Will gasoline face a future of headwinds?

In this insight we take a look at gasoline and blending component flows in the Atlantic Basin.

Despite a recent boost in gasoline margins over the last few days, the light distillates market has been disappointing this year after high demand expectations. Underwhelming margins have prompted many global refiners to outwardly announce run cuts (Asia, USGC) or adjust yields to produce higher volumes of middle distillates. This tightening response seems to have had an impact on global gasoline loadings, as we observe a move down from counter seasonally highs and a return in line with last year’s volumes.

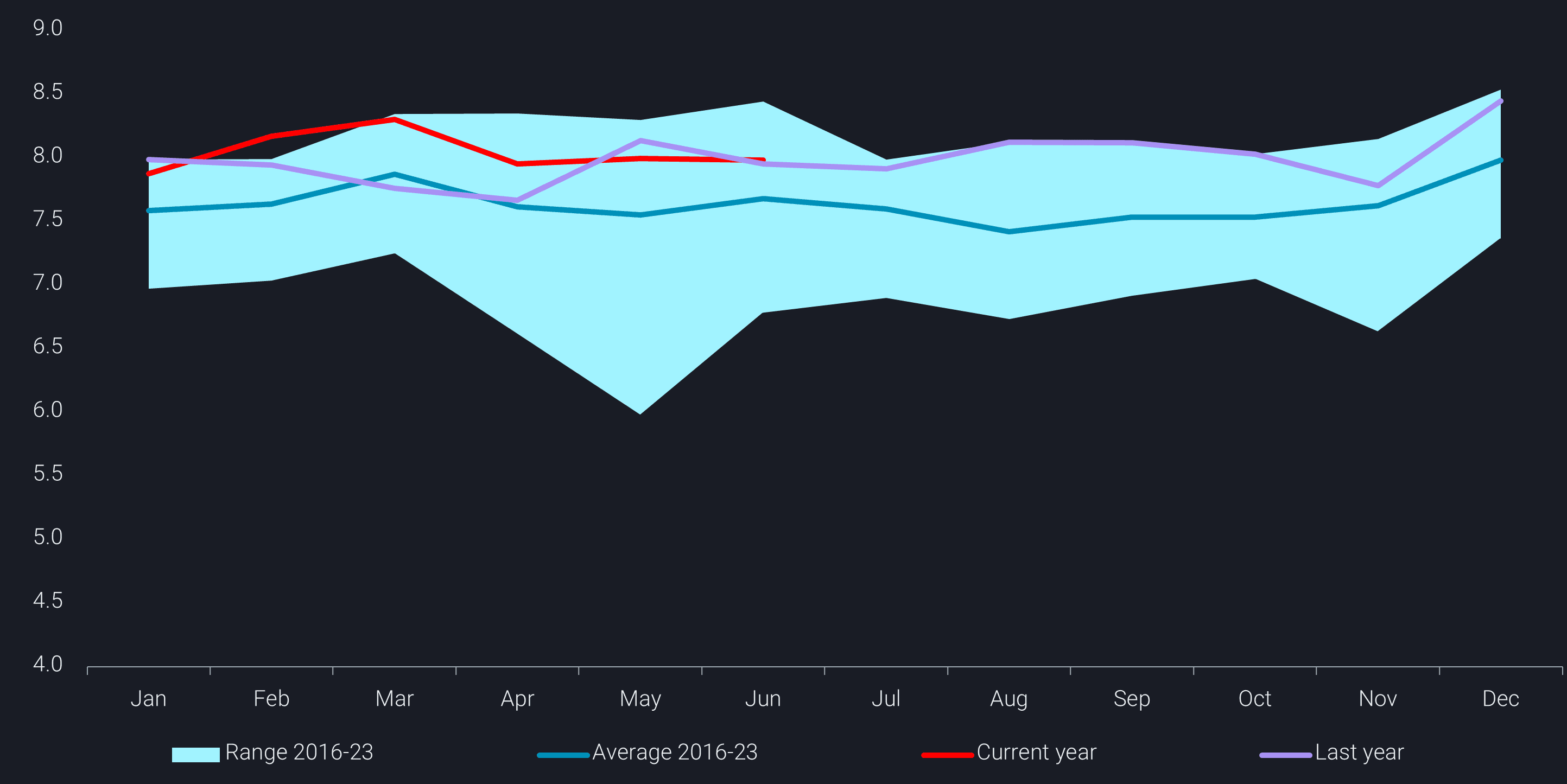

If we hone in on the Atlantic Basin markets, we can see that gasoline/blending component imports into the North America East Coast (Canada East Coast, Caribbean, USAC, USGC, Gulf of Mexico) and the South Atlantic Basin market (South America East Coast and West Africa) are down 10% from Jan-June y-o-y.

Lower seaborne imports have occurred amid a backdrop of counter seasonally high stocks and prolonged refinery outages in both PADD 3 and Europe indicating declining demand in the US market. USAC imports, the second largest gasoline importer after Southeast Asia, fell 9% this year when comparing Jan-June y-o-y.

