US marine fuels share rises in Panama

Vortexa Snapshot: US marine fuels share rises in Panama

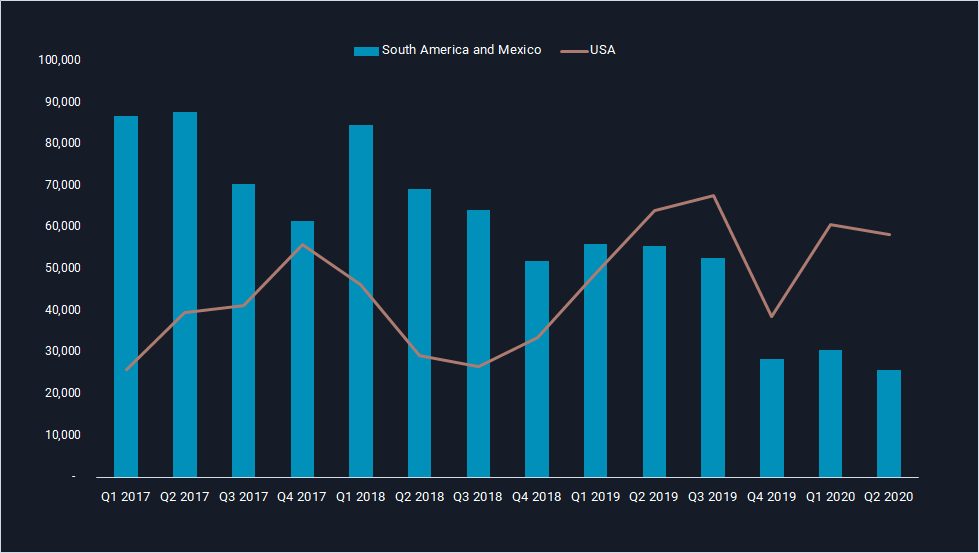

The share of US marine fuels arriving into the global bunkering and storage hub Panama rose sharply in the first half of this year, following the shift to IMO-compliant marine fuels. This displaced previously dominant high sulphur fuel oil (HSFO) from South America, as we highlight below.

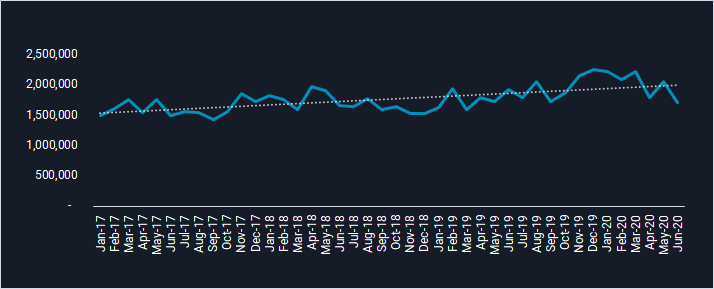

We also note how the steady growth of traffic through the Panama Canal in recent years has supported rising bunkering demand, which will also feed into continued demand for US supply in the long-term.

US takes the lead in Panama

- The US has sharply increased its share of supply in Panama’s fuel oil market since January, backing out other South American suppliers. Panama also typically imports volumes from the Caribbean region.

- US refinery adaptability and the increased availability of light crude gives it an advantage in the production of LSFO, while the South American fuel oil slate remains dominated by high sulphur grades.

- The race for the Panama market intensified in Q2 last year, when the share of US marine fuel -i.e. fuel oil and gasoil- overtook South American suppliers (see chart below).

- Prior to higher US to Panama flows, the US traditionally exported more marine gasoil and fuel oil to Mexico. In Q2 this year, only 15,000 b/d of US fuel oil arrived into Mexico, compared with over 60,000 b/d the same time last year.

South American share of Panama supply falls

- Ecuador, Peru and Mexico – the three largest suppliers, excluding the US – have each seen sharp declines in fuel oil exports to Panama during 1H 2020. The largely heavy and sulfurous profile of their domestic crude production from these countries limits the ability to produce IMO-compliant fuel oil.

- Combined imports from these three countries into Panama fell by 65% year-on-year in the first half of this year. Panama still imports HSFO, which may be blended, or used on tankers fitted with scrubbers.

- Ecuador, historically Panama’s largest supplier, has seen its share decline sharply since 2018 due to falling demand for its HSFO. No fuel oil arrived into Panama from Ecuador during April-May, which marks the first time no flow was seen along the route in over three years.

- Ecuador is importing components in order to blend towards LSFO, while it exports HSFO to the US, partly to be used as a refinery feedstock.

Panama combined fuel oil and gasoil imports by origin (b/d)

Busier Panama traffic lifts bunkering demand

- In the short-term, a reduction in the number of vessels in transit due to Covid-19 has depressed bunkering demand.

- But over a longer time horizon, demand for low sulphur marine fuels in Panama is likely to grow, tracking increased bunkering activity as more crude oil and product tankers travel via the Panama canal.

Crude oil and oil products cargo flows through Panama Canal (b/d)

Interested in a more detailed view of these flows?

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}