South Korea’s jet fuel exports to US West Coast rebound

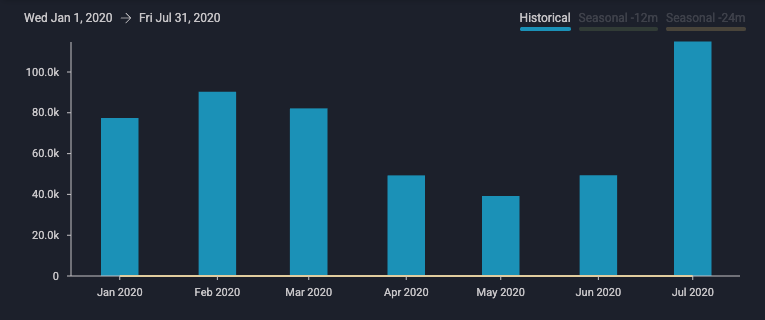

South Korea’s jet exports to the US West Coast (PADD 5) rose to 115,000 b/d in July, the highest in at least four years, according to Vortexa data.

South Korea’s jet fuel exports to the US West Coast (PADD 5) rose to 115,000 b/d in July, the highest in at least four years, according to Vortexa data. The sharp rise in exports follows improved arbitrage economics after an uptick in PADD 5 jet fuel prices and falling clean tanker rates in June.

South Korea jet fuel exports to US West Coast – (b/d)

See this data in the platform here

US West coast jet fuel demand rises, market tightens

US West coast jet fuel demand staged a steady recovery from July. This rise is consistent with an overall month-on-month rise in the country’s jet fuel demand reported by the US EIA.

- PADD 5 imports from South Korea rose 25% month-on-month, with around 100,000 b/d of jet fuel discharged in July, Vortexa data show.

- This compares with a 9% rise in PADD 5 refinery runs over the same period and three consecutive weeks of jet fuel stock draws through to end July, according to the EIA data.

-

In August, two Handymax (MR) tankers laden with jet fuel from Korea are enroute to Los Angeles. But looking ahead, future flows could be pinched by the narrowing arbitrage.

South Korea’s jet exports rise, regional suppliers subdued

South Korea’s jet fuel exports registered a 17% month-on-month uptick in July, recovering from a year-to-date monthly low in June.

- Positive jet fuel cracks (against Dubai) in July, coupled with a strong demand pull from the US likely supported this rise. This comes amidst a deeply negative jet regrade – the price differential between jet/kero and diesel – which has favoured blending jet fuel into diesel.

- In a rare observation, Handymax (MR) tanker Atlantic Harmony carried a jet fuel cargo from Ulsan, Onsan that discharged into Brunei’s Hengyi refinery in August. Brunei has typically been a net exporter of jet/kero since the start-up of Hengyi refinery.

- Jet fuel exports from key regional suppliers – China and India – remain subdued on a bearish demand outlook, and are therefore capping any build in regional balances.

- Both countries exported around 50,000-55,000 b/d of jet fuel last month, around 50% lower than the same time last year.

Interested in a more detailed view of our data?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}