Supply is driving the Atlantic Basin gasoline market tightness

As we witness US gasoline cracks moving toward levels matching 2021 highs, a year hit by severe unplanned supply problems and high refined product demand we can expect to see only further limitations to supplies as spring refinery maintenance ramps up across the globe and demand is set to grow for all refined products in a world emerging from the pandemic.

As we pass the first seven weeks of 2022, we have already witnessed US gasoline cracks moving toward levels matching 2021 highs, a year hit by severe unplanned supply problems and high refined product demand. Looking forward, we can expect to see only further limitations to supplies as spring refinery maintenance ramps up across the globe and demand is set to grow for all refined products in a world emerging from the pandemic.

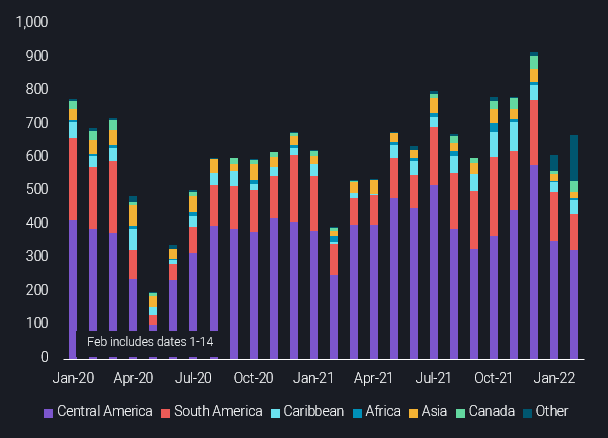

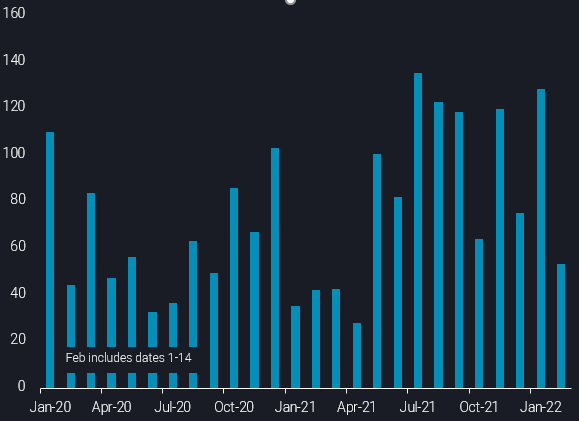

Planned and unplanned PADD 3 refinery maintenance marked the start of this year, taking out several FCCs in Corpus Christi and Beaumont, impacting a large volume of refineries that typically export material to Atlantic Basin markets. PADD 3 refinery utilisation starts the year on a low level, being down almost 6% compared to the same period in 2020.

As a direct result of these turnarounds, we can see PADD 3 January gasoline exports fall to 570kbd, down 30% (or 250kbd) from the average of Q4 2021. Although early indications see February exports slightly higher, the current outages combined with low stocks are negatively impacting gasoline exports out of PADD 3, providing support to regional gasoline values and in extension cracks around the globe.

PADD 3 gasoline/blend components exports by destination region (kbd)

Alternative suppliers also face challenges

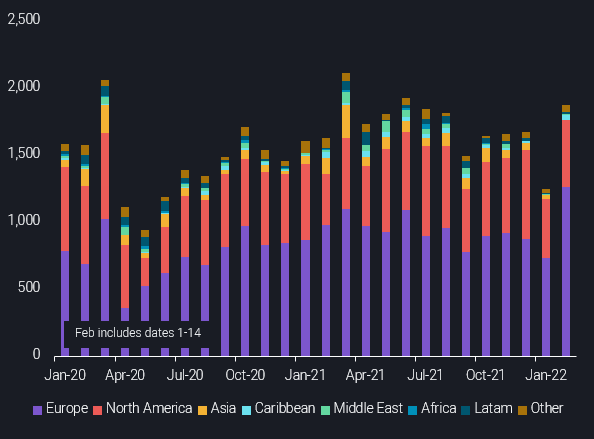

In previous years, we have seen European gasoline loadings towards the Americas make up for the shortfall in PADD 3 exports. However the region is limited by multi-year low gasoline stocks and low refinery runs due to high input (crude, hydrogen) and operational costs (carbon taxes). EU-16 onshore gasoline stocks were 110mb as of January 2022, 10% lower y-o-y, and 13% lower than 2019 levels, according to Euroilstock data.

Further adding to the Atlantic Basin gasoline tightness is the lack of arbitrage cargoes coming from the East of Suez. Refinery maintenance in the Middle East, lower export levels from China and solid regional demand, are all contributing to keep available volumes in the region, including extra volumes from South Korea and Japan.

