Puzzling trends in North Sea crude

Puzzling trends are emerging in the North Sea crude market with Forties cargoes increasingly seen offshore UK, yet at the same time Johan Svedrup flows to Asia are poised to rise. We explore the drivers behind the diverging trends.

North Sea crudes are often viewed collectively as a joint regional market but recent cargo activity suggests supply and demand trends are diverging between grades. One on hand, the volume of Forties on-the-water is rising, suggesting that sellers are finding it increasingly difficult finding spot buyers. Yet at the same time, preliminary indications suggest flows to Asia for Johan Svedrup are set to rise strongly in the coming weeks.

Forties on the water

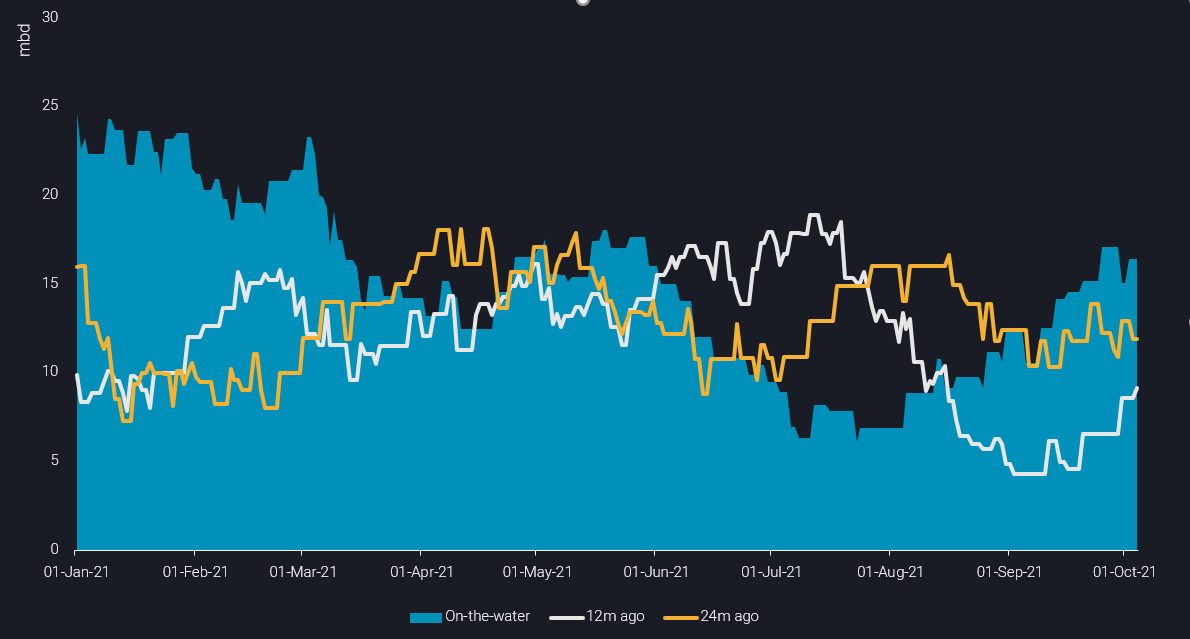

Forties on-the-water volumes – which includes floating storage volumes – stood at just over 16mn bbls as of early October, up sharply from around 7mn bbls in late July and also well above 12 and 24 month ago levels.

Forties crude on-the-water (b/d)

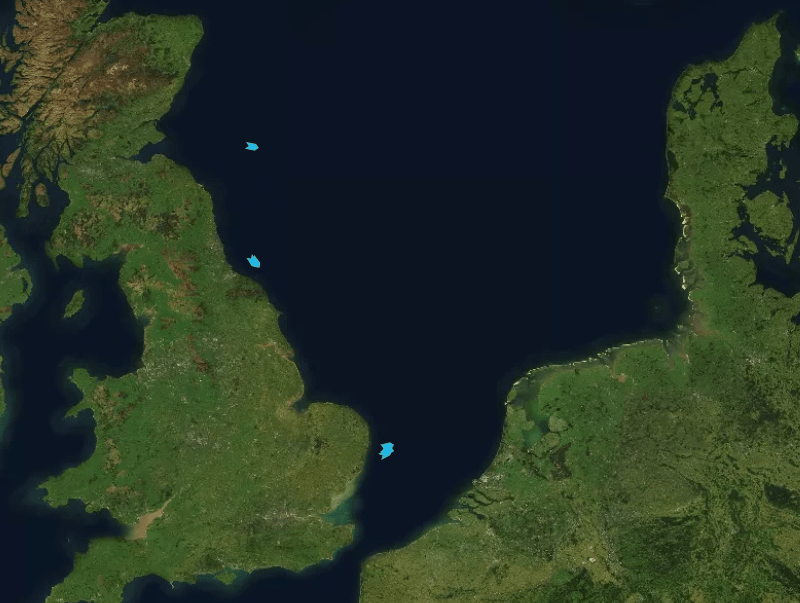

Of the 16mn bbls, almost half of the total volume still remains floating offshore the UK. Usually if these cargoes are not sailing for long-haul destinations such as China or South Korea, they will either clear in the UK or local European market. However at the time of writing, neither of the above scenarios are taking shape.

