Russian oil sanctions set to deal a hard blow on Asia’s economy

As the US and UK join a growing list of trading and refining companies in abandoning Russian oil barrels this week, the repercussions of an increasingly starved global oil market will deal a hard blow on Asia’s economy.

As the US and UK join a growing list of trading and refining companies in abandoning Russian oil barrels this week, the repercussions of an increasingly starved global oil market are starting to ripple across the world. While Russia’s oil supplies account for only 5% of Asia’s total oil imports today, which is arguably insignificant if lost, the surge in oil prices is catalysing a chain reaction of driving inflation to multi-year highs, eroding oil demand and perpetuating the potential of an economic crisis in oil-dependent Asia.

Asian refiners pay a high price for crude supplies

As European refiners accelerate efforts to replace Russian crude barrels, the demand pull is propelling prices of West of Suez spot barrels through the roof. The cost of a barrel of US WTI crude at Houston, a target replacement grade, has surged by nearly 50% and widened its spread significantly against Brent in the recent week compared to the start of the year. Alongside soaring crude prices, chartering rates for dirty tankers have also jumped by 10 – 50% depending on trading routes and time of booking, although we expect freight prices to cool in the weeks ahead as market fundamentals moderate initial price reactions.

All in, Asian refiners are now looking to pay at least 60% more (or additional $70million) to import a 270kt cargo of US WTI crude compared to the start of the year. To finance these more expensive crude purchases, many refiners are knocking on the doors of banks to raise their credit limits and top up margin calls, which may be a small hurdle for major firms with established credit facilities but could be a roadblock for the small to mid-sized refiners.

WTI Houston M1 prices (LHS, $/bl) and USGC-China VLCC rates (RHS, $/t)

Onshore crude inventories offer some buffer, but limited

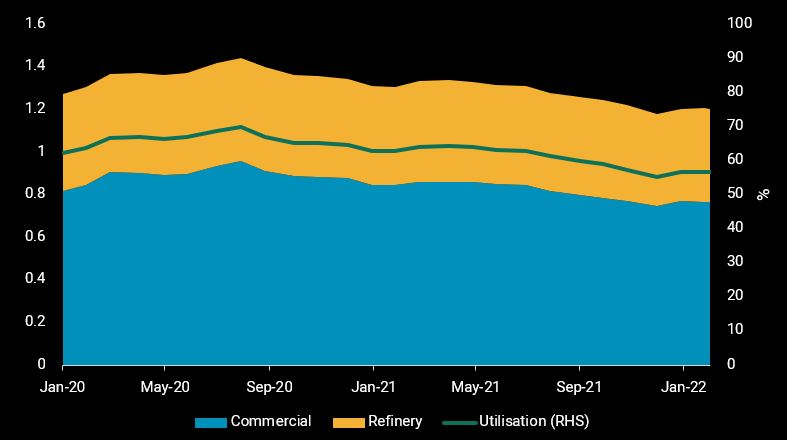

Asian refiners may look to draw on their onshore crude inventories as an alternative to purchasing fresh barrels while allowing the dust to settle. But their supplies are limited as many have consumed their surplus stockpiles over the last year. Combined refinery and commercial crude inventories in Asia have been hovering at historical lows in recent months, drawing from its 1.45bb peak in August 2020 to 1.2bb this week. After keeping aside minimum operational requirements, the available working volumes refiners have are much smaller.

Japan and South Korea have announced plans to join the US in releasing a part of their strategic petroleum reserves (SPRs), although the incremental supplies will likely have a limited and short-term impact on stemming the rise in crude prices in the absence of a longer-term increase in global crude supplies.

Asia onshore crude inventories by storage type (LHS, bb) and capacity utilisation (RHS, %)

Consumer demand shows signs of weakness as price pressures bite

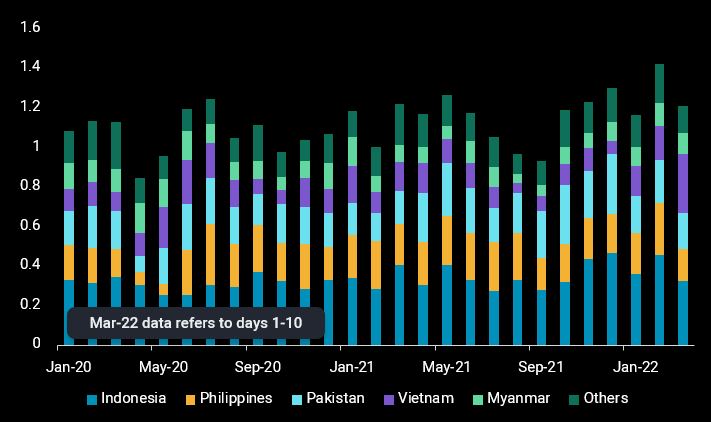

Oil demand sentiments in Asia have been increasingly pressured in recent months as rising oil prices cascade through the supply chains to end consumers. As the first sign of weakness, the petrochemical sector, which takes naphtha and LPG as feedstock, has seen margins falling as downstream prices fail to catch up with feedstock costs, signaling faltering demand. Demand destruction is set to accelerate across other refined products in the weeks ahead, manifesting in an even bigger extent in gasoline and diesel, especially in countries that offer little or no fuel subsidies.

Developing countries in Southeast Asia with weaker currencies will be more susceptible to bigger inflationary pressures, that threaten to reverse their oil demand recovery built up from last year. In China, Chinese government has capped retail price ceilings if crude prices rise above $130/bl to cushion the oil-driven inflation, at the expense of refinery margins. This has prompted several Chinese refiners to cut refining runs or bring forward their maintenance schedule.

Gasoline and diesel imports into Southeast Asia, Pakistan and Bangladesh (kbd)

Political decisions play a key role in influencing oil price trajectories

As much as there is a strong political agenda in deterring Russia’s continued invasion of Ukraine through inflicting maximum financial pain, governments would need to balance this with avoiding a supply shock or energy crisis that would dramatically weaken the global economy. While the US, EU and OPEC are exploring multiple levers to increase global oil production – rolling back Iranian and Venezuela sanctions, raising OPEC production, pushing US shale and Canadian oil sands output higher – efforts should be accelerated to bring these to fruition as soon as possible to smooth the supply crunch and cool inflationary pressures.

More from Vortexa Analysis

- Mar 9, 2022 Current reality to weigh on crude tanker earnings

- Mar 8, 2022 Too many unknowns in “Zeitenwende”, but prices are set to rise

- Mar 3, 2022 What would a reshuffle in flows mean for tanker demand?

- Mar 2, 2022 European refiners can live without Russian Urals

- Mar 1, 2022 New world order = new oil trade order?

- Feb 24, 2022 Light-sweet crude prices soar amid Europe’s thirst

- Feb 23, 2022 European diesel market stuck in tightness

- Feb 21, 2022 Is the surge in Atlantic MR freight rates sustainable?

- Feb 16, 2022 Supply is driving the Atlantic Basin gasoline market tightness

- Feb 15, 2022 Global refining industry struggles to stem growing market tightness

- Feb 10, 2022 Global sweet crude exports edge higher in January

- Feb 9, 2022 How much further will global crude inventories fall?