Russia’s refined product exports: Shifting volumes and trading patterns

Russia’s refined product exports have not rebounded despite the restart of its refineries. Vessels are moving away from Kalamata STS to other locations.

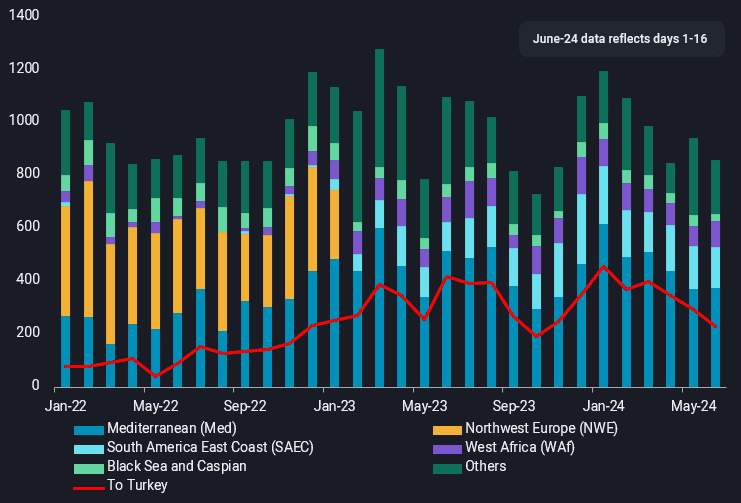

Several Russia refineries have returned from planned maintenance or restored after drone attacks in the past weeks, but the country’s refined product exports show limited growth, contrary to market expectations. The seasonal rise in domestic demand during summer could partly explain the lagged rebound, but weaker buying appetite for Russian diesel amid ample supply could be the other driving factor.

Russian diesel exports to Turkey fall, floating storage volumes elevated

Russia’s diesel exports to Turkey, its largest destination market, is on-track to fall for the third consecutive month and reach a 7-month low in June. Lower discounts of Russian diesel amidst a well-supplied European diesel market have likely reduced the arbitrage for Turkish traders to import Russian diesel for domestic use and export domestic supplies to the rest of Europe. As a reflection of this, Turkey’s diesel exports have been on a decline since April, and have reached 90kbd in 1H June, a multi-year low.

Meanwhile, Russia’s diesel exports to Brazil have remained rangebound in recent months, totalling 165kbd in 1H June. Interestingly, arrivals into Brazil have soared to 280kbd in the same period, setting a record high. Higher arrivals have been bolstered by vessels that had their voyages prolonged due to potential difficulties in finding buyers and have discharged into Brazil this month. As an example, LR1 BEKS SOLAR that loaded Russian diesel in late January was in floating storage around Cape Verde between end-February and mid-June before discharging in Brazil’s Itaqui port on 18 June.