If the emergence of rising floating storage/on-the-water volumes of Forties cargoes was viewed as being representative of the North Sea crude market, then the logical conclusion would be that European refiners are abundantly supplied with prompt barrels and Asian buyers too, seeing little value in importing long-haul North Sea crudes.

However indications from market participants suggest Asian buyers are planning to import more of the North Sea grade Johan Sverdrup in the coming weeks.

Johan Sverdrup finding favour in Asia

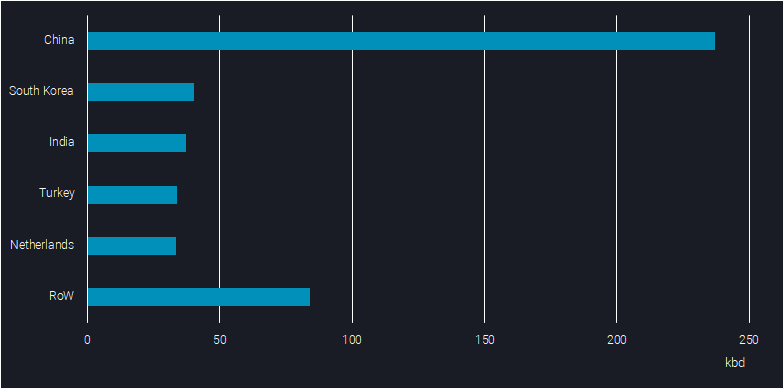

Loading programmes for November indicate potentially eight VLCCs of the grade will be loaded from Mongstad, up from only three in August. The shift to using larger tankers for exports supports the view that cargoes will be travelling further afield – likely to China/Far East Asia.

Top Johan Sverdrup importers (and rest of the world) in 2021 YTD (kbd)

Light vs Medium

Given the proximity between both grades locations – Hound Point, UK and Mongstad, Norway – and the fact that both ports can/do load VLCCs, it’s clear that neither freight nor logistical constraints are driving the diverging fortunes for both grades. Instead it is the difference in the quality of the two crudes.

The lift to gasoline demand from the US driving season is now behind us and European refiners are now looking to winter distillates demand, especially for heating oil, given the current high natural gas price environment. So it makes sense that lighter grades such as Forties (40 API) will find themselves out of favour when compared with medium/distillate-rich grades. We are also seeing this, to a lesser extent, with Ekofisk (38 API) cargoes – also a light North Sea crude grade – sitting off the UK’s coast.

Forties and Ekofisk cargoes offshore UK as of 5 October

Chinese refiners meanwhile are constrained by tight crude import quotas, meaning that they have to focus on those grades that bring them the most processing value and flexibility, while disallowing for sweeping up opportunistic cargoes as easily as in the past. Johan Sverdrup with its 28 API and 0.8% sulphur fits well into the Chinese portfolio, especially as similar Angolan grades are facing declining production.

Timing is crucial in the current market

Overall it may surprise to see crude barrels struggling to find buyers – this is not only limited to the North Sea – but we have to take timing aspects into account. The crude oil and wider energy pricing frenzy has a lot of forward looking aspects attached to it, including both winter-weather and structural supply-side concerns. At this point, however, product supply needs to be planned for November and December, months that may not yet look that strong from the heating perspective. Furthermore, a fair amount of refining maintenance is still going on and coming up. So it would be too early to conclude that floating storage in the North Sea is at crossroads with the oil pricing path. Trading plays may also be involved, and it is definitely worth watching these cargoes on Vortexa’s platform.

More from Vortexa Analysis

- Sep 30, 2021 Europe’s flexible gas markets backfire in global energy crunch

- Sep 29, 2021 OPEC+ supply trends and their repercussions on Asian buyers

- Sep 28, 2021 Reality check: Middle East saves global crude market from massive shortfall

- Sep 23, 2021 Shipping is navigating through uncharted and uncertain territories

- Sep 23, 2021 Looking for lasting repercussions of US storms

- Sep 20, 2021 Flow highlights: Tight supply continues to support prices across the board

- Sep 16, 2021 LatAm road fuel imports set for decline after hitting record

- Sep 15, 2021 Can Asian gasoline sustain their strength in Q4 2021?

- Sep 15, 2021 Reality check: is China ready for U-turn after weakness in last months?

- Sep 9, 2021 The Atlantic Basin pulls diesel into the spotlight

- Sep 8, 2021 Collapse in West African supplies hits dirty freight segment hard