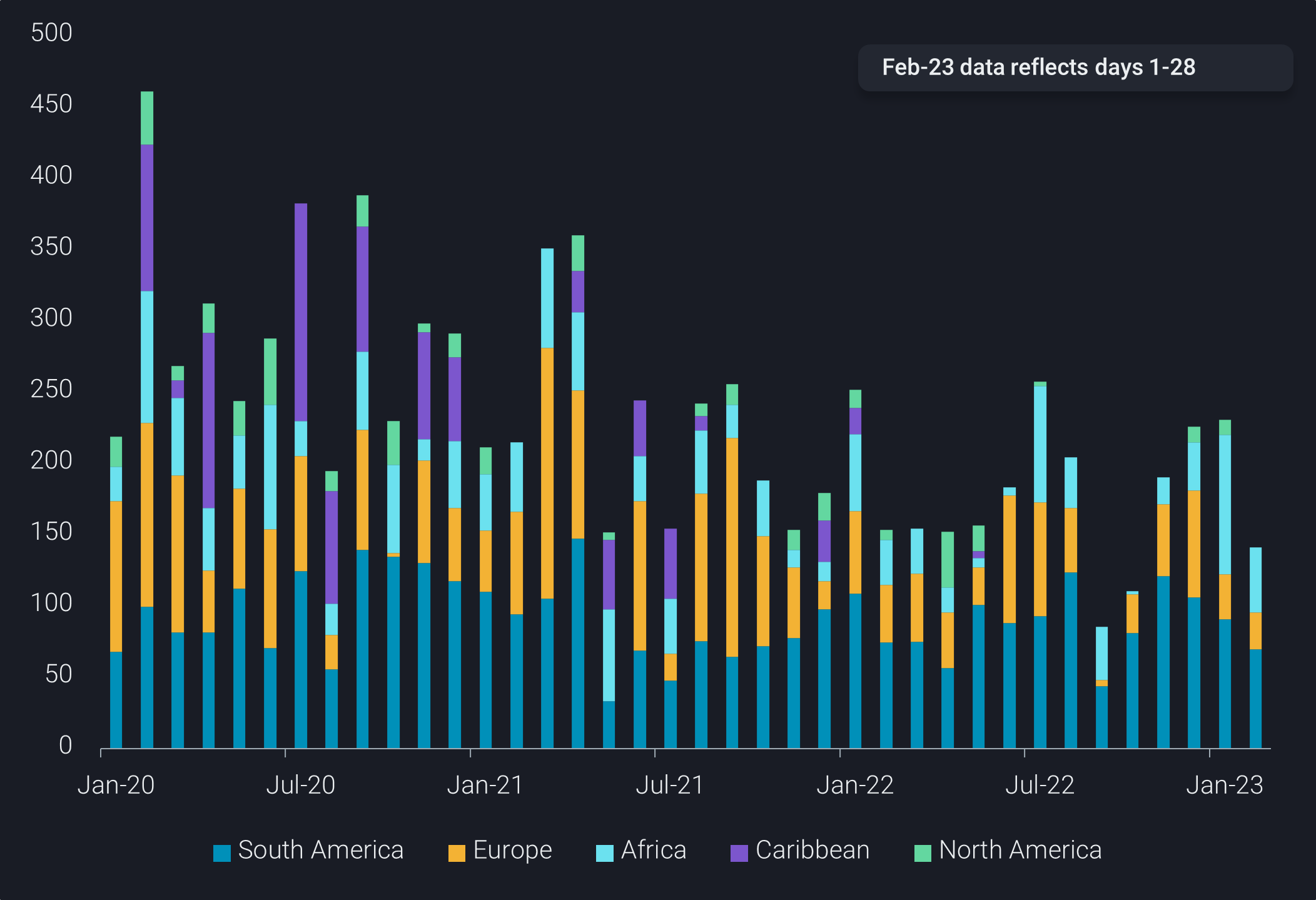

The US, which banned Russian oil imports in April last year, was quickly able to wean off its dependence on Russian residual fuel supplies that averaged 320kbd in 2021. While there are differences in US and European refiners’ capacity to upgrade residues into higher value refined products, competition for non-Russian residual fuel cargoes between the two is likely to intensify.

Wild cards

Kuwait’s state-owned KPC said it expects to ramp up operations at its new Al-Zour refinery in Q2 with the commissioning of its second of three crude distillation units. This could potentially double its already sizable LSFO exports which grew to 70kbd in January (or 320kt) since the startup of the first CDU in late 2022.

Increased LSFO production in China, where refinery output is expected to rise after the country ditched its zero-COVID policy, could ease some of the pressure from LSFO markets.

Meanwhile, the outlook for the bunker market remains uncertain as recessionary pressures weigh on global bunkering demand. However, hopes of a macroeconomic recovery in the second half of the year could see a reversal of this trend.