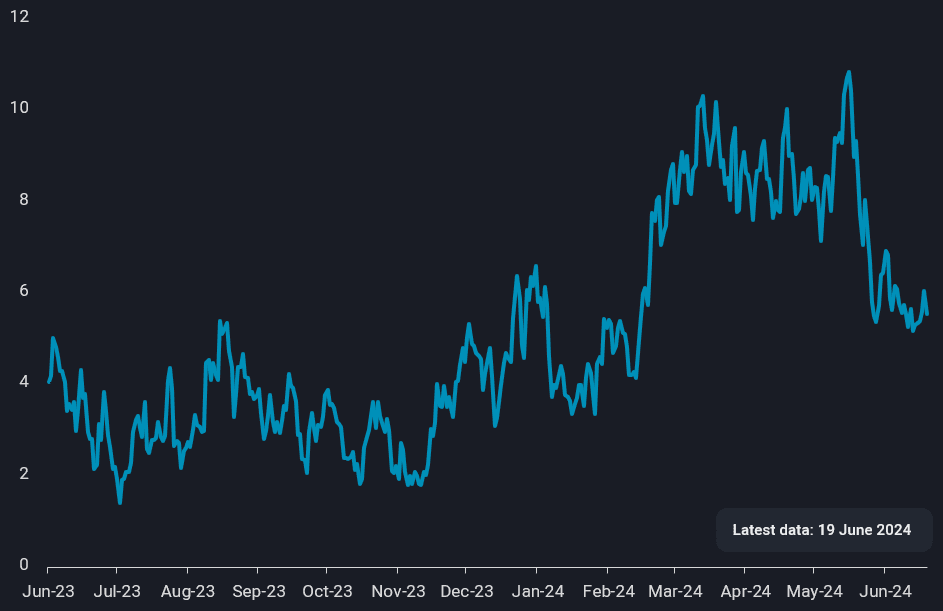

While the volume of Russian diesel in floating storage have fallen from the highs of above 10mb in mid-May to 5.9mb on 19 June, volumes are still more than double compared to year-ago volumes. The majority of the 31 vessels in floating storage currently are concentrated in Russia Baltic and Black Sea, Malta (for STS), West Africa and Brazil.

Russian-origin vessels move away from Kalamata STS to alternative locations

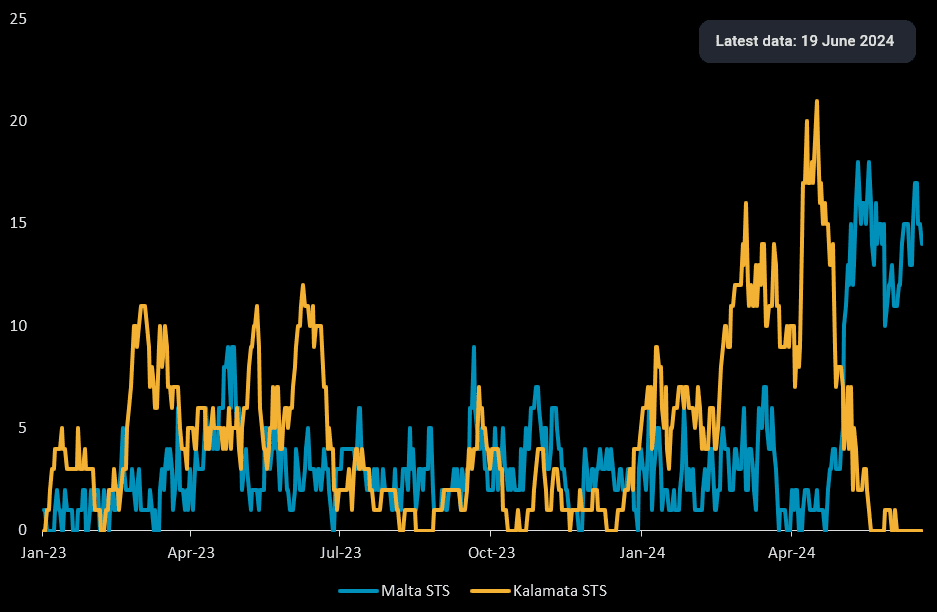

Around 19% of Russia’s refined products exported in the first five months of this year were involved in STS transfers at some point in their voyage, with Kalamata and Malta being popular STS locations.

Malta STS remains one of the most popular locations, with around 10- 15 Russian-origin laden vessels waiting there every day in the past 1.5months, compared to a minimal number the same period last year. In contrast, STS activities in Kalamata have fizzled out, with few or no Russia-origin laden vessels seen waiting in the area this week. The recent Greek naval military exercise in the Gulf of Laconia is expected to last till mid-July, and vessels are likely to stay away from Kalamata STS and move to other locations including Malta and Port Said STS to perform their STS operations.

Russia’s refined product exports remain at risk

As the Russia-Ukraine conflict continues, Russia’s oil infrastructure remains under threat from attacks, adding to volatility in Russia’s refined product exports. Tuapse refinery was shut down in mid-May, whilst Novoshakhtinsk refinery had to be taken offline after being attacked in early June. A slower uptake in Russian diesel despite lower exports are also pointing towards uncertainty in the wider market’s interest for Russia’s cargoes. With its focus on meeting rising domestic demand, Russia’s clean product exports could see limited growth in the near-term.