PADD 3 gasoline exports seek alternative outlets

PADD 3 gasoline exports seek alternative outlets

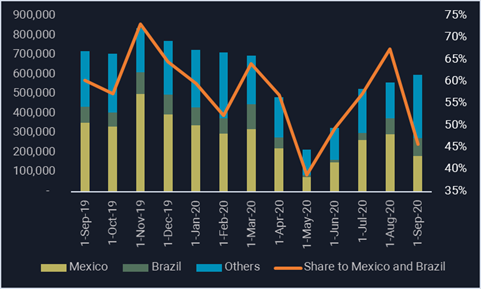

US Gulf coast (PADD 3) gasoline exports have been making a recovery from pandemic-induced lows, but weaker demand from top importers Brazil and Mexico has prompted traders to seek alternative outlets in recent weeks – including elsewhere in Central and South America and the Caribbean.

Mexico and Brazil pull back on imports

- PADD 3 gasoline exports collapsed in April and May, in the wake of the pandemic, but have recovered during the summer and through September. Vortexa data show that PADD 3 has exported 600,000 b/d of gasoline this month, down 120,000 b/d, or 17%, from September 2019.

- Mexico and Brazil are the top two destinations for gasoline exported from PADD 3, accounting for around 60% of liftings over the last twelve months.

- But the combined share of PADD 3 gasoline exports to these top importers has fallen to just 46% this month, preliminary data indicate. The last time the share of PADD 3 barrels to Mexico and Brazil collapsed in a similar way, it was against a backdrop of falling overall flows. This time though, gasoline flows out of PADD 3 are instead increasing while a smaller share, and total volume, is being sent to Mexico and Brazil.

- Increasing flows from PADD 3 but lower flows to Mexico and Brazil have forced cargoes exported from PADD 3 in September to diversify into markets throughout the Caribbean, Central and South America.

PADD 3 Gasoline Exports (b/d)

See latest data in the Vortexa platform

Want to know more about these flows?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}