Russia’s naphtha: Where’s next after the EU ban?

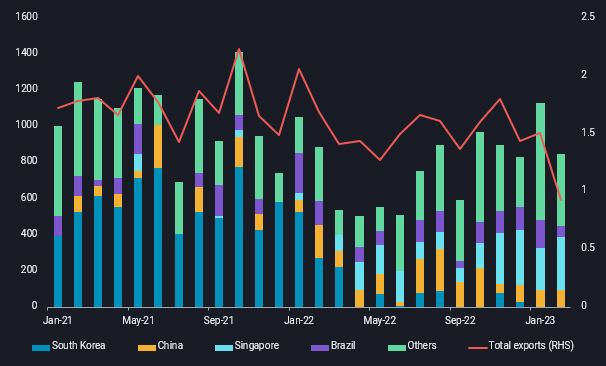

Russia’s naphtha exports have nosedived post the EU ban amid limited alternative markets and challenging fundamentals.

A sharp slowdown in Russia’s naphtha exports to a multi-year low in February is hinting at the possibility that the country is struggling to find alternative buyers after the EU ban came into effect early last month.

Attracting Asian buyers, Russia’s single largest alternative market for naphtha, has proven to be challenging. Russian naphtha fell out of favour with its biggest buyers in East Asia shortly after the Russia-Ukraine conflict started, with flows plunging to historical lows last year and remaining muted, restricting its potential buyers to India and Southeast Asia. The price cap and hesitation of handling Russian cargoes in lieu of potential financial, logistical and reputational risks could further reduce interest from market players within the region.

Adding to the challenge, market fundamentals for naphtha are showing limited signs of recovery in the near-term. Although Asia’s cracker margins have improved in recent weeks amid a tighter ethylene market, they remain in the red. Ample supplies from the Middle East, partially contracted on a term basis with several cracker operators, are also limiting appetite for Russian naphtha even though they may be discounted.

Of the 930kt Russian naphtha exported in February, at least 60% of the volume is headed for Asia, with Singapore being the top destination country. It is interesting to highlight that Russian naphtha have all discharged into storage terminals in Singapore so far, and none to refinery or cracker-linked terminals. Indonesia has also increased imports of Russian naphtha, starting with one MR cargo in November and expanding to one LR1 cargo in January and February, per month. All the Russian naphtha cargoes have discharged into the country’s Chandra Asri Terminal so far, likely as feedstock to the nearby cracker.

Outside of Asia, UAE’s Fujairah’s oil storage terminals offers another outlet for Russian naphtha, potentially paving the way for re-classification of the cargo origin, if re-exported. The terminal received around 40kbd of Russian naphtha over the past six months, accounting for almost half of its seaborne naphtha arrivals. But opportunities for Russian naphtha to flow to Fujairah may be capped as higher volumes will increase the length in the Middle East and inevitably depress regional naphtha prices, which does not bode well for regional exporters.

Meanwhile, Russia may be shifting its refinery yields or blending naphtha into gasoline for domestic consumption to manage its naphtha surplus. But this is unlikely to fully eliminate its naphtha surplus, and refinery run cuts may soon be its only option remaining to manage its surplus inventories.