Gasoline/blending component loadings targeting the Americas Atlantic coasts by origin (kbd)

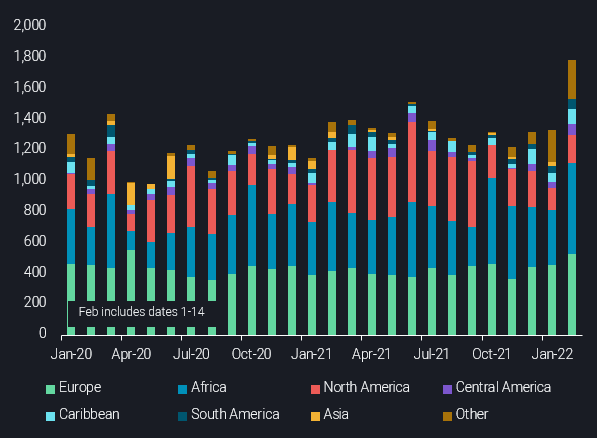

Early indications for gasoline/blending component loadings from Northwest Europe on MR and LR (1+2) tankers for the first half of February hint at a strong supply reaction from Europe, albeit the competition for these volumes is vivid, with Nigeria seeking prompt cargoes after the recent off-spec issue. The extra NWE volumes may help to cool markets a bit, but are pretty unlikely to be sustainable.

NW European gasoline liftings by destination region (kbd)

In the US, tight gasoline supplies due to the strong refinery and fluid catalytic cracker (FCC) maintenance this quarter have led to the country’s gasoline exports sinking to a 7-month low in January, with volumes trending down further in the first two weeks of this month. Fortunately, the fall of tonne-miles for gasoline from the US has been partially offset by stronger tonne-mile demand for jet and diesel, cushioning the impact on the overall TC18 MR tanker rates.

Hot LatAm demand

Mexican demand, the largest importer of gasoline from PADD 3, reached 684 kbd in December 2021, only 49kbd down from the same time in 2019, indicating that demand is rising again (Pemex statistics). And although domestic gasoline production has surpassed 2019 levels, 400 to 500kbd of seaborne imports are still required to meet demand.

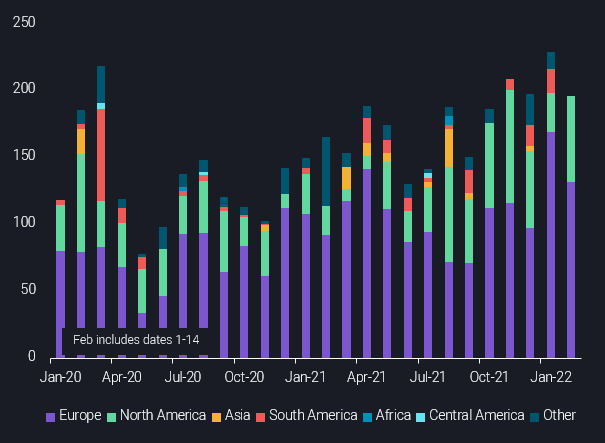

Meanwhile, the Caribbean has been increasingly used as a home for gasoline/blending component cargoes, especially from Europe. This is likely to reflect a combination of strong regional demand and a mixed function of storage, blending and re-supply to LatAm markets.

Gasoline/blending component imports into the Caribbean by origin region (kbd)

Naphtha availability for the gasoline pool may be curtailed

As reforming margins stay strong in tandem with healthy Atlantic Basin gasoline demand, we see heavy naphtha grades move toward reformers in Northwest Europe, especially in January, for gasoline blending and possibly hydrogen production, with catalytic reformers being the only units in a refinery that produce rather than consume hydrogen.

Heavy naphtha imports into Europe (kbd)

From a global perspective we note naphtha imports generally trending lower over recent months, probably reflecting some combination of weaker steam cracker margins, less external supply needs amid all the new integrated refining/petchem capacity in China being ramped up, and a strong pull into the gasoline pool. However, we deem this trend unlikely to continue, with especially Asian players being likely to price up naphtha to attract again higher inflows from the Atlantic Basin, adding to the bullish cocktail for gasoline markets down the line.

Outlook for H1 2022 looks very promising

In conclusion, gasoline demand should show a strong performance over the coming months, as the Northern Hemisphere moves slowly into the driving season and the world recovers from Covid-19. On the supply side, a lot of refining maintenance is still coming up, with limited spare capacity in the system, illustrated by a strong comeback of Japan as transportation fuel exporter so far this year. Furthermore, the aging Western refining fleet appears increasingly prone to outages. Finally, with summer specs coming in, naphtha being unlikely to remain that cheap, and jet fuel demand set to stage a comeback, the options of refiners to produce and blend gasoline will be curtailed, making up for an overall very strong gasoline outlook over the next couple of months.

More from Vortexa Analysis

- Feb 15, 2022 Global refining industry struggles to stem growing market tightness

- Feb 10, 2022 Global sweet crude exports edge higher in January

- Feb 9, 2022 How much further will global crude inventories fall?

- Feb 8, 2022 How is Omicron impacting Asia’s oil demand so far?

- Feb 2, 2022 Can clean tanker markets benefit from surging diesel prices?

- Feb 1, 2022 Russian roulette being played out in Ukraine, leaving the gas market guessing

- Jan 27, 2022 Naphtha & LPG: Falling freight rates suggest flows will remain curtailed

- Jan 26, 2022 Reality check on Russian oil and gas sanctions

- Jan 25, 2022 China’s crude destocking pauses. Is it looking for a refill?

- Jan 20, 2022: Maiden Crude Tanker CPP Voyages: What happened and what to expect

- Jan 19, 2022: Oil price rally is driven by lack of supply right now

- Jan 18, 2022: Global diesel market pricing in tighter supplies ahead

- Jan 13, 2022: Omicron: pre-emptive supply cuts & resilient demand draw stocks and lift prices