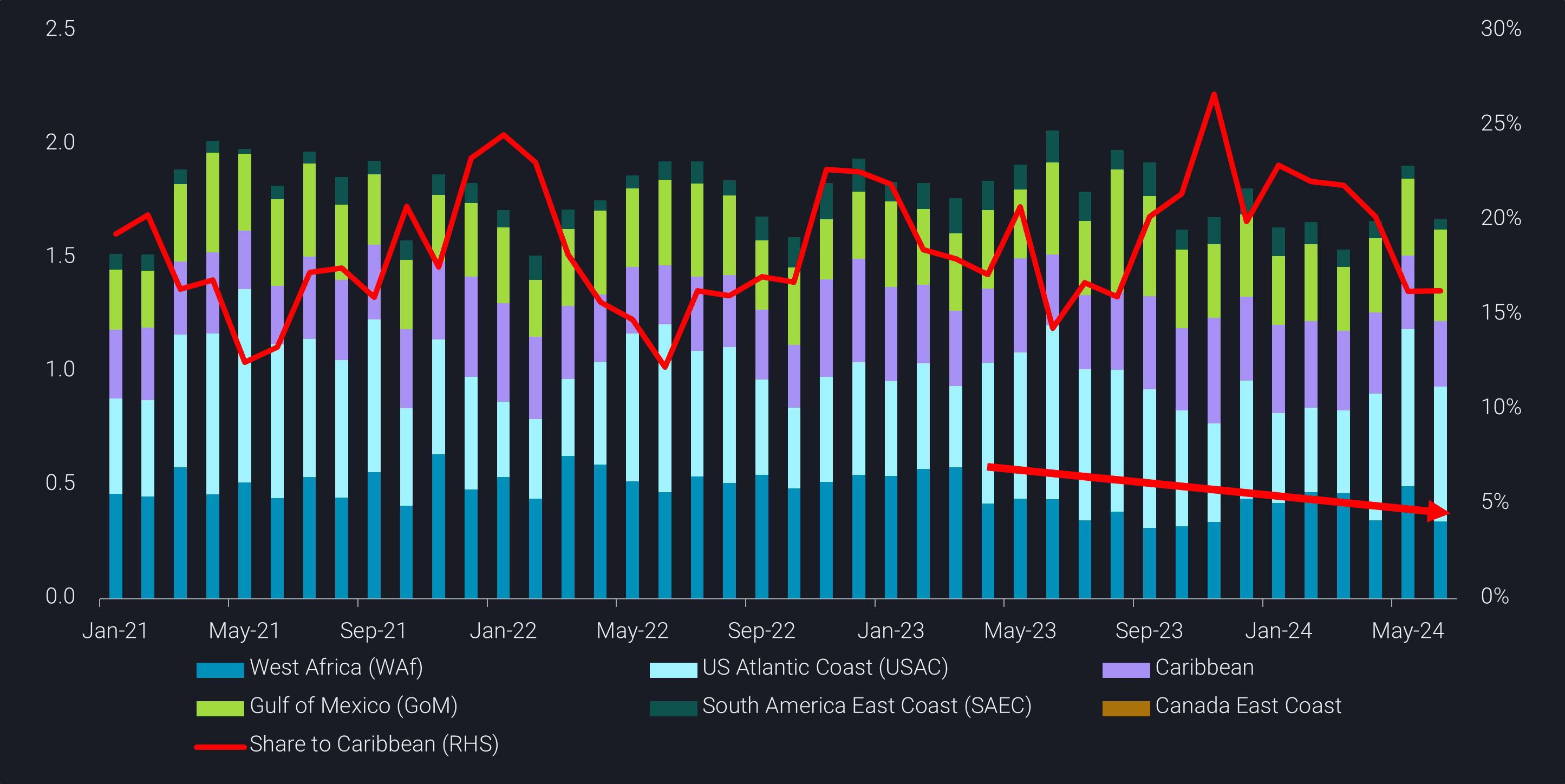

Meanwhile, imports into Mexico’s East Coast also started off the year weak, falling to a multi-year low in March to 240 kbd. However, the last three months have shown a sharp reversal upwards due to a series of unplanned outages which could continue into the foreseeable future after running the refineries hard during the Q32023 and Q12024. Pemex’s six refineries in Mexico operated at 51.8% capacity in May, down from 58.4% in April and 65.3% in March when operations had reached an eight-year high (Bloomberg). Considering that the majority of the refining capacity is located in the East Coast, we can likely expect import demand to continue until the start of the Dos Bocas refinery (340kbd) which is expected to produce 170kbd of gasoline for domestic consumption.

And as we enter into July, all eyes are on the slow ramp up of the 650kbd Dangote refinery which is expected to start gasoline production this month eventually reaching 360kbd. Although there are currently no signs yet and the refinery is said to be operating normally after a fire broke out on June 26 (Argus Media).

While seaborne imports into USAC, Mexico East Coast and West Africa have been feeble, the opposite has been true for the Caribbean where oversupplied volumes tend to get blended and then reexported to nearby markets in LatAm or PADD 1. However, these flows to the Caribbean especially from Europe are likely due to a buildup of gasoline stocks in anticipation for what was expected to be a strong USAC driving season.

Looking forward, these rising gasoline exports should face strong headwinds getting absorbed into major import markets as demand slows down, especially with the growing possibility of more capacity coming online.